Eye on Lithium: Spot lithium chemical prices fall ahead of Chinese holiday

Lithium chemical spot prices have slipped. Pic: via Getty Images

- Lithium spot prices are slipping as contract prices rise

- US$300bn in battery factory investment over last four years highlights strong demand

- Greenwing cashed up following $12m share placement

All your ASX lithium news for Friday, January 13.

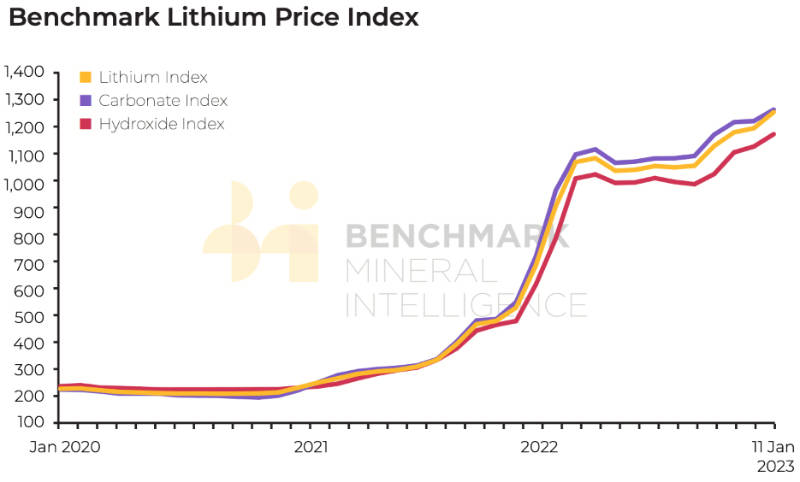

Lithium pricing had a bit of a mixed start to the new year with Benchmark Minerals Intelligence noting a narrowing gap between lithium carbonate spot and contract prices.

In China’s domestic market, prices of technical grade LCE fell by 3.1% in the week to 11 January 2023 while battery grade LCE dropped by 4.3% as demand for lithium chemicals slowed down ahead of the Spring Festival holiday later this month.

This sent seaborne spot transactions in Asia down 2.6% in the period 4 January – 11 January 2023 to an average of US$76,000/t (CIF Asia) though spot pricing in the international market remained stable.

In contrast, LCE contract prices for the first quarter increased substantially to align more closely with spot market pricing with the lower end of LCE prices into Europe, North America and Asia jumping up to US$62,000/t.

Pricing for lithium hydroxide also fell by 2.9% within China while overall spot pricing CIF Asia fell by 0.6% to an average of US$81,500/t.

Contract pricing in Asia ranged from US$64,000 to US$80,000 per tonne.

Pricing for spodumene concentrate under offtake contracts continuing to rise between the end of 2022 and 11 January 2023 as producers looked to adjust contracts to introduce mechanisms that more closely echo the lithium chemical spot market.

However, average pricing still fell by 6.3% to US$6,000/t with Benchmark explaining that this was due to a high-priced spot transaction in the previous assessment period which was not followed by any further transactions at the same level.

Rising battery production still unlikely to meet demand

That’s not to say that the fall in lithium pricing will become a trend (at least not now) as demand for the critical element is likely to continue climbing.

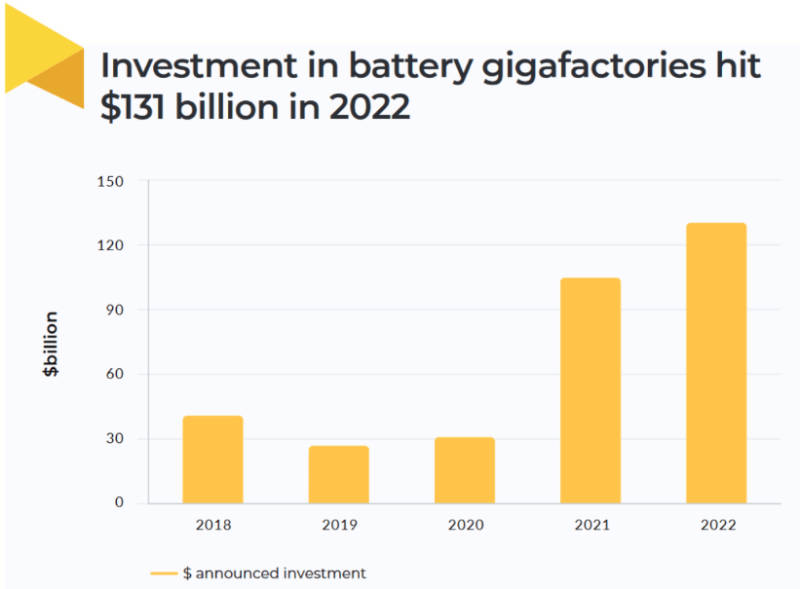

Benchmark noted that almost US$300bn of investment in new battery gigafactories have been announced over the past four years – US$131bn of which was committed in 2022.

This reflects the growing push towards electrification with electric vehicle adoption continuing to rise – albeit at a slightly slower pace – with BloombergNEF predicting sales of 13.6 million vehicles in 2023, up from more than 10 million in 2022.

The investment in new battery factories is expected to increase global production of lithium ion batteries five-gold by the end of the decade with China poised to remain the biggest producer with a predicted 69% share of the market in 2030.

Despite this, Benchmark believes the demand for Tier 1 cells will outstrip supply over the next few years due to growing EV and energy storage requirements.

Here’s how ASX lithium stocks were tracking today:

| Code | Company | Price | % Today | Market Cap |

|---|---|---|---|---|

| GW1 | Greenwing Resources | 0.36 | 31% | $34,716,188 |

| RAG | Ragnar Metals Ltd | 0.014 | 17% | $4,550,219 |

| AAJ | Aruma Resources Ltd | 0.063 | 11% | $8,946,806 |

| EMC | Everest Metals Corp | 0.1 | 10% | $9,685,413 |

| SRI | Sipa Resources Ltd | 0.036 | 9% | $7,490,535 |

| WML | Woomera Mining Ltd | 0.019 | 9% | $16,732,821 |

| INF | Infinity Lithium | 0.13 | 8% | $55,511,051 |

| THR | Thor Mining PLC | 0.0065 | 8% | $8,731,877 |

| LLI | Loyal Lithium Ltd | 0.39 | 8% | $18,896,400 |

| ZEO | Zeotech Limited | 0.045 | 7% | $68,909,638 |

| CAI | Calidus Resources | 0.385 | 7% | $157,655,414 |

| IPT | Impact Minerals | 0.008 | 7% | $18,610,279 |

| EUR | European Lithium Ltd | 0.083 | 6% | $113,040,656 |

| LRV | Larvottoresources | 0.17 | 6% | $10,760,756 |

| DRE | Dreadnought Resources Ltd | 0.1025 | 6% | $298,715,854 |

| MXR | Maximus Resources | 0.041 | 5% | $12,443,175 |

| KZR | Kalamazoo Resources | 0.22 | 5% | $31,252,069 |

| LRS | Latin Resources Ltd | 0.12 | 4% | $251,698,683 |

| KAI | Kairos Minerals Ltd | 0.024 | 4% | $45,174,150 |

| TYX | Tyranna Res Ltd | 0.024 | 4% | $55,324,782 |

| LPI | Lithium Pwr Int Ltd | 0.49 | 4% | $295,675,853 |

| PLL | Piedmont Lithium Inc | 0.8625 | 4% | $345,970,892 |

| QXR | Qx Resources Limited | 0.054 | 4% | $46,636,841 |

| IMI | Infinitymining | 0.275 | 4% | $20,266,755 |

| JRL | Jindalee Resources | 1.93 | 4% | $106,724,877 |

| PNN | Power Minerals Ltd | 0.56 | 4% | $39,012,204 |

| AML | Aeon Metals Ltd. | 0.03 | 3% | $31,795,618 |

| CHR | Charger Metals | 0.46 | 3% | $19,452,894 |

| PGD | Peregrine Gold | 0.475 | 3% | $17,825,869 |

| TUL | Tulla Resources | 0.355 | 3% | $73,432,716 |

| STM | Sunstone Metals Ltd | 0.04 | 3% | $102,197,410 |

| MRR | Minrex Resources Ltd | 0.041 | 3% | $43,394,700 |

| GL1 | Globallith | 2.2 | 2% | $458,322,500 |

| CRR | Critical Resources | 0.045 | 2% | $69,974,635 |

| LNR | Lanthanein Resources | 0.023 | 2% | $22,085,450 |

| AM7 | Arcadia Minerals | 0.235 | 2% | $10,740,515 |

| AOU | Auroch Minerals Ltd | 0.057 | 2% | $23,959,327 |

| WR1 | Winsome Resources | 1.86 | 2% | $254,721,398 |

| AS2 | Askarimetalslimited | 0.69 | 1% | $33,550,603 |

| LLO | Lion One Metals Ltd | 1.085 | 1% | $12,377,021 |

| NWM | Norwest Minerals | 0.073 | 1% | $15,991,732 |

| TKM | Trek Metals Ltd | 0.08 | 1% | $28,751,662 |

| WES | Wesfarmers Limited | 48.29 | 1% | $54,227,517,955 |

| GLN | Galan Lithium Ltd | 1.19 | 1% | $360,496,378 |

| RIO | Rio Tinto Limited | 122.13 | 1% | $44,976,556,488 |

| AGY | Argosy Minerals Ltd | 0.67 | 1% | $933,930,986 |

| LTR | Liontown Resources | 1.575 | 1% | $3,437,421,323 |

| ESS | Essential Metals Ltd | 0.4925 | 1% | $130,862,680 |

| ADV | Ardiden Ltd | 0.008 | 0% | $21,506,683 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | $2,752,409,203 |

| EMH | European Metals Hldg | 0.69 | 0% | $86,827,195 |

| MLS | Metals Australia | 0.052 | 0% | $31,565,882 |

| QPM | Queensland Pacific | 0.115 | 0% | $200,830,011 |

| PSC | Prospect Res Ltd | 0.115 | 0% | $53,159,838 |

| RLC | Reedy Lagoon Corp. | 0.01 | 0% | $5,667,196 |

| TKL | Traka Resources | 0.007 | 0% | $5,059,422 |

| TON | Triton Min Ltd | 0.037 | 0% | $51,163,015 |

| NMT | Neometals Ltd | 0.91 | 0% | $502,994,470 |

| AX8 | Accelerate Resources | 0.024 | 0% | $9,062,442 |

| BYH | Bryah Resources Ltd | 0.026 | 0% | $7,312,590 |

| EMS | Eastern Metals | 0.08 | 0% | $3,125,153 |

| FG1 | Flynngold | 0.096 | 0% | $7,519,060 |

| FRS | Forrestaniaresources | 0.16 | 0% | $9,742,608 |

| GSM | Golden State Mining | 0.05 | 0% | $5,850,710 |

| CTN | Catalina Resources | 0.009 | 0% | $11,146,382 |

| TMB | Tambourahmetals | 0.11 | 0% | $4,531,186 |

| WCN | White Cliff Min Ltd | 0.013 | 0% | $9,792,707 |

| KGD | Kula Gold Limited | 0.029 | 0% | $10,475,146 |

| SCN | Scorpion Minerals | 0.07 | 0% | $24,199,433 |

| AZI | Altamin Limited | 0.078 | 0% | $30,553,907 |

| ENT | Enterprise Metals | 0.009 | 0% | $6,345,726 |

| AVW | Avira Resources Ltd | 0.003 | 0% | $6,401,370 |

| RMX | Red Mount Min Ltd | 0.005 | 0% | $9,941,744 |

| RDT | Red Dirt Metals Ltd | 0.445 | 0% | $185,394,041 |

| A8G | Australasian Metals | 0.2 | 0% | $8,234,099 |

| EFE | Eastern Resources | 0.019 | 0% | $21,959,280 |

| SRZ | Stellar Resources | 0.013 | 0% | $13,060,202 |

| LSR | Lodestar Minerals | 0.005 | 0% | $8,692,187 |

| VKA | Viking Mines Ltd | 0.008 | 0% | $8,202,067 |

| VMC | Venus Metals Cor Ltd | 0.125 | 0% | $22,259,835 |

| RGL | Riversgold | 0.028 | 0% | $26,473,096 |

| G88 | Golden Mile Res Ltd | 0.021 | 0% | $4,296,385 |

| EPM | Eclipse Metals | 0.023 | 0% | $46,557,908 |

| EVR | Ev Resources Ltd | 0.015 | 0% | $13,934,761 |

| MM1 | Midasmineralsltd | 0.2 | 0% | $11,426,353 |

| M2R | Miramar | 0.08 | 0% | $5,654,539 |

| LRD | Lordresourceslimited | 0.225 | 0% | $7,489,040 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | $74,238,031 |

| AUN | Aurumin | 0.061 | 0% | $10,843,536 |

| KTA | Krakatoa Resources | 0.045 | 0% | $15,511,946 |

| DAF | Discovery Alaska Ltd | 0.029 | 0% | $6,502,806 |

| FTL | Firetail Resources | 0.145 | 0% | $9,425,000 |

| IR1 | Irismetals | 1.16 | 0% | $72,766,800 |

| CY5 | Cygnus Gold Limited | 0.445 | 0% | $81,824,024 |

| LLL | Leolithiumlimited | 0.565 | 0% | $557,461,155 |

| OCN | Oceanalithiumlimited | 0.44 | 0% | $16,022,160 |

| SGQ | St George Min Ltd | 0.07 | 0% | $58,428,309 |

| MIN | Mineral Resources. | 88.65 | -1% | $16,909,424,730 |

| MNS | Magnis Energy Tech | 0.3925 | -1% | $383,280,936 |

| IGO | IGO Limited | 14.82 | -1% | $11,313,581,126 |

| SYA | Sayona Mining Ltd | 0.2275 | -1% | $1,997,720,662 |

| PAM | Pan Asia Metals | 0.38 | -1% | $56,539,402 |

| AZL | Arizona Lithium Ltd | 0.068 | -1% | $168,532,820 |

| NVA | Nova Minerals Ltd | 0.675 | -1% | $143,887,080 |

| AKE | Allkem Limited | 12.505 | -2% | $8,098,257,692 |

| GT1 | Greentechnology | 0.905 | -2% | $175,479,322 |

| MMC | Mitremining | 0.285 | -2% | $7,854,679 |

| VUL | Vulcan Energy | 6.98 | -2% | $1,019,824,990 |

| LEL | Lithenergy | 0.8 | -2% | $49,022,250 |

| ZNC | Zenith Minerals Ltd | 0.255 | -2% | $91,341,790 |

| LIT | Lithium Australia | 0.049 | -2% | $61,059,584 |

| ARN | Aldoro Resources | 0.22 | -2% | $25,405,271 |

| MTM | Mtmongerresources | 0.075 | -3% | $4,390,865 |

| LIS | Lisenergylimited | 0.375 | -3% | $63,876,962 |

| LKE | Lake Resources | 0.84 | -3% | $1,203,795,022 |

| PAT | Patriot Lithium | 0.32 | -3% | $19,127,626 |

| LPD | Lepidico Ltd | 0.0155 | -3% | $122,204,340 |

| 1MC | Morella Corporation | 0.0145 | -3% | $91,478,707 |

| TEM | Tempest Minerals | 0.027 | -4% | $14,133,453 |

| PLS | Pilbara Min Ltd | 4.01 | -4% | $12,471,553,078 |

| A11 | Atlantic Lithium | 0.65 | -4% | $408,875,621 |

| CXO | Core Lithium | 1.1425 | -4% | $2,197,792,581 |

| RAS | Ragusa Minerals Ltd | 0.12 | -4% | $17,824,848 |

| VSR | Voltaic Strategic | 0.024 | -4% | $7,660,766 |

| INR | Ioneer Ltd | 0.46 | -4% | $1,007,202,368 |

| MQR | Marquee Resource Ltd | 0.044 | -4% | $15,051,545 |

| CMD | Cassius Mining Ltd | 0.019 | -5% | $8,169,858 |

| CZL | Cons Zinc Ltd | 0.018 | -5% | $9,164,798 |

| DAL | Dalaroometalsltd | 0.09 | -5% | $2,838,125 |

| WC8 | Wildcat Resources | 0.032 | -6% | $22,508,773 |

| BMM | Balkanminingandmin | 0.3 | -6% | $14,327,044 |

| ASN | Anson Resources Ltd | 0.21 | -7% | $265,107,358 |

| AOA | Ausmon Resorces | 0.006 | -8% | $5,572,381 |

| DTM | Dart Mining NL | 0.055 | -10% | $9,492,854 |

| BNR | Bulletin Res Ltd | 0.105 | -13% | $35,110,932 |

| XTC | Xantippe Res Ltd | 0.005 | -17% | $61,752,208 |

| ALY | Alchemy Resource Ltd | 0.02 | -17% | $28,273,830 |

Who has news out today?

Drilling at the company’s Hickory project has discovered extensive stacked pegmatites with assaying confirming the presence of both spodumene and lepidolite.

This includes a top hit of 3m grading 0.27% Li2O and 53.2 parts per million (ppm) tantalum from a depth of 161m in hole HYRC006.

Alchemy said the assays confirm the presence of a lithium caesium tantalum (LCT) pegmatite system which remains open at depth and continues for about 3km to the north and west under shallow alluvial cover.

It expects a recently completed gravity survey to help map pegmatites under cover and guide the next steps.

Everest Metals Corporation (ASX:EMC)

Everest’s Phase 1 due diligence reconnaissance drilling at the Mt Edon project, which it has exercised its right to farm into, has highlighted an extensive and well developed pegmatite field.

Not only are the intersected pegmatites highly anomalous in terms of lithium, caesium, tantalum and rubidium, they also appear to be connected at depth, which is an indication of possible sill structures.

The company plans to carry out supplementary mapping in the current quarter to support the current structural interpretation of the pegmatites.

It can earn up to 51% in the project by issuing 5 million shares in EMC, reimbursing $25,000 for historical costs and granting the vendor a 1% gross royalty on the value of all minerals produced and sold from the tenement.

Energy Transition Minerals (ASX:ETM)

An aeromagnetic survey at the company’s Villasrubias project in Spain has identified several areas of lithium prospectivity which provide support for a follow-up drill program.

The survey defined two zones with contrasting geophysical character and highlight prospective trends.

Energy Transition Minerals expects to start a drill program of at least 10 holes in January to test the prospective bodies defined by geophysics.

Greenwing is cashed up to accelerate outstanding option payments and pay its share of development expenses for the San Jorge lithium project in Argentina after completing a placement of 21.8 million shares worth $12m to NIO Inc.

The lithium brine project consists of 15 granted exploration licences covering 38,000 hectares.

Geophysics has indicated a basin depth of up to 600m while brine samples have returned results of up to 285mg/l lithium.

The project is located in close proximity to large third party resources and mines. It may also be suitable for direct lithium extraction to produce lithium hydroxide.

Lithium Power International (ASX:LPI)

Lithium Power has kicked off drilling at the East Kirup lithium prospect within its Greenbushes project just 20km northwest along the Donnybrook Shear Zone from the Greenbushes lithium mine.

The inaugural drill program, which uses rigs with very small footprints due to the need to carry out work in forested areas, consists of 960m of reverse circulation and 400m of diamond drilling in the previously undrilled area.

As such, the program has broad objectives including defining the water table, water quality and flow rates, and stratigraphy and geochemical anomalies along the Donnybrook Shear Zone previously defined by laterite and soil sampling.

The company is planning to spin-off its Western Australia hard rock lithium projects into a new company, Western Lithium.

ALY, EMC, ETM, GW1 and LPI share prices today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.