Eye on Lithium: Lithium exports go parabolic, set to contribute $9.4b to Australia’s economy by 2023-24

Pic: PM Images / Stone Plus via Getty Images

- The ABS says lithium will add $9.4b to our economy in 2023/24

- European Lithium nabs offtake deal with BMW for Austria project

- Greenwing Resources expands brine body at Argentinian project

All your ASX lithium news for Friday, August 5.

The Australian Bureau of Statistics (ABS) says lithium is forecast to contribute $9.4 billion in revenue to our economy by 2023-24.

Not really surprising since Australia is the world’s biggest exporter of lithium.

“Australian exports of lithium are primarily in the form of spodumene concentrate however as global demand grows, several Australian lithium mines are commencing production of lithium hydroxide,” the ABS said.

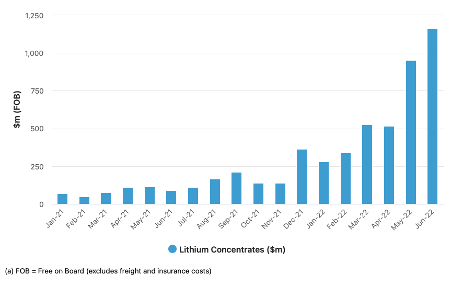

In June 2022 exports passed $1b

For most of 2021, monthly lithium exports didn’t exceed $250m, but exports values more than doubled from November to December 2021.

From April 2022 to May 2022, exports of lithium almost doubled again, and in June 2022 surpassed a massive $1 billion for the first time.

In June 2022, exports of lithium concentrates reached a record high of $1,163m, up $1,073m (1189%) from June month 2021.

And for the June quarter 2022, total lithium exports were $2,632m, up $2,318m (737%) from the June quarter 2021.

WA exported and China imported

WA accounted for over 99% of Australian lithium exports in each month since January 2021.

And China is the one buying it all.

In 2021 China accounted for over 85% of total value in each month of 2021 and in 2022, they accounted for over 94% in each month of the year to date.

Breaking that down into monetary value, in June 2022, $1,128m worth of lithium was exported to China.

That’s around 97% of the total lithium exports for that month.

Here’s how ASX lithium stocks were tracking today:

Lithium stocks missing from our list? Shoot a friendly mail to [email protected]

| Code | Company | Price | % Month | % Week | % Today | Market Cap |

|---|---|---|---|---|---|---|

| PGD | Peregrine Gold | 0.795 | 121% | 89% | 89% | $16,080,533.70 |

| TEM | Tempest Minerals | 0.051 | -42% | 19% | 31% | $19,685,880.86 |

| TKL | Traka Resources | 0.007 | 17% | 0% | 17% | $4,132,647.37 |

| TKM | Trek Metals Ltd | 0.068 | 24% | 0% | 13% | $18,636,609.00 |

| EUR | European Lithium Ltd | 0.092 | 56% | 23% | 12% | $114,226,546.69 |

| GW1 | Greenwing Resources | 0.24 | 9% | 7% | 12% | $26,498,180.04 |

| EMH | European Metals Hldg | 0.795 | 19% | 20% | 11% | $85,587,027.24 |

| LRV | Larvottoresources | 0.22 | 0% | -4% | 10% | $8,306,500.00 |

| SRI | Sipa Resources Ltd | 0.044 | 26% | 16% | 10% | $8,200,992.12 |

| MNS | Magnis Energy Tech | 0.355 | 16% | 8% | 9% | $315,357,731.98 |

| QXR | Qx Resources Limited | 0.036 | 24% | 24% | 9% | $28,358,956.59 |

| IR1 | Irismetals | 0.445 | 89% | 24% | 9% | $24,446,250.00 |

| LPI | Lithium Pwr Int Ltd | 0.58 | 32% | 6% | 7% | $188,538,217.92 |

| MLS | Metals Australia | 0.06 | 20% | 3% | 7% | $31,810,026.70 |

| ALY | Alchemy Resource Ltd | 0.016 | 14% | -6% | 7% | $14,296,110.86 |

| CXO | Core Lithium | 1.29 | 38% | 15% | 7% | $2,097,418,961.00 |

| 1MC | Morella Corporation | 0.018 | 0% | -5% | 6% | $95,645,637.76 |

| ESS | Essential Metals Ltd | 0.49 | 34% | 13% | 5% | $114,616,652.63 |

| AZL | Arizona Lithium Ltd | 0.079 | -10% | 3% | 5% | $180,369,417.08 |

| WR1 | Winsome Resources | 0.2 | -2% | 5% | 5% | $25,671,658.86 |

| GT1 | Greentechnology | 0.705 | 17% | 10% | 5% | $123,460,660.81 |

| CHR | Charger Metals | 0.51 | 44% | 10% | 5% | $15,801,801.98 |

| MTM | Mtmongerresources | 0.105 | -13% | -5% | 5% | $3,751,003.30 |

| LTR | Liontown Resources | 1.48 | 49% | 16% | 5% | $3,091,037,529.18 |

| CAI | Calidus Resources | 0.755 | 19% | 14% | 5% | $293,638,289.76 |

| BNR | Bulletin Res Ltd | 0.11 | -4% | -4% | 5% | $30,722,065.50 |

| MMG | Monger Gold Ltd | 0.24 | 17% | 7% | 4% | $9,209,200.00 |

| NMT | Neometals Ltd | 1.255 | 31% | 7% | 4% | $660,793,557.18 |

| INR | Ioneer Ltd | 0.64 | 49% | 16% | 4% | $1,290,352,456.74 |

| GL1 | Globallith | 1.56 | 34% | 8% | 4% | $238,047,384.00 |

| ASN | Anson Resources Ltd | 0.14 | 40% | 0% | 4% | $138,768,165.23 |

| AM7 | Arcadia Minerals | 0.14 | -18% | -13% | 4% | $6,304,215.42 |

| EFE | Eastern Resources | 0.028 | 27% | 12% | 4% | $26,849,789.04 |

| G88 | Golden Mile Res Ltd | 0.028 | -3% | 8% | 4% | $5,500,780.58 |

| MRR | Minrex Resources Ltd | 0.057 | 68% | 39% | 4% | $58,308,082.86 |

| INF | Infinity Lithium | 0.145 | 21% | 7% | 4% | $58,101,829.24 |

| LPD | Lepidico Ltd | 0.029 | 12% | -3% | 4% | $182,200,802.92 |

| EVR | Ev Resources Ltd | 0.029 | 16% | 7% | 4% | $25,927,553.99 |

| IGO | IGO Limited | 11.52 | 16% | 8% | 4% | $8,428,390,758.69 |

| KAI | Kairos Minerals Ltd | 0.03 | 50% | 15% | 3% | $56,900,711.24 |

| ZNC | Zenith Minerals Ltd | 0.3 | 15% | -8% | 3% | $99,981,060.91 |

| PLS | Pilbara Min Ltd | 2.86 | 27% | 5% | 3% | $8,245,870,023.68 |

| AKE | Allkem Limited | 11.76 | 16% | 6% | 3% | $7,282,055,342.12 |

| MIN | Mineral Resources. | 57.105 | 24% | 7% | 3% | $10,511,753,335.50 |

| DRE | Dreadnought Resources Ltd | 0.072 | 47% | 11% | 3% | $198,872,348.57 |

| MQR | Marquee Resource Ltd | 0.073 | 11% | 0% | 3% | $22,408,848.18 |

| VUL | Vulcan Energy | 7.9 | 36% | 5% | 2% | $1,106,548,523.72 |

| LKE | Lake Resources | 0.915 | 24% | 18% | 2% | $1,243,813,635.87 |

| CRR | Critical Resources | 0.046 | 7% | 7% | 2% | $66,960,685.76 |

| CZL | Cons Zinc Ltd | 0.0245 | 44% | 23% | 2% | $9,296,587.51 |

| PNN | Power Minerals Ltd | 0.5 | 19% | -1% | 2% | $30,143,263.85 |

| LIS | Lisenergylimited | 0.76 | 67% | -3% | 2% | $123,606,069.32 |

| GLN | Galan Lithium Ltd | 1.315 | 26% | 14% | 2% | $392,675,176.98 |

| RIO | Rio Tinto Limited | 97.04 | -4% | -1% | 2% | $35,376,905,194.20 |

| ZEO | Zeotech Limited | 0.063 | 29% | -2% | 2% | $94,544,759.14 |

| LEL | Lithenergy | 1 | 48% | 8% | 2% | $44,472,750.00 |

| AS2 | Askarimetalslimited | 0.34 | 42% | 31% | 1% | $15,098,205.45 |

| LIT | Lithium Australia | 0.075 | 25% | 9% | 1% | $76,620,290.05 |

| WES | Wesfarmers Limited | 47.56 | 10% | 3% | 1% | $53,290,491,374.00 |

| JRL | Jindalee Resources | 2.57 | -6% | 0% | 1% | $145,742,573.64 |

| OCN | Oceanalithiumlimited | 0.435 | 40% | -1% | 1% | $14,415,750.00 |

| TUL | Tulla Resources | 0.54 | -2% | -4% | 1% | $85,716,026.52 |

| ADV | Ardiden Ltd | 0.008 | 14% | -11% | 0% | $21,346,682.85 |

| AGY | Argosy Minerals Ltd | 0.395 | 22% | -1% | 0% | $535,713,821.59 |

| AML | Aeon Metals Ltd. | 0.028 | 22% | 0% | 0% | $27,751,677.04 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | $2,752,409,203.44 |

| PLL | Piedmont Lithium Inc | 0.66 | 26% | 10% | 0% | $348,196,728.00 |

| QPM | Queensland Pacific | 0.15 | 25% | -3% | 0% | $234,541,969.65 |

| RLC | Reedy Lagoon Corp. | 0.014 | -18% | -13% | 0% | $7,803,976.77 |

| TON | Triton Min Ltd | 0.027 | 50% | 0% | 0% | $33,987,172.78 |

| BMM | Balkanminingandmin | 0.2 | 11% | 0% | 0% | $6,550,000.00 |

| ARN | Aldoro Resources | 0.2 | 48% | -5% | 0% | $19,917,463.40 |

| AAJ | Aruma Resources Ltd | 0.066 | 0% | -1% | 0% | $10,359,459.20 |

| PAM | Pan Asia Metals | 0.39 | -9% | 7% | 0% | $28,828,894.38 |

| AX8 | Accelerate Resources | 0.036 | 20% | 6% | 0% | $9,736,520.36 |

| BYH | Bryah Resources Ltd | 0.031 | 11% | 3% | 0% | $7,012,422.43 |

| DTM | Dart Mining NL | 0.073 | 38% | -11% | 0% | $9,873,991.68 |

| FRS | Forrestaniaresources | 0.155 | 24% | 3% | 0% | $4,818,377.12 |

| IMI | Infinitymining | 0.125 | -19% | 4% | 0% | $7,187,500.00 |

| MMC | Mitremining | 0.115 | -4% | -4% | 0% | $3,114,786.50 |

| RAG | Ragnar Metals Ltd | 0.043 | 10% | 8% | 0% | $16,304,950.23 |

| SHH | Shree Minerals Ltd | 0.008 | -11% | -11% | 0% | $9,907,895.14 |

| TMB | Tambourahmetals | 0.175 | 35% | 9% | 0% | $7,208,704.65 |

| TSC | Twenty Seven Co. Ltd | 0.003 | 0% | 50% | 0% | $7,982,441.72 |

| WCN | White Cliff Min Ltd | 0.011 | -8% | -15% | 0% | $7,189,636.98 |

| WML | Woomera Mining Ltd | 0.015 | -12% | 0% | 0% | $10,302,495.99 |

| LRS | Latin Resources Ltd | 0.074 | 6% | -8% | 0% | $143,991,723.10 |

| SCN | Scorpion Minerals | 0.065 | -10% | -3% | 0% | $21,569,027.48 |

| ENT | Enterprise Metals | 0.011 | 0% | -21% | 0% | $7,182,787.57 |

| AVW | Avira Resources Ltd | 0.003 | -14% | -14% | 0% | $6,356,370.00 |

| NVA | Nova Minerals Ltd | 0.89 | 24% | 8% | 0% | $160,380,033.65 |

| RMX | Red Mount Min Ltd | 0.006 | 9% | -8% | 0% | $9,854,183.15 |

| NWM | Norwest Minerals | 0.045 | 67% | 5% | 0% | $8,127,332.42 |

| AOA | Ausmon Resorces | 0.0055 | -8% | -8% | 0% | $4,715,091.39 |

| VKA | Viking Mines Ltd | 0.007 | 17% | 0% | 0% | $7,176,809.02 |

| IPT | Impact Minerals | 0.0075 | -6% | -6% | 0% | $18,610,279.17 |

| VMC | Venus Metals Cor Ltd | 0.19 | 12% | 6% | 0% | $30,414,949.77 |

| RGL | Riversgold | 0.028 | 4% | 4% | 0% | $21,178,527.97 |

| RAS | Ragusa Minerals Ltd | 0.078 | 0% | -5% | 0% | $9,807,420.17 |

| EPM | Eclipse Metals | 0.024 | 20% | 20% | 0% | $46,107,033.91 |

| WC8 | Wildcat Resources | 0.023 | -12% | -4% | 0% | $14,841,272.72 |

| AOU | Auroch Minerals Ltd | 0.061 | 9% | -2% | 0% | $22,551,809.74 |

| XTC | Xantippe Res Ltd | 0.008 | 14% | -11% | 0% | $64,107,788.51 |

| WMC | Wiluna Mining Corp | 0.205 | -13% | 0% | 0% | $74,238,030.68 |

| AUN | Aurumin | 0.15 | 25% | 3% | 0% | $16,383,487.80 |

| DAF | Discovery Alaska Ltd | 0.039 | -29% | -15% | 0% | $8,745,153.22 |

| DAL | Dalaroometalsltd | 0.11 | 12% | 0% | 0% | $3,286,250.00 |

| CY5 | Cygnus Gold Limited | 0.215 | 43% | 34% | 0% | $25,366,842.73 |

| RDT | Red Dirt Metals Ltd | 0.425 | 6% | 10% | -1% | $130,958,403.18 |

| LRD | Lordresourceslimited | 0.2025 | -16% | -8% | -1% | $6,515,847.31 |

| PSC | Prospect Res Ltd | 0.1325 | 180% | 10% | -2% | $62,405,027.37 |

| KTA | Krakatoa Resources | 0.049 | -13% | -4% | -2% | $17,235,495.85 |

| SYA | Sayona Mining Ltd | 0.21 | 40% | 5% | -2% | $1,783,972,687.78 |

| LLL | Leolithiumlimited | 0.4625 | -3% | 14% | -3% | $468,662,033.20 |

| FG1 | Flynngold | 0.096 | -4% | -4% | -3% | $6,342,043.95 |

| SRZ | Stellar Resources | 0.016 | 7% | -11% | -3% | $13,848,493.33 |

| AZI | Altamin Limited | 0.09 | -5% | -5% | -3% | $36,429,657.94 |

| EMS | Eastern Metals | 0.14 | -7% | 4% | -3% | $5,605,156.25 |

| A8G | Australasian Metals | 0.24 | 17% | -8% | -4% | $10,292,623.50 |

| KZR | Kalamazoo Resources | 0.23 | 31% | -2% | -4% | $34,846,649.76 |

| STM | Sunstone Metals Ltd | 0.045 | 5% | -12% | -4% | $122,032,981.69 |

| LNR | Lanthanein Resources | 0.021 | 17% | 31% | -5% | $18,432,162.54 |

| M2R | Miramar | 0.1 | 18% | -9% | -5% | $6,739,599.62 |

| THR | Thor Mining PLC | 0.0095 | 6% | -5% | -5% | $10,689,009.73 |

| GSM | Golden State Mining | 0.05 | 16% | 2% | -6% | $6,170,329.91 |

| TYX | Tyranna Res Ltd | 0.029 | 53% | 32% | -6% | $47,503,180.68 |

| MXR | Maximus Resources | 0.05 | 11% | 0% | -7% | $17,166,911.47 |

| MM1 | Midasmineralsltd | 0.185 | -16% | -3% | -8% | $11,426,352.80 |

| FTL | Firetail Resources | 0.23 | -6% | -15% | -8% | $15,445,625.00 |

| KGD | Kula Gold Limited | 0.026 | 13% | -7% | -10% | $6,240,093.33 |

| LSR | Lodestar Minerals | 0.006 | -14% | 0% | -14% | $12,169,061.44 |

A solid 62 stocks were in the green, 46 were flat and 23 were red.

Who has news out today?

The company has received a massive vote of confidence with premium automobile manufacturer BMW AG signing up to be its first offtake partner for battery-grade lithium hydroxide from the Wolfsberg project in Austria.

BMW AG previously flagged that by 2030, 50% of its sales would be electric vehicles, a move that is certainly welcome in the European Union given its move to effectively ban petrol and diesel cars from 2035.

“Securing our first offtake with BMW AG is another key milestone for the company. Partnering with BMW AG is an ideal fit for EUR,” chairman Tony Sage said.

BMW AG has been granted the first right to purchase 100% of the lithium hydroxide produced from identified resources at the project, which currently stands at about 12.88Mt grading 1% Li2O.

Should both parties agree to a binding contract, BMW AG will make an upfront payment of US$15 million, which will be repaid through equal offsets against deliveries of the battery chemical.

Proceeds from the prepayment will be used for the development of the Project including supporting the commencement of the construction phase and further progress towards the successful implementation of the Wolfsberg Project.

Greenwing has wrapped up a Transient Electromagnetic (TEM) Geophysical survey at its San Jorge Lithium brine project in Argentina, which it says has “significantly expanded the surface area underlain by a highly conductive response, indicative of an expanded brine body.”

CEO Craig Lennon said the information will be used to finalise locations for the Phase 1 drilling program, to confirm the range of lithium concentrations and porosity values in the project.

“We look forward to commencing the maiden drilling program when the permit is approved by the Mines Department, amid the continued strong outlook for lithium long term,” he said.

Drilling is planned for September/October.

Core has appointed a new CEO in Gareth Manderson, who has 28 years’ experience in various leadership and technical roles.

His experience in developing teams, delivering projects and safely operating mining and processing operations make Gareth the perfect fit for Core’s first CEO, as our Finniss Lithium Project moves from construction to operation later this year,” chairman Greg English said.

“There are many synergies between Gareth’s previous senior roles in managing complex mine, mineral processing, port, township and logistics operations during his tenure at Rio Tinto and the Finniss Project which is 25km from the Darwin CBD and port.

“Gareth’s previous Northern Territory experience and managing the effects of the annual wet season will also be essential as we plan to be operating in this environment for years to come.”

EUR, GW1 and CXO share prices today:

At Stockhead we tell it like it is. While European Lithium is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.