Eye on Lithium: Experts say it’s time for an Aussie take on the IRA to capture lithium value

Pic: Getty Images

- Power Minerals delivers highest average lithium grades to date at the Salta lithium-brine project in Argentina

- Red Mountain finds increased geological confidence in its Mustang lithium project

- Burley kicks off a 5,000m maiden drilling program at the Chubb lithium project in Quebec

All your lithium news, Thursday April 6.

Climate Energy Finance global EV supply chain analyst, Matt Pollard, says it is time for an Australian version of the Inflation Reduction Act (IRA) to seize its multi-hundred-billion-dollar, once-in-a-hundred-year investment and export opportunity to dominate the dramatically expanding global value-added critical minerals industry.

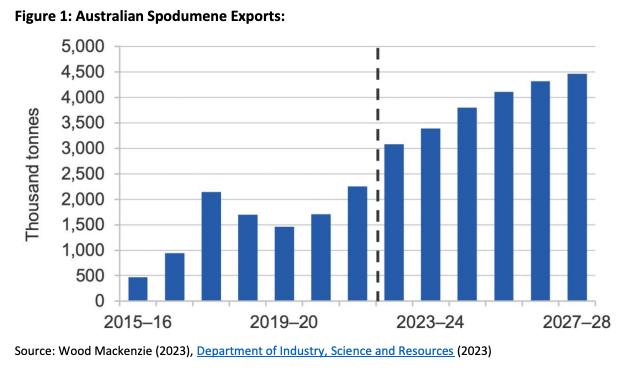

In the latest Australian Lithium Export Market Review, Pollard highlights how Australia is just at the start of its critical mineral industry development opportunity comparative to the future economic growth.

“This can be accelerated if industry and public policy align in Australia’s national interest,” he says.

“Australia will be home to three of the largest lithium hydroxide facilities in the world, all with ASX-listed companies holding equity stakes.

“In 2022, Australia supplied 79 per cent of the world’s hard-rock lithium (spodumene concentrate), and 53 per cent of the global lithium supply while the US Geological Survey identified Chile and China as fast-growing lithium markets, capturing 30 per cent and 15 per cent market share respectively (up from 26 per cent and 13 per cent).

“But key to this is policy settings that attract investment and significant strategic commitment of public finding to incentivise and crowd-in private capital, as is the case in our partner nations including the US, with Biden’s game-changing Inflation Reduction Act.”

Lithium price

The last couple of months has seen lithium chemical prices rise to eye-popping levels before dropping rapidly on short-term demand concerns, but Benchmark’s Simon Moores says this kind of volatility is the name of the game as lithium rushes to scale supply from a wide range of sources with varying costs to get out of the ground.

Benchmark Lithium Prices from 2016 to now:

I’ve marked up on the chart below the high and low of Benchmark’s global weighted average lithium carbonate price in big red lines:

High: ~$70/kg

Low: ~$8/kg

Today (dashed red line): ~$55/kg @benchmarkmin pic.twitter.com/7NONPasfn5— Simon Moores (@sdmoores) April 5, 2023

“Where lithium prices settle in this next round of falling prices will be crucial in determining what our new base cost is and will give further confidence to new money/finance coming into the market,” he explains.

“It may take 12 months to find that out as the EV market recalibrates to a new higher demand level but expect rounds of lithium prices increases and decreases to occur every two to three years into the 2030s.”

Here’s how ASX lithium stocks are tracking:

| CODE | COMPANY | PRICE | RETURN TODAY % | MARKET CAP |

|---|---|---|---|---|

| G88 | Golden Mile Res Ltd | 0.018 | 29% | $3,688,051 |

| FG1 | Flynngold | 0.096 | 19% | $8,332,756 |

| TON | Triton Min Ltd | 0.036 | 13% | $44,249,094 |

| NIS | Nickelsearch | 0.1 | 11% | $5,445,488 |

| LSR | Lodestar Minerals | 0.0055 | 10% | $8,692,187 |

| MXR | Maximus Resources | 0.044 | 10% | $12,762,231 |

| CY5 | Cygnus Metals Ltd | 0.24 | 9% | $40,452,327 |

| LLO | Lion One Metals Ltd | 1.2 | 9% | $13,209,859 |

| AML | Aeon Metals Ltd. | 0.025 | 9% | $25,217,214 |

| PAT | Patriot Lithium | 0.27 | 8% | $15,221,876 |

| NMT | Neometals Ltd | 0.6125 | 7% | $315,062,470 |

| TYX | Tyranna Res Ltd | 0.018 | 6% | $40,909,231 |

| EFE | Eastern Resources | 0.0115 | 5% | $13,661,411 |

| CAI | Calidus Resources | 0.235 | 4% | $98,898,939 |

| DRE | Dreadnought Resources Ltd | 0.0665 | 4% | $212,014,606 |

| INF | Infinity Lithium | 0.135 | 4% | $60,136,972 |

| LRV | Larvottoresources | 0.155 | 3% | $10,088,208 |

| RAS | Ragusa Minerals Ltd | 0.099 | 3% | $13,689,483 |

| A8G | Australasian Metals | 0.17 | 3% | $6,793,132 |

| AS2 | Askarimetalslimited | 0.42 | 2% | $24,612,517 |

| LRD | Lordresourceslimited | 0.22 | 2% | $7,789,906 |

| KTA | Krakatoa Resources | 0.0275 | 2% | $9,307,168 |

| EMC | Everest Metals Corp | 0.072 | 1% | $7,556,751 |

| FRS | Forrestaniaresources | 0.087 | 1% | $5,236,652 |

| MNS | Magnis Energy Tech | 0.2275 | 1% | $227,324,584 |

| CXO | Core Lithium | 0.8775 | 1% | $1,613,864,611 |

| ESS | Essential Metals Ltd | 0.4875 | 1% | $129,769,847 |

| GLN | Galan Lithium Ltd | 1.015 | 0% | $309,984,559 |

| ADV | Ardiden Ltd | 0.008 | 0% | $21,506,683 |

| 1MC | Morella Corporation | 0.009 | 0% | $54,887,224 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | $2,752,409,203 |

| LPD | Lepidico Ltd | 0.012 | 0% | $91,653,261 |

| RLC | Reedy Lagoon Corp. | 0.008 | 0% | $4,533,757 |

| TKL | Traka Resources | 0.006 | 0% | $4,908,078 |

| AAJ | Aruma Resources Ltd | 0.071 | 0% | $11,144,267 |

| PAM | Pan Asia Metals | 0.32 | 0% | $49,633,789 |

| AX8 | Accelerate Resources | 0.026 | 0% | $9,817,646 |

| BYH | Bryah Resources Ltd | 0.022 | 0% | $6,187,576 |

| EMS | Eastern Metals | 0.062 | 0% | $2,421,994 |

| GSM | Golden State Mining | 0.034 | 0% | $3,978,483 |

| IMI | Infinitymining | 0.17 | 0% | $13,001,314 |

| MMC | Mitremining | 0.29 | 0% | $11,088,179 |

| RAG | Ragnar Metals Ltd | 0.016 | 0% | $6,066,958 |

| CTN | Catalina Resources | 0.005 | 0% | $6,192,434 |

| TEM | Tempest Minerals | 0.02 | 0% | $10,136,433 |

| WCN | White Cliff Min Ltd | 0.007 | 0% | $5,488,381 |

| WML | Woomera Mining Ltd | 0.01 | 0% | $9,561,612 |

| KZR | Kalamazoo Resources | 0.16 | 0% | $23,971,100 |

| QXR | Qx Resources Limited | 0.036 | 0% | $32,287,044 |

| AZI | Altamin Limited | 0.0705 | 0% | $27,616,031 |

| ENT | Enterprise Metals | 0.009 | 0% | $6,345,726 |

| AVW | Avira Resources Ltd | 0.003 | 0% | $6,401,370 |

| NVA | Nova Minerals Ltd | 0.465 | 0% | $98,063,746 |

| BNR | Bulletin Res Ltd | 0.089 | 0% | $26,129,608 |

| RDT | Red Dirt Metals Ltd | 0.355 | 0% | $157,942,159 |

| MQR | Marquee Resource Ltd | 0.02 | 0% | $6,544,150 |

| SRZ | Stellar Resources | 0.01 | 0% | $10,046,309 |

| AOA | Ausmon Resorces | 0.0045 | 0% | $4,361,802 |

| IPT | Impact Minerals | 0.011 | 0% | $27,295,076 |

| SRI | Sipa Resources Ltd | 0.026 | 0% | $5,932,112 |

| RGL | Riversgold | 0.015 | 0% | $14,182,016 |

| EPM | Eclipse Metals | 0.017 | 0% | $34,477,016 |

| EVR | Ev Resources Ltd | 0.016 | 0% | $14,975,745 |

| THR | Thor Energy PLC | 0.0045 | 0% | $6,651,508 |

| CZL | Cons Zinc Ltd | 0.018 | 0% | $8,682,441 |

| M2R | Miramar | 0.044 | 0% | $3,437,357 |

| FBM | Future Battery | 0.079 | 0% | $33,799,766 |

| XTC | Xantippe Res Ltd | 0.004 | 0% | $42,320,399 |

| LLI | Loyal Lithium Ltd | 0.32 | 0% | $19,036,800 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | $74,238,031 |

| LIS | Lisenergylimited | 0.33 | 0% | $54,751,682 |

| DAF | Discovery Alaska Ltd | 0.03 | 0% | $6,727,041 |

| FTL | Firetail Resources | 0.1 | 0% | $7,700,000 |

| IR1 | Irismetals | 1.16 | 0% | $74,506,800 |

| DAL | Dalaroometalsltd | 0.059 | 0% | $1,762,625 |

| OCN | Oceanalithiumlimited | 0.34 | 0% | $12,776,010 |

| CMD | Cassius Mining Ltd | 0.022 | 0% | $8,986,844 |

| SGQ | St George Min Ltd | 0.056 | 0% | $47,068,591 |

| PL3 | Patagonia Lithium | 0.2 | 0% | $9,800,700 |

| RDT | Red Dirt Metals Ltd | 0.355 | 0% | $157,942,159 |

| LM1 | Leeuwin Metals Ltd | 0.25 | 0% | $10,072,499 |

| ENT | Enterprise Metals | 0.009 | 0% | $6,345,726 |

| FIN | FIN Resources Ltd | 0.017 | 0% | $9,587,657 |

| RIO | Rio Tinto Limited | 116.285 | 0% | $43,294,947,039 |

| WES | Wesfarmers Limited | 50.925 | -1% | $58,264,531,002 |

| AGY | Argosy Minerals Ltd | 0.4 | -1% | $568,785,037 |

| SYA | Sayona Mining Ltd | 0.1925 | -1% | $1,733,949,571 |

| TKM | Trek Metals Ltd | 0.069 | -1% | $25,476,156 |

| DTM | Dart Mining NL | 0.068 | -1% | $10,737,819 |

| DTM | Dart Mining NL | 0.068 | -1% | $10,737,819 |

| ASN | Anson Resources Ltd | 0.1675 | -1% | $207,634,210 |

| IGO | IGO Limited | 12.21 | -2% | $9,390,120,881 |

| VUL | Vulcan Energy | 5.74 | -2% | $836,227,805 |

| LPI | Lithium Pwr Int Ltd | 0.31 | -2% | $198,165,731 |

| CHR | Charger Metals | 0.305 | -2% | $13,551,454 |

| CHR | Charger Metals | 0.305 | -2% | $13,551,454 |

| QPM | Queensland Pacific | 0.1375 | -2% | $244,488,709 |

| JRL | Jindalee Resources | 2.3 | -2% | $134,840,570 |

| NWM | Norwest Minerals | 0.04 | -2% | $10,142,220 |

| LTR | Liontown Resources | 2.595 | -2% | $5,847,889,324 |

| GL1 | Globallith | 1.365 | -3% | $298,442,558 |

| INR | Ioneer Ltd | 0.2875 | -3% | $619,009,789 |

| LLL | Leolithiumlimited | 0.4775 | -3% | $483,461,887 |

| ARN | Aldoro Resources | 0.18 | -3% | $20,888,779 |

| LNR | Lanthanein Resources | 0.0175 | -3% | $20,188,360 |

| STM | Sunstone Metals Ltd | 0.033 | -3% | $89,095,178 |

| ZNC | Zenith Minerals Ltd | 0.155 | -3% | $56,272,967 |

| PSC | Prospect Res Ltd | 0.15 | -3% | $71,650,217 |

| WC8 | Wildcat Resources | 0.03 | -3% | $20,522,705 |

| PLS | Pilbara Min Ltd | 3.605 | -3% | $11,182,590,426 |

| MIN | Mineral Resources. | 76.03 | -4% | $15,220,625,713 |

| PGD | Peregrine Gold | 0.39 | -4% | $19,475,344 |

| ZEO | Zeotech Limited | 0.051 | -4% | $86,957,401 |

| AKE | Allkem Limited | 10.795 | -4% | $7,154,523,725 |

| AZL | Arizona Lithium Ltd | 0.047 | -4% | $131,857,320 |

| BMM | Balkanminingandmin | 0.23 | -4% | $10,745,283 |

| BUR | Burleyminerals | 0.23 | -4% | $14,739,445 |

| GT1 | Greentechnology | 0.66 | -4% | $131,609,491 |

| LIT | Lithium Australia | 0.032 | -4% | $40,909,921 |

| SCN | Scorpion Minerals | 0.063 | -5% | $22,816,609 |

| VKA | Viking Mines Ltd | 0.0105 | -5% | $11,277,843 |

| A11 | Atlantic Lithium | 0.515 | -5% | $327,100,496 |

| WR1 | Winsome Resources | 1.41 | -5% | $239,808,125 |

| LKE | Lake Resources | 0.4525 | -5% | $675,661,236 |

| CRR | Critical Resources | 0.04 | -5% | $66,979,705 |

| LRS | Latin Resources Ltd | 0.1 | -5% | $231,173,766 |

| KAI | Kairos Minerals Ltd | 0.02 | -5% | $41,245,963 |

| EMH | European Metals Hldg | 0.59 | -5% | $78,048,056 |

| MLS | Metals Australia | 0.038 | -5% | $24,281,448 |

| GW1 | Greenwing Resources | 0.19 | -5% | $29,748,401 |

| PLL | Piedmont Lithium Inc | 0.7675 | -5% | $350,550,990 |

| VMC | Venus Metals Cor Ltd | 0.18 | -5% | $33,834,950 |

| VSR | Voltaic Strategic | 0.018 | -5% | $5,838,704 |

| EUR | European Lithium Ltd | 0.07 | -5% | $110,203,699 |

| MRR | Minrex Resources Ltd | 0.017 | -6% | $19,527,615 |

| KGD | Kula Gold Limited | 0.016 | -6% | $6,344,603 |

| AUN | Aurumin | 0.03 | -6% | $6,328,263 |

| ALY | Alchemy Resource Ltd | 0.015 | -6% | $18,849,220 |

| TMB | Tambourahmetals | 0.085 | -7% | $3,748,526 |

| PNN | Power Minerals Ltd | 0.42 | -7% | $32,510,629 |

| LEL | Lithenergy | 0.62 | -7% | $39,999,750 |

| AM7 | Arcadia Minerals | 0.185 | -8% | $9,339,578 |

| TUL | Tulla Resources | 0.305 | -8% | $106,195,321 |

| MM1 | Midasmineralsltd | 0.18 | -8% | $11,140,694 |

| RMX | Red Mount Min Ltd | 0.0035 | -13% | $9,087,404 |

| RMX | Red Mount Min Ltd | 0.0035 | -13% | $9,087,404 |

| MTM | Mtmongerresources | 0.1 | -13% | $8,137,428 |

A total of 27 companies ended the week in the green, 57 fell flat, and 63 tumbled into the red.

Who’s got news out?

POWER MINERALS (ASX:PNN)

Power Minerals says drilling at the Incahuasi salar at the Salta lithium-brine project in Argentina has delivered the highest average lithium grades to date, along with high brine density results.

During the four-hole program, hole PM23-IN-04 intersected lithium-bearing brines in a 60m interval under the alluvial fan in the southern area of the salar.

The hole returned 214mg/L and a high average brine density of 1.21kg/L, with lithium concentration higher on average than the first three drillholes at Incahuasi.

Power Minerals plans to confirm a maiden JORC mineral resource at Incahuasi, while the drill rig moves to the Rincon salar, the next target in its ongoing mineral resource definition drilling campaign.

RED MOUNTAIN MINING (ASX:RMX)

Red Mountain has found increased geological confidence in its Mustang lithium project based on recent samples’ assay grades, onsite mapping and evaluation of the lithology and stratigraphy.

This evaluation work identified numerous targets that will be drill tested in an eight-hole Phase-1 drilling program.

A permit has been lodged with the Nevada Bureau of Land Management (BLM) with the review process expected to be completed within four weeks.

BURLEY MINERALS (ASX:BUR)

Burley has kicked off a 5,000m maiden drilling program at the Chubb lithium project in Quebec to confirm, extend, and verify lithium-bearing mineralisation as well as the number of spodumene-bearing pegmatite dykes in the central region of the block tenure.

Diamond core samples will confirm historic geological data and further enhance the rheology/lithology database and resource model for the central region of the deposit while drilling will look at the interaction of the white spodumene bearing pegmatites with the pink (rubidium-bearing) pegmatites.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.