Eye on Lithium: Energy storage market firing up, set to hit 500GW by 2031

Pic: Via Getty

- The global energy storage market is set to reach 500GW by 2031, Woodmac says

- Pilbara Minerals says adding capacity to Pilgangoora is “money for jam”

- Neometals kicked off Lithium-ion Battery (LIB) recycling project operations during the quarter

All your ASX lithium news for Friday, July 29.

The ducks are lining up for energy storage, according to Benchmark Minerals Intelligence Boss Simon Moores.

Everything is pushing in the direction of energy storage.

With lithium ion battery industry growing at ~40% this year, that growth is eqiv of entire industry in 2019

And we haven’t even seen residential storage take off yet

Meanwhile, an energy crisis has begun in London… https://t.co/mvejxXFowB

— Simon Moores (@sdmoores) July 28, 2022

And he’s not alone in this opinion, with Wood Mackenzie flagging that the global energy storage market is set to reach 500GW by 2031.

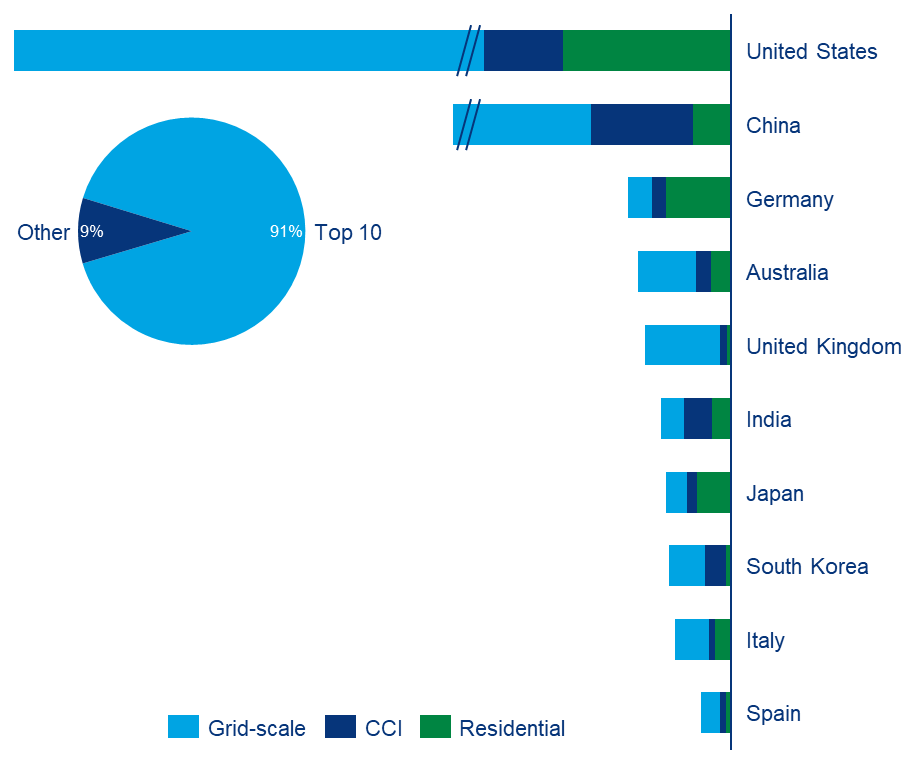

The Global Energy Storage Outlook highlighted that Europe demand lags behind as the region’s grid-scale market struggles to stabilise, with only 159 gigawatt hours (GWh) forecasted for the region by 2031, compared to 422 GWh for China and 600 GWh for the United States (US).

“Growth has stalled in Europe as regulatory barriers fail to improve storage project economics,” WoodMac global head of energy storage Dan Shreve says.

“In addition, limited access to power markets and a lack of revenue stacking opportunities, combined with a lack of capacity market auctions, has lowered investment for grid-scale storage assets in Europe.”

Despite this, Germany’s energy storage market continues to grow and is set to become the third biggest energy storage market by 2030, following US and China – with 32 GWh forecasted for the country, 61% from the residential segment.

WoodMac did note however that the European Commission’s REPowerEU plan will boost the EU energy storage market further as it pushes for a higher share of renewable supply in EU Member States.

Europe has already seen a 12 GWh increase since the plan was launched in May 2022, which set out a 600GW target for the solar PV market and pledged to ease permitting processes for both storage and PV systems.

“While REPowerEU does not set out a specific target for energy storage, higher renewable supply targets will drive demand for flexible power solutions, including energy storage assets,” Shreve added.

Here’s how ASX lithium stocks were tracking today:

Lithium stocks missing from our list? Shoot a friendly mail to [email protected]

| Code | Company | Price | % Month | % Week | % Today | Market Cap |

|---|---|---|---|---|---|---|

| TSC | Twenty Seven Co. Ltd | 0.003 | 0% | 0% | 50% | $5,321,627.81 |

| CY5 | Cygnus Gold Limited | 0.2 | 29% | 33% | 25% | $18,877,650.40 |

| MRR | Minrex Resources Ltd | 0.051 | 42% | 50% | 24% | $43,466,025.40 |

| TYX | Tyranna Res Ltd | 0.027 | 93% | 50% | 23% | $33,711,934.67 |

| TMB | Tambourahmetals | 0.18 | 24% | 13% | 13% | $6,590,815.68 |

| LSR | Lodestar Minerals | 0.0065 | 8% | 0% | 8% | $10,430,624.09 |

| NWM | Norwest Minerals | 0.046 | 64% | 44% | 7% | $7,766,117.64 |

| CAI | Calidus Resources | 0.705 | 18% | 16% | 7% | $269,168,432.28 |

| WML | Woomera Mining Ltd | 0.016 | -11% | 0% | 7% | $10,302,495.99 |

| LNR | Lanthanein Resources | 0.017 | 6% | 6% | 6% | $13,405,209.12 |

| ESS | Essential Metals Ltd | 0.46 | 18% | 7% | 6% | $107,222,029.88 |

| LEL | Lithenergy | 0.98 | 36% | 26% | 5% | $41,989,500.00 |

| CHR | Charger Metals | 0.49 | 32% | 4% | 5% | $15,150,181.28 |

| RAG | Ragnar Metals Ltd | 0.042 | 5% | 11% | 5% | $15,167,395.56 |

| EPM | Eclipse Metals | 0.021 | 11% | 0% | 5% | $38,422,528.26 |

| GT1 | Greentechnology | 0.67 | 7% | -4% | 5% | $117,932,571.52 |

| CRR | Critical Resources | 0.045 | -2% | 2% | 5% | $63,984,655.28 |

| BNR | Bulletin Res Ltd | 0.12 | 4% | 9% | 4% | $33,647,976.50 |

| AS2 | Askarimetalslimited | 0.27 | 0% | 10% | 4% | $11,718,010.20 |

| KAI | Kairos Minerals Ltd | 0.027 | 42% | 17% | 4% | $51,014,430.77 |

| G88 | Golden Mile Res Ltd | 0.027 | -10% | 0% | 4% | $5,297,047.96 |

| INF | Infinity Lithium | 0.14 | 17% | 8% | 4% | $56,026,763.91 |

| TON | Triton Min Ltd | 0.028 | 65% | 22% | 4% | $33,987,172.78 |

| EVR | Ev Resources Ltd | 0.028 | 0% | -7% | 4% | $25,001,569.92 |

| LLL | Leolithiumlimited | 0.42 | -30% | 2% | 4% | $399,596,049.36 |

| QXR | Qx Resources Limited | 0.03 | 3% | 0% | 3% | $24,921,507.31 |

| AUN | Aurumin | 0.15 | 36% | 0% | 3% | $15,837,371.54 |

| IGO | IGO Limited | 11.02 | 5% | 9% | 3% | $8,087,620,242.84 |

| ZEO | Zeotech Limited | 0.066 | 38% | 33% | 3% | $97,594,590.08 |

| GL1 | Globallith | 1.49 | 16% | 36% | 3% | $229,318,979.92 |

| IR1 | Irismetals | 0.37 | 54% | 35% | 3% | $21,465,000.00 |

| CXO | Core Lithium | 1.155 | 11% | 8% | 3% | $1,949,867,680.50 |

| RDT | Red Dirt Metals Ltd | 0.395 | -8% | 13% | 3% | $117,253,454.01 |

| LKE | Lake Resources | 0.795 | -5% | 7% | 3% | $1,077,025,177.15 |

| MMG | Monger Gold Ltd | 0.23 | -12% | 0% | 2% | $9,009,000.00 |

| PSC | Prospect Res Ltd | 0.1225 | 155% | 147% | 2% | $55,471,135.44 |

| VUL | Vulcan Energy | 7.66 | 30% | 8% | 2% | $1,076,448,110.51 |

| PLL | Piedmont Lithium Inc | 0.61 | -3% | 12% | 2% | $316,542,480.00 |

| LTR | Liontown Resources | 1.295 | 22% | 4% | 2% | $2,795,087,127.45 |

| ZNC | Zenith Minerals Ltd | 0.33 | 22% | 16% | 2% | $112,047,740.68 |

| AKE | Allkem Limited | 11.29 | 5% | 12% | 2% | $7,090,757,916.32 |

| LIT | Lithium Australia | 0.07 | 27% | -4% | 1% | $71,443,243.43 |

| PLS | Pilbara Min Ltd | 2.765 | 16% | 8% | 1% | $8,126,796,088.32 |

| MIN | Mineral Resources. | 53.87 | 9% | 13% | 1% | $10,078,025,134.81 |

| NVA | Nova Minerals Ltd | 0.835 | 31% | 14% | 1% | $148,666,885.13 |

| OCN | Oceanalithiumlimited | 0.445 | 0% | -4% | 1% | $14,751,000.00 |

| INR | Ioneer Ltd | 0.555 | 28% | 12% | 1% | $1,153,566,125.80 |

| EMH | European Metals Hldg | 0.665 | -6% | -16% | 1% | $79,109,491.56 |

| WES | Wesfarmers Limited | 46.55 | 8% | -2% | 1% | $52,496,803,204.60 |

| GLN | Galan Lithium Ltd | 1.16 | -1% | 5% | 0% | $351,581,263.11 |

| AML | Aeon Metals Ltd. | 0.028 | 27% | 0% | 0% | $27,751,677.04 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | $2,752,409,203.44 |

| EUR | European Lithium Ltd | 0.075 | 23% | 0% | 0% | $103,836,855.98 |

| MLS | Metals Australia | 0.058 | 16% | 26% | 0% | $32,946,099.08 |

| QPM | Queensland Pacific | 0.155 | 35% | 7% | 0% | $242,360,035.31 |

| TKL | Traka Resources | 0.006 | 0% | 0% | 0% | $4,132,647.37 |

| BMM | Balkanminingandmin | 0.2 | 11% | 8% | 0% | $6,550,000.00 |

| AAJ | Aruma Resources Ltd | 0.067 | 14% | -3% | 0% | $10,516,420.70 |

| PAM | Pan Asia Metals | 0.365 | -22% | -4% | 0% | $26,980,888.33 |

| AX8 | Accelerate Resources | 0.034 | 0% | 6% | 0% | $9,195,602.57 |

| BYH | Bryah Resources Ltd | 0.03 | -12% | -3% | 0% | $6,786,215.25 |

| EMS | Eastern Metals | 0.135 | 4% | 8% | 0% | $5,218,593.75 |

| FG1 | Flynngold | 0.1 | 16% | 1% | 0% | $6,406,105.00 |

| FRS | Forrestaniaresources | 0.15 | 15% | -6% | 0% | $4,662,945.60 |

| GSM | Golden State Mining | 0.049 | 23% | 2% | 0% | $5,704,644.63 |

| IMI | Infinitymining | 0.12 | -11% | -8% | 0% | $6,900,000.00 |

| MMC | Mitremining | 0.12 | 0% | -4% | 0% | $3,250,212.00 |

| SHH | Shree Minerals Ltd | 0.009 | 29% | 0% | 0% | $11,146,382.03 |

| KGD | Kula Gold Limited | 0.028 | 40% | -13% | 0% | $6,024,917.70 |

| KZR | Kalamazoo Resources | 0.235 | 31% | 18% | 0% | $34,120,677.89 |

| AZI | Altamin Limited | 0.095 | -1% | 0% | 0% | $37,213,091.44 |

| PGD | Peregrine Gold | 0.42 | 18% | -1% | 0% | $16,080,533.70 |

| AVW | Avira Resources Ltd | 0.0035 | 0% | 0% | 0% | $7,415,765.00 |

| RMX | Red Mount Min Ltd | 0.0065 | 18% | -7% | 0% | $10,675,365.08 |

| EFE | Eastern Resources | 0.025 | 9% | -4% | 0% | $24,860,915.78 |

| AOA | Ausmon Resorces | 0.006 | 20% | 0% | 0% | $5,143,736.06 |

| VKA | Viking Mines Ltd | 0.007 | 17% | 0% | 0% | $7,176,809.02 |

| IPT | Impact Minerals | 0.008 | 0% | 14% | 0% | $19,850,964.45 |

| SRI | Sipa Resources Ltd | 0.038 | 9% | 0% | 0% | $7,790,942.51 |

| RGL | Riversgold | 0.027 | -7% | -4% | 0% | $20,422,151.97 |

| WC8 | Wildcat Resources | 0.024 | -4% | 0% | 0% | $15,486,545.45 |

| THR | Thor Mining PLC | 0.01 | 0% | 0% | 0% | $10,689,009.73 |

| DRE | Dreadnought Resources Ltd | 0.065 | 48% | 27% | 0% | $184,514,430.82 |

| M2R | Miramar | 0.11 | 29% | 26% | 0% | $7,060,532.93 |

| LRD | Lordresourceslimited | 0.22 | -2% | 13% | 0% | $6,992,616.62 |

| WMC | Wiluna Mining Corp | 0.205 | -21% | 0% | 0% | $74,238,030.68 |

| GW1 | Greenwing Resources | 0.225 | 7% | 2% | 0% | $27,730,653.53 |

| DAF | Discovery Alaska Ltd | 0.046 | -8% | 0% | 0% | $10,314,796.11 |

| FTL | Firetail Resources | 0.27 | -2% | 15% | 0% | $16,681,275.00 |

| DAL | Dalaroometalsltd | 0.11 | 29% | 10% | 0% | $3,286,250.00 |

| RIO | Rio Tinto Limited | 97.345 | -9% | 2% | 0% | $36,267,824,107.80 |

| AGY | Argosy Minerals Ltd | 0.395 | 22% | 7% | -1% | $542,420,394.80 |

| LRS | Latin Resources Ltd | 0.079 | 20% | 1% | -1% | $155,615,182.40 |

| AZL | Arizona Lithium Ltd | 0.076 | -16% | -11% | -1% | $185,179,268.20 |

| MNS | Magnis Energy Tech | 0.325 | 5% | -8% | -2% | $320,209,389.39 |

| LPI | Lithium Pwr Int Ltd | 0.535 | 30% | 15% | -2% | $190,283,942.16 |

| LIS | Lisenergylimited | 0.77 | 51% | -1% | -2% | $130,242,636.80 |

| A8G | Australasian Metals | 0.255 | 6% | 9% | -2% | $10,704,328.44 |

| STM | Sunstone Metals Ltd | 0.05 | 22% | -4% | -2% | $132,418,767.37 |

| KTA | Krakatoa Resources | 0.05 | 11% | -15% | -2% | $17,580,205.77 |

| MXR | Maximus Resources | 0.049 | 9% | 4% | -2% | $15,895,288.40 |

| TUL | Tulla Resources | 0.5475 | 5% | 2% | -2% | $89,721,448.32 |

| JRL | Jindalee Resources | 2.5 | -12% | -4% | -2% | $146,890,152.96 |

| SYA | Sayona Mining Ltd | 0.195 | 11% | 3% | -3% | $1,649,619,303.20 |

| WR1 | Winsome Resources | 0.185 | -16% | -3% | -3% | $25,671,658.86 |

| MM1 | Midasmineralsltd | 0.185 | -5% | -5% | -3% | $10,855,035.16 |

| VMC | Venus Metals Cor Ltd | 0.175 | 9% | 3% | -3% | $28,814,162.94 |

| MQR | Marquee Resource Ltd | 0.069 | 8% | -1% | -3% | $22,408,848.18 |

| TKM | Trek Metals Ltd | 0.066 | 5% | 3% | -3% | $21,121,490.20 |

| SCN | Scorpion Minerals | 0.065 | -7% | -4% | -3% | $22,232,689.86 |

| AOU | Auroch Minerals Ltd | 0.06 | 5% | -6% | -3% | $22,921,511.54 |

| LPD | Lepidico Ltd | 0.029 | 7% | -3% | -3% | $195,215,145.99 |

| NMT | Neometals Ltd | 1.12 | 21% | 9% | -4% | $641,600,383.32 |

| MTM | Mtmongerresources | 0.105 | -22% | -5% | -5% | $4,126,103.63 |

| TEM | Tempest Minerals | 0.041 | -45% | -9% | -5% | $21,704,945.57 |

| ARN | Aldoro Resources | 0.2 | 48% | 38% | -5% | $20,913,336.57 |

| 1MC | Morella Corporation | 0.018 | 0% | 6% | -5% | $98,348,065.73 |

| ADV | Ardiden Ltd | 0.0085 | 21% | -6% | -6% | $24,015,018.20 |

| SRZ | Stellar Resources | 0.017 | 6% | 6% | -6% | $15,107,447.27 |

| RAS | Ragusa Minerals Ltd | 0.077 | -9% | 1% | -6% | $10,310,364.79 |

| RLC | Reedy Lagoon Corp. | 0.015 | -12% | -17% | -6% | $8,918,830.59 |

| PNN | Power Minerals Ltd | 0.47 | 8% | 1% | -7% | $31,066,016.83 |

| ASN | Anson Resources Ltd | 0.13 | 31% | -4% | -7% | $143,907,726.90 |

| DTM | Dart Mining NL | 0.076 | 33% | 23% | -7% | $11,091,333.12 |

| ENT | Enterprise Metals | 0.011 | 38% | 10% | -8% | $7,835,768.26 |

| CZL | Cons Zinc Ltd | 0.018 | 0% | -5% | -10% | $7,267,156.26 |

| LRV | Larvottoresources | 0.205 | -29% | 0% | -11% | $9,552,475.00 |

| XTC | Xantippe Res Ltd | 0.008 | 0% | 0% | -11% | $71,781,512.08 |

| WCN | White Cliff Min Ltd | 0.0115 | -12% | -18% | -12% | $8,496,843.71 |

| AM7 | Arcadia Minerals | 0.14 | -28% | -7% | -13% | $7,471,662.72 |

| ALY | Alchemy Resource Ltd | 0.014 | 8% | -22% | -18% | $16,202,258.97 |

A total of 49 stocks were in the green, 42 were flat and 40 were red.

Who’s got news quarterlies out today?

PLS boss Dale Henderson has described the company’s decision to add another 100,000t of capacity at its Pilgangoora project which will take its spodumene production potential to as much as 680,000t in a $291m project as “money for jam.”

The company increased production by 56% quarter on quarter in the three months to June 30 to 127,236dmt, with shipments lifting 127% to 132,424t. Its annual production rose 34% to 377,902dmt, near the upper end of PLS’ guidance of 340-380,000t.

A further 200,000t of capacity has been commissioned with the start-up of the Ngangaju plant at Pilgangoora and average realised selling prices rose 61% to US$4,267/dmt, with a record sale of US$7017/t on a 6% Li2O equivalent basis in one of the company’s patented Battery Materials Exchange auctions.

“It’s great to have that capital project approved,” Henderson said. “The board has made it clear to us to drop the clutch and get on with the expansion.

“In this market it’s money for jam and we are positioned like none other to capitalise in this market.”

At the company’s Lithium-ion Battery (LIB) Recycling Project operations commenced during the quarter at the commercial 10 tonnes per day (tpd) shredding and beneficiation (Spoke) plant in Hilchenbach, Germany, following receipt of operating permit.

Cornerstone LIB feedstock supply and intermediate ‘black mass’ product off-take agreements were secured, and the company signed a cooperation agreement with a Mercedes-Benz recycling subsidiary for the engineering, equipment supply and installation of a 10tpd Spoke and hydrometallurgical refinery (Hub) plant in Kuppenheim, Germany.

Plus, NMT completed the first stage of front-end engineering studies for the Stelco 50tpd Spoke plant in Hamilton Canada under a technology licensing and JV ‘buy-in’ option agreement.

During the quarter, Zenith’s maiden drill testing at the Split Rocks project in WA returned results including 20m at 1.0% Li2O, including10m at 1.7% Li2O.

oA program of 45 initial RC holes (~9,000 metres) has commenced to follow-up on the thick, high-grade lithium mineralisation.

Plus, drilling at the Waratah Well project retruned 7m at 0.67% Li2O, with 2,000m of follow up drilling planned.

And the Australian Lithium Alliance (which is 40% ZNC, 60% EV Metals) is gearing up to test the Mt Ida North lithium target in August.

Lake says Citi and JPMorgan were appointed joint coordinators for proposed debt finance of the Kachi Lithium project in Argentina during the quarter, and discussions continue with UK Export Finance (UKEF) and Export Development Canada (EDC) to support approximately 70% of the total finance required for Kachi’s expanded production.

The company is also advancing the Definitive Feasibility Study (DFS) continues to advance with final drafts expected toward the end of 3Q 2022, based on 50,000 tonnes per annum lithium carbonate equivalent (LCE).

And more importantly, Lake says the Lilac demonstration plant has arrive on site – a bit of an -in-your-face to a sassy report from J Capital earlier this month who said the company put forth incorrect information on technical matters and inaccurate assertions on its progress to-date with Lilac.

PLS, NMT, ZNC and LKE share prices today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.