Eye on Lithium: Chinese batteries fly off shelves, while Aussies bat it out of the park in Canada

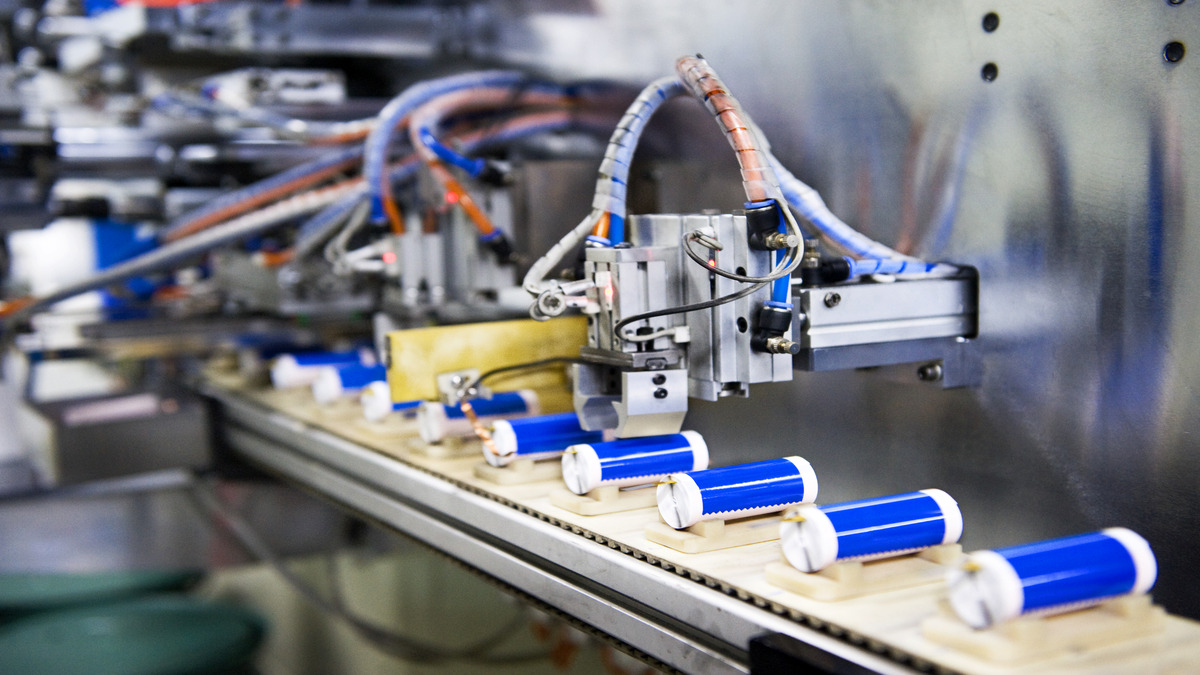

Chinese batteries are flying off the shelves. Image via Getty.

- China’s battery manufacturing is on the rise again

- Livent is livid about impending refined lithium shortages

- Aussies are batting well in Canada, again

All your lithium news, Wednesday, June 14.

Good news coming out of China recently, as its lithium-ion battery sector maintained growth momentum in the first two months of this year, according to official data.

Total output of lithium-ion batteries exceeded 102 gigawatt-hours (GWh) in the period, jumping 24% year-on-year, said China’s Ministry of Industry and Information Technology.

Lithium-ion batteries used for power storage surpassed 15GWh, while the installed capacity of power batteries for EVs came in at about 38GWh.

China’s exports of lithium-ion batteries reached 70.6 billion yuan (about US$10.26bn) in January and February.

Growth on the manufacturing side of things means replacement materials such as lithium and its other component elements should see an uptick in imports from the Chinese market.

Meanwhile, Livent is worried about shortfalls in battery-grade lithium, as the market is getting tighter.

“There is no consensus across the industry as to what makes a lithium spec. Those specs are getting tighter, those requirements are getting tighter, so as long as we keep moving in that direction, it’s very hard to envision a world in which lithium becomes commoditised and we enter into a potential oversupply,” Livent’s North American operations manager Sarah Maryssael said.

Here’s how Aussie lithium stocks are tracking:

| Code | Company | Price | % Today | Market Cap |

|---|---|---|---|---|

| G88 | Golden Mile Res Ltd | 0.049 | 104% | $6,711,436 |

| ARN | Aldoro Resources | 0.14 | 27% | $14,786,612 |

| IMI | Infinitymining | 0.155 | 24% | $9,559,790 |

| RLC | Reedy Lagoon Corp. | 0.006 | 20% | $2,833,598 |

| NIS | Nickelsearch | 0.076 | 19% | $3,872,347 |

| EMS | Eastern Metals | 0.054 | 13% | $1,875,092 |

| VKA | Viking Mines Ltd | 0.009 | 13% | $8,202,067 |

| MM1 | Midasmineralsltd | 0.225 | 13% | $11,426,353 |

| KAI | Kairos Minerals Ltd | 0.019 | 12% | $33,389,589 |

| RAG | Ragnar Metals Ltd | 0.02 | 11% | $6,825,328 |

| WC8 | Wildcat Resources | 0.1375 | 10% | $82,752,841 |

| VSR | Voltaic Strategic | 0.115 | 10% | $38,793,063 |

| LRS | Latin Resources Ltd | 0.2075 | 9% | $484,656,101 |

| KTA | Krakatoa Resources | 0.024 | 9% | $7,994,285 |

| FBM | Future Battery | 0.13 | 8% | $51,341,416 |

| AM7 | Arcadia Minerals | 0.135 | 8% | $5,837,237 |

| JRL | Jindalee Resources | 2.05 | 8% | $109,020,035 |

| LNR | Lanthanein Resources | 0.016 | 7% | $16,823,634 |

| GSM | Golden State Mining | 0.05 | 6% | $6,780,418 |

| PGD | Peregrine Gold | 0.275 | 6% | $14,586,679 |

| LIS | Lisenergylimited | 0.285 | 6% | $44,796,830 |

| LLL | Leolithiumlimited | 0.9475 | 5% | $888,055,230 |

| AZI | Altamin Limited | 0.073 | 4% | $27,420,173 |

| AKE | Allkem Limited | 16.005 | 4% | $9,788,051,620 |

| BMM | Balkanminingandmin | 0.1875 | 4% | $8,598,963 |

| MIN | Mineral Resources. | 70.7 | 4% | $13,189,553,785 |

| MRR | Minrex Resources Ltd | 0.0135 | 4% | $14,103,278 |

| DLI | Delta Lithium | 0.68 | 4% | $296,925,140 |

| AS2 | Askarimetalslimited | 0.275 | 4% | $17,856,588 |

| A8G | Australasian Metals | 0.14 | 4% | $7,036,267 |

| PLS | Pilbara Min Ltd | 4.915 | 4% | $14,211,408,660 |

| INR | Ioneer Ltd | 0.3525 | 4% | $713,435,011 |

| PLL | Piedmont Lithium Inc | 0.9225 | 4% | $385,173,310 |

| VUL | Vulcan Energy | 3.79 | 4% | $612,447,202 |

| IGO | IGO Limited | 15.15 | 3% | $11,131,836,851 |

| FRS | Forrestaniaresources | 0.068 | 3% | $4,018,826 |

| CAI | Calidus Resources | 0.175 | 3% | $94,814,068 |

| RIO | Rio Tinto Limited | 116.155 | 3% | $41,902,886,236 |

| TON | Triton Min Ltd | 0.036 | 3% | $54,647,446 |

| AGY | Argosy Minerals Ltd | 0.4575 | 3% | $624,961,337 |

| MNS | Magnis Energy Tech | 0.19 | 3% | $206,336,324 |

| LTR | Liontown Resources | 2.875 | 3% | $6,161,345,288 |

| VMC | Venus Metals Cor Ltd | 0.195 | 3% | $34,433,450 |

| QPM | Queensland Pacific | 0.1075 | 2% | $183,366,532 |

| GL1 | Globallith | 1.545 | 2% | $391,167,815 |

| LRD | Lordresourceslimited | 0.1 | 2% | $3,638,948 |

| LRD | Lordresourceslimited | 0.1 | 2% | $3,638,948 |

| CXO | Core Lithium | 1.04 | 1% | $1,904,979,714 |

| EG1 | Evergreenlithium | 0.35 | 1% | $19,399,350 |

| NMT | Neometals Ltd | 0.5775 | 1% | $315,062,470 |

| RAS | Ragusa Minerals Ltd | 0.077 | 1% | $10,837,508 |

| GLN | Galan Lithium Ltd | 0.94 | 1% | $313,331,327 |

| A11 | Atlantic Lithium | 0.605 | 1% | $365,544,996 |

| GT1 | Greentechnology | 0.66 | 1% | $125,261,147 |

| WES | Wesfarmers Limited | 48.215 | 0% | $54,454,316,441 |

| ADV | Ardiden Ltd | 0.007 | 0% | $18,818,347 |

| AML | Aeon Metals Ltd. | 0.018 | 0% | $19,735,211 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | $2,752,409,203 |

| ESS | Essential Metals Ltd | 0.44 | 0% | $117,729,345 |

| EUR | European Lithium Ltd | 0.1 | 0% | $148,923,918 |

| LIT | Lithium Australia | 0.036 | 0% | $43,962,900 |

| LPD | Lepidico Ltd | 0.012 | 0% | $91,653,387 |

| TKL | Traka Resources | 0.007 | 0% | $6,099,305 |

| PAM | Pan Asia Metals | 0.26 | 0% | $40,369,239 |

| AX8 | Accelerate Resources | 0.02 | 0% | $7,592,035 |

| BYH | Bryah Resources Ltd | 0.018 | 0% | $6,149,240 |

| FG1 | Flynngold | 0.074 | 0% | $7,760,642 |

| LRV | Larvottoresources | 0.135 | 0% | $9,079,387 |

| MMC | Mitremining | 0.27 | 0% | $10,323,477 |

| CTN | Catalina Resources | 0.003 | 0% | $3,715,461 |

| TEM | Tempest Minerals | 0.014 | 0% | $7,095,503 |

| CRR | Critical Resources | 0.043 | 0% | $68,574,459 |

| PNN | Power Minerals Ltd | 0.44 | 0% | $31,827,085 |

| MTM | MTM Critical Metals | 0.12 | 0% | $10,602,907 |

| QXR | Qx Resources Limited | 0.032 | 0% | $28,699,594 |

| ENT | Enterprise Metals | 0.004 | 0% | $2,820,323 |

| STM | Sunstone Metals Ltd | 0.02 | 0% | $61,639,698 |

| AVW | Avira Resources Ltd | 0.0025 | 0% | $5,334,475 |

| BNR | Bulletin Res Ltd | 0.061 | 0% | $17,909,057 |

| EFE | Eastern Resources | 0.012 | 0% | $14,903,358 |

| SRZ | Stellar Resources | 0.01 | 0% | $10,059,642 |

| LSR | Lodestar Minerals | 0.004 | 0% | $7,373,589 |

| NWM | Norwest Minerals | 0.031 | 0% | $8,606,670 |

| AOA | Ausmon Resorces | 0.004 | 0% | $3,877,157 |

| IPT | Impact Minerals | 0.013 | 0% | $36,981,151 |

| RGL | Riversgold | 0.015 | 0% | $14,268,922 |

| EPM | Eclipse Metals | 0.012 | 0% | $24,336,718 |

| EVR | Ev Resources Ltd | 0.014 | 0% | $13,103,777 |

| THR | Thor Energy PLC | 0.005 | 0% | $7,300,064 |

| YAR | Yari Minerals Ltd | 0.017 | 0% | $8,200,083 |

| MXR | Maximus Resources | 0.034 | 0% | $10,847,896 |

| LLI | Loyal Lithium Ltd | 0.32 | 0% | $19,036,800 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | $74,238,031 |

| ALY | Alchemy Resource Ltd | 0.018 | 0% | $21,205,373 |

| DAF | Discovery Alaska Ltd | 0.03 | 0% | $7,027,041 |

| FTL | Firetail Resources | 0.105 | 0% | $8,085,000 |

| IR1 | Irismetals | 1.16 | 0% | $74,506,800 |

| TUL | Tulla Resources | 0.32 | 0% | $108,126,145 |

| CMD | Cassius Mining Ltd | 0.024 | 0% | $9,803,830 |

| PL3 | Patagonia Lithium | 0.185 | 0% | $9,065,648 |

| RMX | Red Mount Min Ltd | 0.004 | 0% | $9,087,404 |

| LM1 | Leeuwin Metals Ltd | 0.28 | 0% | $12,539,800 |

| ENT | Enterprise Metals | 0.004 | 0% | $2,820,323 |

| FIN | FIN Resources Ltd | 0.015 | 0% | $9,278,030 |

| DTM | Dart Mining NL | 0.045 | 0% | $7,752,925 |

| MAN | Mandrake Res Ltd | 0.04 | 0% | $23,950,397 |

| KOB | Kobaresourceslimited | 0.17 | 0% | $17,920,833 |

| IEC | Intra Energy Corp | 0.006 | 0% | $4,234,690 |

| LEL | Lithenergy | 0.965 | -1% | $92,634,750 |

| TMB | Tambourahmetals | 0.089 | -1% | $3,707,334 |

| AZL | Arizona Lithium Ltd | 0.0405 | -1% | $112,736,745 |

| LLO | Lion One Metals Ltd | 0.79 | -1% | $10,546,275 |

| SYA | Sayona Mining Ltd | 0.1775 | -1% | $1,807,044,844 |

| DAL | Dalaroometalsltd | 0.071 | -1% | $3,119,400 |

| OCN | Oceanalithiumlimited | 0.355 | -1% | $14,103,540 |

| SCN | Scorpion Minerals | 0.069 | -1% | $24,199,433 |

| TKM | Trek Metals Ltd | 0.066 | -1% | $29,409,321 |

| NVA | Nova Minerals Ltd | 0.28 | -2% | $60,103,638 |

| LPM | Lithium Plus | 0.25 | -2% | $16,826,991 |

| MQR | Marquee Resource Ltd | 0.049 | -2% | $16,360,375 |

| LPI | Lithium Pwr Int Ltd | 0.3125 | -2% | $201,356,019 |

| BUR | Burleyminerals | 0.19 | -3% | $14,550,862 |

| WR1 | Winsome Resources | 1.515 | -3% | $252,624,549 |

| ASN | Anson Resources Ltd | 0.175 | -3% | $220,237,309 |

| EMH | European Metals Hldg | 0.805 | -3% | $104,446,553 |

| LKE | Lake Resources | 0.465 | -3% | $682,773,459 |

| CHR | Charger Metals | 0.375 | -4% | $17,048,604 |

| DRE | Dreadnought Resources Ltd | 0.049 | -4% | $169,714,139 |

| PSC | Prospect Res Ltd | 0.11 | -4% | $53,159,838 |

| ZNC | Zenith Minerals Ltd | 0.105 | -5% | $38,761,897 |

| KGD | Kula Gold Limited | 0.019 | -5% | $7,464,238 |

| TYX | Tyranna Res Ltd | 0.019 | -5% | $62,128,507 |

| ZEO | Zeotech Limited | 0.055 | -5% | $95,160,929 |

| CY5 | Cygnus Metals Ltd | 0.275 | -5% | $62,100,806 |

| PAT | Patriot Lithium | 0.275 | -5% | $17,802,376 |

| MLS | Metals Australia | 0.032 | -6% | $21,217,230 |

| 1MC | Morella Corporation | 0.0075 | -6% | $48,788,644 |

| WCN | White Cliff Min Ltd | 0.007 | -7% | $7,192,908 |

| GW1 | Greenwing Resources | 0.205 | -7% | $32,980,151 |

| AUN | Aurumin | 0.027 | -7% | $7,861,655 |

| WML | Woomera Mining Ltd | 0.013 | -7% | $13,386,257 |

| SGQ | St George Min Ltd | 0.049 | -8% | $44,547,059 |

| KZR | Kalamazoo Resources | 0.12 | -8% | $19,982,391 |

| AAJ | Aruma Resources Ltd | 0.047 | -8% | $10,006,294 |

| M2R | Miramar | 0.044 | -8% | $3,858,324 |

| INF | Infinity Lithium | 0.1 | -9% | $50,885,130 |

| SRI | Sipa Resources Ltd | 0.019 | -14% | $5,019,479 |

| EMC | Everest Metals Corp | 0.11 | -15% | $16,826,304 |

| EMC | Everest Metals Corp | 0.11 | -15% | $16,826,304 |

| XTC | Xantippe Res Ltd | 0.0025 | -17% | $34,440,299 |

54 lithium stocks were in the green today, while 54 stayed even. 42 of them saw red.

WHO’S GOT NEWS OUT?

SULTAN RESOURCES (ASX:SLZ)

SLZ is off exploring with helicopter-backed geologists at its Kembler and Ruddy lithium projects in Canada.

At Kembler, the explorer completed a desktop review that highlighted multiple pegmatite occurrences and will now undertake initial exploration activities with helicopter-supported geologists to do recon mapping and sampling of priority targets later this month.

Exploration at Ruddy is ongoing too, with an initial focus of exploration at the ‘LCT Goldilocks Zone’, an area that covers ~3.5km of east-west strike in the centre-south of the project and sits across a greenstone belt.

The propellers will spin once again to map out priority outcrops, and samples from both projects will be shipped off to the lab and reported to the market soon.

RECHARGE METALS (ASX:REC)

REC has again expanded its footprint into the region by snapping up the Wapistan project, 120km north of its flagship Express interest.

The 107km2 Wapistan lithium project takes the company’s total James Bay footprint up over 180km2, and is a stone’s throw from Q2 Metals’ Mia lithium project where outcropping lithium has been confirmed at two prospects as well as at Ophir Gold’s Radis project.

Importantly, it overlies 30km of the same greenstone belts which host lithium mineralisation at Mia and Radis.

More broadly, the James Bay region has seen a remarkable amount of attention with fellow Australian Discovery Alaska picking up three early-stage projects, one (Mia Adjacent) of which is located close to Wapistan.

While no lithium targeting or exploration has been carried out at Wapistan, the sheer volume of nearology is reason enough for the company to be keen to get to grips with its new project.

“The Wapistan Lithium Project presents Recharge with a fantastic opportunity to acquire a ‘belt-scale’ project within the James Bay area,” REC MD Felicity Repacholi-Muir said.

“The easy access to Wapistan, its proximity to other highly successful projects, and having geological teams available nearby that can start quickly, make this an obvious opportunity to create value for Recharge’s investors.

“The company plans to be active throughout the summer field season at both Wapistan and Express once conditions permit, and we look forward to revealing the potential we see at both projects as findings warrant.”

LORD RESOURCES (ASX:LRD)

Phase 1 exploration drilling at Lord Resources’ Horse Rocks has found a fractionated lithium-caesium-tantalum system with anomalous intercepts at shallow depths.

Geological interpretation indicates the pegmatites are a series of stacked sheets, dipping at a low angle towards the east while a structural control is evident to the placement of pegmatite intrusions.

The pegmatites also tend to thicken at or near the contacts of the north-south trending ultramafic and high-magnesium basalt units.

LRD says elevated lithium assays within sheared greenstone lithologies are likely to be from lithium-rich fluids coming from deeper pegmatite intrusions, which provides further evidence that lithium-bearing pegmatites may be present deeper within the system.

Assays have been sent to the lab and the company is eagerly awaiting results, as it plans to carry out structural reviews, including obtaining magnetic and radiometric geophysical datasets.

At Stockhead, we tell it like it is. While Recharge Metals, Lord Resources and Sultan Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.