Eye on Lithium: What oversupply? CBA analyst says electric vehicle supply chain still screaming for more lithium

Pic: Hill Street Studios / DigitalVision via Getty Images

- CBA says level of pressure on lithium supply is huge out to 2030

- High lithium prices could be the catalyst for new battery chemistries

- Core Lithium progresses development of Finnis project in the NT

All your ASX lithium news for Tuesday, June 21.

A few weeks back Goldman Sachs, and then Credit Suisse – both well respected investment banks – released reports forecasting imminent oversupply in the lithium space.

Lithium stocks were hammered. In the ensuing weeks, however, industry experts and fellow investment banks have come out to counter these claims.

Among them was Benchmark Mineral Intelligence who gave four reasons why Goldman Sachs is wrong, and why the lithium market will remain in structural shortage until 2025.

And now CBA director mining and energy economist Vivek Dhar has added his forecasts to the debate.

On the conflicting views, Dhar says if you look at other research houses like Wood Mackenzie, they say we’ll need roughly 30-40% more lithium supply by 2030.

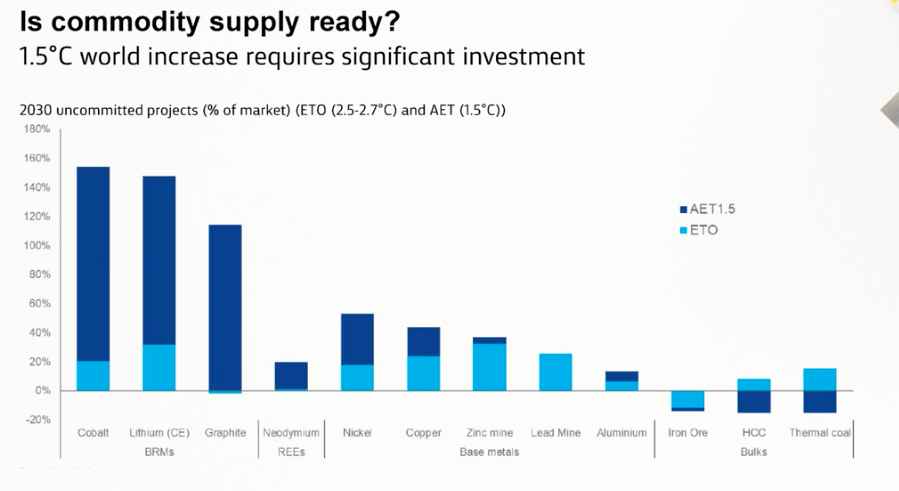

“If you look at what you need to hit 1.5 °, you actually jump up your uncommitted new supply by 2030 closer to 150% – so the level of pressure on lithium supply is huge,” he said.

“And to say that we’re going to have a hiccup when the EV supply chain is just screaming for more materials, it’s hard for me to see how that stacks up.”

Dhar pointed to the fact that major EV players like Tesla and BYD have looked at buying upstream, so there’s a link now between downstream and ensuring upstream supply.

“I think that the idea that we’re going to move away from lithium because the demand side falls away is very challenging to see in this environment,” Dhar said.

Prices could be the chemistry catalyst

“Prices are very strong, and it will likely moderate because we’ll hit a point where it just becomes unprofitable, but I think the first thing that will change is the battery chemistries,” Dhar said.

He expects rising lithium prices – along with nickel and cobalt – will be the catalyst to evolve the type of battery chemistries used.

Here’s how ASX lithium stocks were tracking today:

Lithium stocks missing from our list? Shoot a friendly mail to [email protected]

| Code | Company | Price | % Month | % Week | % Today | Market Cap |

|---|---|---|---|---|---|---|

| AML | Aeon Metals Ltd. | 0.024 | -33% | -11% | 14% | $20,813,757.78 |

| RGL | Riversgold | 0.03 | -39% | -12% | 11% | $20,422,151.97 |

| BNR | Bulletin Res Ltd | 0.1325 | -32% | -2% | 10% | $34,810,932.00 |

| RMX | Red Mount Min Ltd | 0.0055 | -31% | -8% | 10% | $8,211,819.29 |

| 1MC | Morella Corporation | 0.0175 | -38% | -3% | 9% | $82,819,423.78 |

| M2R | Miramar | 0.082 | -34% | -25% | 9% | $4,813,999.73 |

| RDT | Red Dirt Metals Ltd | 0.355 | -36% | -21% | 9% | $98,980,188.45 |

| TEM | Tempest Minerals | 0.039 | -39% | -13% | 8% | $18,171,582.34 |

| QXR | Qx Resources Limited | 0.026 | -46% | -19% | 8% | $20,624,695.70 |

| KGD | Kula Gold Limited | 0.027 | -18% | -10% | 8% | $5,379,390.80 |

| LIS | Lisenergylimited | 0.4525 | -26% | -5% | 8% | $69,683,958.54 |

| SYA | Sayona Mining Ltd | 0.14 | -50% | 0% | 8% | $1,071,522,420.28 |

| ALY | Alchemy Resource Ltd | 0.016 | -43% | -11% | 7% | $14,296,110.86 |

| TKM | Trek Metals Ltd | 0.064 | -12% | -18% | 7% | $18,636,609.00 |

| MQR | Marquee Resource Ltd | 0.066 | -37% | -20% | 6% | $19,340,806.07 |

| MRR | Minrex Resources Ltd | 0.035 | -36% | -13% | 6% | $33,287,611.80 |

| SRI | Sipa Resources Ltd | 0.038 | -5% | -3% | 6% | $7,380,892.91 |

| ZNC | Zenith Minerals Ltd | 0.285 | -21% | -22% | 6% | $92,854,121.85 |

| FTL | Firetail Resources | 0.29 | -11% | -16% | 5% | $16,990,187.50 |

| BMM | Balkanminingandmin | 0.2 | -26% | -11% | 5% | $6,222,500.00 |

| G88 | Golden Mile Res Ltd | 0.04 | -27% | -20% | 5% | $7,741,839.33 |

| ASN | Anson Resources Ltd | 0.105 | -9% | -9% | 5% | $102,791,233.50 |

| QPM | Queensland Pacific | 0.105 | -38% | -16% | 5% | $156,361,313.10 |

| AOU | Auroch Minerals Ltd | 0.07 | -21% | -19% | 4% | $24,753,270.53 |

| PAM | Pan Asia Metals | 0.475 | -3% | 1% | 4% | $33,514,683.02 |

| INR | Ioneer Ltd | 0.385 | -29% | -13% | 4% | $773,780,785.40 |

| FRS | Forrestaniaresources | 0.135 | -41% | -16% | 4% | $3,652,844.52 |

| GSM | Golden State Mining | 0.046 | -34% | -12% | 3% | $5,180,748.70 |

| LRS | Latin Resources Ltd | 0.062 | -56% | -13% | 3% | $115,803,824.28 |

| AGY | Argosy Minerals Ltd | 0.325 | -20% | -16% | 3% | $427,133,250.81 |

| AKE | Allkem Limited | 10.095 | -23% | -7% | 3% | $6,249,049,242.80 |

| RIO | Rio Tinto Limited | 104.54 | -4% | -10% | 3% | $37,711,855,180.26 |

| ESS | Essential Metals Ltd | 0.355 | -35% | -17% | 3% | $85,038,161.63 |

| NVA | Nova Minerals Ltd | 0.585 | -9% | 4% | 3% | $102,715,302.45 |

| VUL | Vulcan Energy | 5.55 | -26% | -14% | 3% | $712,199,936.90 |

| MM1 | Midasmineralsltd | 0.2 | -34% | -20% | 3% | $10,615,434.38 |

| A8G | Australasian Metals | 0.205 | -44% | -20% | 3% | $8,234,098.80 |

| NMT | Neometals Ltd | 0.9375 | -29% | -12% | 2% | $501,764,402.34 |

| PLS | Pilbara Min Ltd | 2.09 | -27% | -7% | 2% | $6,072,770,703.36 |

| WR1 | Winsome Resources | 0.21 | -52% | -33% | 2% | $27,698,368.77 |

| IGO | IGO Limited | 10.58 | -9% | -7% | 2% | $7,822,576,508.29 |

| RAS | Ragusa Minerals Ltd | 0.088 | 10% | 0% | 2% | $10,813,309.42 |

| MLS | Metals Australia | 0.047 | -55% | -18% | 2% | $24,289,664.79 |

| AZL | Arizona Lithium Ltd | 0.095 | -39% | -14% | 2% | $207,642,886.72 |

| LPD | Lepidico Ltd | 0.0255 | -12% | -9% | 2% | $162,679,288.33 |

| ZEO | Zeotech Limited | 0.052 | 0% | -12% | 2% | $77,770,688.97 |

| AS2 | Askarimetalslimited | 0.27 | -49% | -14% | 2% | $11,022,481.55 |

| EUR | European Lithium Ltd | 0.055 | -31% | -18% | 2% | $74,677,336.34 |

| MNS | Magnis Energy Tech | 0.305 | -25% | -12% | 2% | $289,945,598.70 |

| LIT | Lithium Australia | 0.071 | -17% | -12% | 1% | $72,478,368.97 |

| MIN | Mineral Resources. | 48.99 | -18% | -14% | 1% | $9,140,313,208.77 |

| GLN | Galan Lithium Ltd | 1.085 | -25% | -9% | 1% | $325,707,317.34 |

| GL1 | Globallith | 1.2 | -32% | -15% | 1% | $188,057,433.36 |

| PNN | Power Minerals Ltd | 0.405 | -29% | -12% | 1% | $24,601,398.40 |

| CRR | Critical Resources | 0.0455 | -46% | -16% | 1% | $66,960,685.76 |

| AZI | Altamin Limited | 0.096 | 0% | 1% | 1% | $37,213,091.44 |

| CAI | Calidus Resources | 0.635 | -27% | -7% | 1% | $254,030,904.54 |

| LTR | Liontown Resources | 1.02 | -22% | -9% | 0% | $2,225,108,575.97 |

| ADV | Ardiden Ltd | 0.008 | -33% | -11% | 0% | $21,346,682.85 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | 0% | 0% | $2,752,409,203.44 |

| INF | Infinity Lithium | 0.125 | -7% | -11% | 0% | $51,876,633.25 |

| FFX | Firefinch Ltd | 0.225 | -76% | -17% | 0% | $265,779,724.73 |

| PLL | Piedmont Lithium Inc | 0.695 | -19% | -6% | 0% | $366,661,706.00 |

| RLC | Reedy Lagoon Corp. | 0.017 | -37% | -6% | 0% | $9,476,257.50 |

| TON | Triton Min Ltd | 0.022 | -19% | -19% | 0% | $27,693,251.89 |

| LEL | Lithenergy | 0.72 | -41% | -20% | 0% | $32,508,000.00 |

| ARN | Aldoro Resources | 0.145 | -34% | -17% | 0% | $14,385,970.41 |

| CHR | Charger Metals | 0.39 | -32% | -14% | 0% | $12,706,603.65 |

| AAJ | Aruma Resources Ltd | 0.067 | -17% | -4% | 0% | $10,516,420.70 |

| AM7 | Arcadia Minerals | 0.19 | -19% | -17% | 0% | $8,872,599.48 |

| EMS | Eastern Metals | 0.125 | -42% | -17% | 0% | $4,450,000.00 |

| IMI | Infinitymining | 0.14 | -13% | -10% | 0% | $8,050,000.00 |

| MMC | Mitremining | 0.12 | -17% | -8% | 0% | $3,250,212.00 |

| SHH | Shree Minerals Ltd | 0.008 | -24% | 0% | 0% | $9,777,895.14 |

| TMB | Tambourahmetals | 0.14 | -36% | -22% | 0% | $5,766,963.72 |

| TSC | Twenty Seven Co. Ltd | 0.003 | -25% | -14% | 0% | $7,982,441.72 |

| WCN | White Cliff Min Ltd | 0.016 | -24% | -11% | 0% | $10,457,653.79 |

| WML | Woomera Mining Ltd | 0.018 | -14% | -10% | 0% | $12,362,995.19 |

| MTM | Mtmongerresources | 0.105 | -32% | -30% | 0% | $3,807,303.47 |

| SCN | Scorpion Minerals | 0.072 | -28% | -9% | 0% | $23,891,845.82 |

| ENT | Enterprise Metals | 0.011 | -27% | -15% | 0% | $7,091,115.41 |

| KAI | Kairos Minerals Ltd | 0.02 | -26% | -9% | 0% | $39,241,869.82 |

| STM | Sunstone Metals Ltd | 0.038 | -32% | -25% | 0% | $97,828,963.88 |

| PGD | Peregrine Gold | 0.39 | -20% | -11% | 0% | $14,931,800.91 |

| AVW | Avira Resources Ltd | 0.004 | 0% | 0% | 0% | $8,475,160.00 |

| EFE | Eastern Resources | 0.023 | -41% | -15% | 0% | $22,872,042.51 |

| SRZ | Stellar Resources | 0.017 | -29% | -11% | 0% | $14,268,144.64 |

| AOA | Ausmon Resorces | 0.006 | -25% | -14% | 0% | $5,143,736.06 |

| VKA | Viking Mines Ltd | 0.007 | -22% | -13% | 0% | $7,176,809.02 |

| VMC | Venus Metals Cor Ltd | 0.16 | -9% | -6% | 0% | $24,172,589.28 |

| EPM | Eclipse Metals | 0.021 | -22% | -9% | 0% | $40,343,654.67 |

| DRE | Dreadnought Resources Ltd | 0.042 | 5% | 14% | 0% | $119,224,709.14 |

| XTC | Xantippe Res Ltd | 0.008 | -27% | -11% | 0% | $61,544,455.19 |

| LRD | Lordresourceslimited | 0.18 | -45% | -18% | 0% | $5,541,231.78 |

| AUN | Aurumin | 0.125 | -34% | -24% | 0% | $13,652,906.50 |

| KTA | Krakatoa Resources | 0.053 | -30% | -17% | 0% | $18,269,625.60 |

| TYX | Tyranna Res Ltd | 0.016 | 78% | 0% | 0% | $24,517,770.67 |

| DAF | Discovery Alaska Ltd | 0.05 | -23% | -7% | 0% | $11,211,734.90 |

| IR1 | Irismetals | 0.29 | -54% | 5% | 0% | $17,291,250.00 |

| DAL | Dalaroometalsltd | 0.095 | -30% | 16% | 0% | $2,838,125.00 |

| CY5 | Cygnus Gold Limited | 0.155 | -3% | -9% | 0% | $18,287,723.83 |

| PSC | Prospect Res Ltd | 0.965 | 2% | 1% | -1% | $432,296,591.33 |

| JRL | Jindalee Resources | 2.83 | -22% | -7% | -1% | $163,530,053.10 |

| GT1 | Greentechnology | 0.69 | -19% | -17% | -1% | $109,693,240.00 |

| KZR | Kalamazoo Resources | 0.2275 | -35% | -19% | -1% | $33,394,706.02 |

| LPI | Lithium Pwr Int Ltd | 0.37 | -37% | -14% | -1% | $130,929,318.00 |

| MXR | Maximus Resources | 0.046 | -38% | -23% | -2% | $14,941,571.10 |

| RAG | Ragnar Metals Ltd | 0.039 | -9% | -13% | -3% | $15,167,395.56 |

| NWM | Norwest Minerals | 0.028 | -39% | -20% | -3% | $5,237,614.22 |

| EMH | European Metals Hldg | 0.64 | -35% | -24% | -4% | $93,616,681.73 |

| EVR | Ev Resources Ltd | 0.025 | -44% | -19% | -4% | $24,075,585.85 |

| MMG | Monger Gold Ltd | 0.24 | -21% | -4% | -4% | $10,010,000.00 |

| CZL | Cons Zinc Ltd | 0.019 | -17% | -14% | -5% | $7,267,156.26 |

| CXO | Core Lithium | 1.02 | -24% | -18% | -5% | $1,862,279,608.30 |

| THR | Thor Mining PLC | 0.009 | -31% | -25% | -5% | $10,139,359.24 |

| BYH | Bryah Resources Ltd | 0.033 | -27% | -13% | -6% | $7,917,251.13 |

| LNR | Lanthanein Resources | 0.015 | -46% | -17% | -6% | $13,405,209.12 |

| LRV | Larvottoresources | 0.215 | -32% | -10% | -7% | $9,552,475.00 |

| GW1 | Greenwing Resources | 0.21 | -36% | -18% | -9% | $28,346,890.27 |

| AX8 | Accelerate Resources | 0.028 | -24% | -15% | -10% | $8,167,225.87 |

| WC8 | Wildcat Resources | 0.027 | -21% | -16% | -10% | $19,358,181.81 |

| WMC | Wiluna Mining Corp | 0.275 | -43% | -43% | -11% | $109,936,225.35 |

| DTM | Dart Mining NL | 0.051 | -30% | -22% | -12% | $7,845,089.28 |

| TKL | Traka Resources | 0.007 | -13% | -13% | -13% | $5,510,196.49 |

| FG1 | Flynngold | 0.105 | -28% | -19% | -13% | $7,687,326.00 |

| IPT | Impact Minerals | 0.007 | -30% | -13% | -13% | $19,850,964.45 |

| LKE | Lake Resources | 1.185 | -22% | -15% | -13% | $1,824,460,018.09 |

| LSR | Lodestar Minerals | 0.006 | -40% | -14% | -14% | $12,169,061.44 |

A total of 57 stocks were in the green today, 44 flatlined and 27 were in the red.

Who’s got news out today?

Near term miner Core says it remains on track to ship first spodumene concentrate from the Finniss project in the NT by the end of CY 2022 – subject to the successful ramp-up of the Grants open pit, DMS plant and crusher and no further COVID-19 or weather-related delays.

The company says the mining rate has increased at the Grants Stage 1 open pit – which will be the initial source of ore for the DMS plant until BP33 and other mines are bought online – and construction activities for the DMS plant has commenced.

Core also expects to complete a reserve and resource upgrade for the project in the coming weeks.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.