Eye on Lithium: Carmakers are rolling out mini EVs for less than $US20,000

Mitsubishi's All-Electric Kei-Car has a driving range of 180 km. Pic: Mitsubishi Motors.

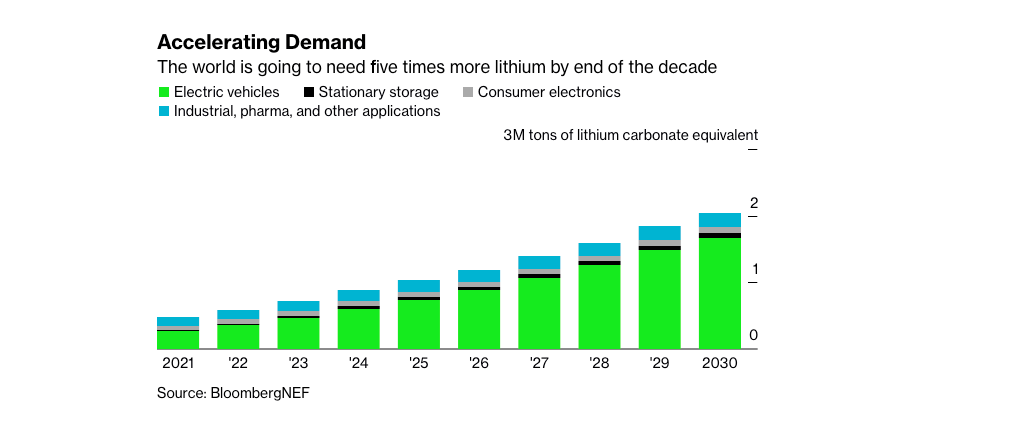

- The world’s demand for lithium is increasing but the lack of investment in new supply poses a great issue

- Nissan Motor Co and Mitsubishi Motors unveil new electric “kei” mini vehicles worth US$15,000

- LIT managing director Adrian Griffin will take on new role as technical director

Here is all your ASX lithium news for Tuesday, May 31.

Nissan Motor Co and Mitsubishi Motors have recently unveiled A new electric “kei” mini vehicle as Japan’s government pushes for the country to hit net-zero emissions by 2050 and while it might not suit all users, it does provide insight into how EV markets are evolving.

Electric kei cars should finally get the Japanese EV market going, after a very slow start.

Nissan, Mitsubishi: launching this year

Honda: 2024

Suzuki, Toyota/Daihatsu: 2025

https://t.co/XpxFDd3RX2— Colin Mckerracher (@colinmckerrache) February 2, 2022

The Nissan and Mitsubishi model will travel 170 km on a single charge and cost +2 million yen ($US17,500) after government subsidies.

With EV prices dropping to below the $US20,000 mark it should come as no surprise that the world is going to need about five times more lithium by the end of the decade.

Of course, the quickest way to increase supply is by ramping-up output from existing sources but as Bloomberg states, for many brine lithium producers increasing output quickly is constrained by their permits and the time taken to let the liquid evaporate.

Another longer-term solution is to find new deposits, but while mining superpowers Australia and Canada have both committed to developing critical mineral resources, the time it takes to develop a new mine cannot be underestimated.

“There is plenty of lithium in the ground, but timely investment is the issue,” said Joe Lowry, founder of advisory firm Global Lithium.

“Tesla can build a gigafactory in about two years, cathode plants can be built in less time, but it can take up to 10 years to build a greenfield lithium brine project.”

Here’s how ASX lithium stocks were tracking today:

Lithium stocks missing from our list? Shoot a friendly mail to [email protected]

| CODE | COMPANY | Last | %Mth | %Wk | % | MARKET CAP |

|---|---|---|---|---|---|---|

| ADV | Ardiden Ltd | 0.0115 | -23% | -4% | -4% | $32,020,024 |

| AGY | Argosy Minerals Ltd | 0.5 | 10% | 23% | 2% | $663,830,843 |

| 1MC | Morella Corporation | 0.028 | -24% | 4% | 4% | $139,757,778 |

| AML | Aeon Metals Ltd. | 0.035 | -22% | -8% | 3% | $32,053,802 |

| ASN | Anson Resources Ltd | 0.145 | 0% | 21% | 0% | $149,047,289 |

| AVZ | AVZ Minerals Ltd | 0.78 | -21% | 0% | 0% | $2,752,409,203 |

| CXO | Core Lithium | 1.365 | -3% | 3% | -1% | $2,381,985,546 |

| EMH | European Metals Hldg | 0.96 | -17% | -2% | -1% | $135,849,771 |

| ESS | Essential Metals Ltd | 0.585 | -11% | 8% | -4% | $150,334,339 |

| EUR | European Lithium Ltd | 0.078 | -19% | -1% | 3% | $105,101,436 |

| GLN | Galan Lithium Ltd | 1.5 | -13% | 5% | -2% | $465,731,024 |

| INF | Infinity Lithium | 0.14 | -20% | 8% | 4% | $56,026,764 |

| INR | Ioneer Ltd | 0.5525 | -18% | 0% | -3% | $1,192,040,669 |

| JRL | Jindalee Resources | 3.47 | -21% | 1% | -2% | $203,121,540 |

| LIT | Lithium Australia | 0.092 | -8% | 2% | 0% | $95,235,201 |

| LKE | Lake Resources | 1.49 | -24% | -1% | 0% | $1,994,916,209 |

| LPD | Lepidico Ltd | 0.0305 | -10% | 9% | 2% | $195,205,805 |

| LPI | Lithium Pwr Int Ltd | 0.6 | -24% | 5% | -2% | $214,724,082 |

| LTR | Liontown Resources | 1.385 | -5% | 7% | 0% | $3,047,193,025 |

| MIN | Mineral Resources. | 62.95 | 8% | 6% | 0% | $11,862,919,441 |

| FFX | Firefinch Ltd | 1.0725 | -4% | 11% | -2% | $1,293,461,327 |

| MLS | Metals Australia | 0.082 | -41% | -14% | -1% | $36,105,203 |

| AKE | Allkem Limited | 13.995 | 14% | 8% | -1% | $8,990,979,013 |

| PLL | Piedmont Lithium Inc | 0.915 | -3% | 10% | -1% | $488,002,990 |

| PLS | Pilbara Min Ltd | 2.95 | 4% | 5% | -1% | $8,870,965,895 |

| QPM | Queensland Pacific | 0.18 | -8% | 9% | -3% | $289,268,429 |

| PSC | Prospect Res Ltd | 0.955 | -2% | 1% | 0% | $425,611,592 |

| RLC | Reedy Lagoon Corp. | 0.027 | -7% | -7% | 0% | $14,805,645 |

| SYA | Sayona Mining Ltd | 0.205 | -36% | -13% | 0% | $1,473,555,131 |

| TKL | Traka Resources | 0.008 | -20% | 0% | -6% | $5,854,584 |

| TON | Triton Min Ltd | 0.027 | -16% | -7% | 0% | $33,987,173 |

| VUL | Vulcan Energy | 7.84 | -8% | 4% | -1% | $1,042,629,113 |

| GL1 | Globallith | 1.59 | -21% | -6% | -3% | $260,265,140 |

| BMM | Balkanminingandmin | 0.305 | -9% | 2% | 0% | $9,988,750 |

| LEL | Lithenergy | 1.21 | -17% | -5% | -2% | $55,986,000 |

| ARN | Aldoro Resources | 0.225 | -18% | 2% | 2% | $21,826,990 |

| NMT | Neometals Ltd | 1.365 | -14% | 5% | 0% | $745,791,899 |

| IGO | IGO Limited | 12.56 | -5% | 8% | 0% | $9,496,138,375 |

| CHR | Charger Metals | 0.56 | -19% | 0% | 3% | $17,756,664 |

| AAJ | Aruma Resources Ltd | 0.086 | -18% | 12% | -3% | $13,969,574 |

| PAM | Pan Asia Metals | 0.485 | -10% | -4% | -4% | $37,197,615 |

| AX8 | Accelerate Resources | 0.036 | -28% | 0% | -3% | $9,747,979 |

| AM7 | Arcadia Minerals | 0.235 | -18% | 7% | 7% | $7,698,350 |

| AS2 | Askarimetalslimited | 0.495 | -27% | -5% | 0% | $20,581,902 |

| BYH | Bryah Resources Ltd | 0.047 | -16% | 7% | 0% | $10,631,737 |

| DTM | Dart Mining NL | 0.069 | -5% | -5% | 1% | $9,197,691 |

| EMS | Eastern Metals | 0.175 | -17% | -13% | -3% | $6,408,000 |

| FG1 | Flynngold | 0.135 | -16% | -7% | 0% | $8,648,242 |

| FRS | Forrestaniaresources | 0.19 | -47% | 0% | 0% | $5,338,773 |

| GSM | Golden State Mining | 0.065 | -14% | -4% | -4% | $7,059,396 |

| IMI | Infinitymining | 0.165 | -18% | 3% | 0% | $9,487,500 |

| LRV | Larvottoresources | 0.3 | -31% | 0% | -2% | $12,568,288 |

| MMC | Mitremining | 0.15 | -14% | 3% | 0% | $4,062,765 |

| RAG | Ragnar Metals Ltd | 0.048 | -2% | 12% | 2% | $17,821,690 |

| SHH | Shree Minerals Ltd | 0.011 | -15% | 10% | 5% | $12,833,487 |

| TMB | Tambourahmetals | 0.21 | -16% | -2% | 0% | $8,650,446 |

| TEM | Tempest Minerals | 0.048 | -52% | -9% | -2% | $24,720,868 |

| TSC | Twenty Seven Co. Ltd | 0.0035 | -13% | -13% | 0% | $9,312,849 |

| WCN | White Cliff Min Ltd | 0.021 | -25% | 0% | 0% | $13,725,671 |

| WML | Woomera Mining Ltd | 0.027 | 8% | 23% | 4% | $17,857,660 |

| AZL | Arizona Lithium Ltd | 0.15 | -14% | -3% | 0% | $334,907,882 |

| CRR | Critical Resources | 0.08 | -20% | -1% | 0% | $119,018,231 |

| KGD | Kula Gold Limited | 0.033 | -31% | 0% | -1% | $7,208,384 |

| LRS | Latin Resources Ltd | 0.1175 | -13% | -6% | -2% | $231,507,342 |

| PNN | PepinNini Minerals | 0.525 | -39% | 1% | 0% | $32,257,199 |

| WR1 | Winsome Resources | 0.415 | -12% | -2% | -2% | $57,423,447 |

| KZR | Kalamazoo Resources | 0.34 | -16% | -7% | 0% | $49,366,087 |

| MTM | Mtmongerresources | 0.18 | -10% | 20% | 3% | $6,345,506 |

| QXR | Qx Resources Limited | 0.053 | -24% | 10% | 0% | $45,546,203 |

| SCN | Scorpion Minerals | 0.1 | 14% | -5% | 0% | $33,183,119 |

| AZI | Altamin Limited | 0.096 | 28% | 0% | 0% | $37,604,808 |

| ENT | Enterprise Metals | 0.015 | -17% | 15% | 0% | $9,669,703 |

| KAI | Kairos Minerals Ltd | 0.0265 | -9% | -2% | 2% | $51,014,431 |

| STM | Sunstone Metals Ltd | 0.054 | -19% | 2% | -2% | $141,594,553 |

| PGD | Peregrine Gold | 0.52 | 2% | 6% | 0% | $19,909,068 |

| AVW | Avira Resources Ltd | 0.0045 | -10% | 0% | 0% | $9,534,555 |

| NVA | Nova Minerals Ltd | 0.635 | -17% | -5% | 0% | $114,428,451 |

| GT1 | Greentechnology | 1.01 | -11% | 15% | -2% | $140,318,960 |

| BNR | Bulletin Res Ltd | 0.18 | -10% | 3% | 3% | $50,765,943 |

| RMX | Red Mount Min Ltd | 0.008 | -16% | 0% | -6% | $13,960,093 |

| CAI | Calidus Resources | 0.84 | -16% | 0% | -1% | $342,383,109 |

| MRR | Minrex Resources Ltd | 0.058 | -15% | 9% | -5% | $61,531,646 |

| RDT | Red Dirt Metals Ltd | 0.56 | 9% | 1% | -3% | $174,371,295 |

| A8G | Australasian Metals | 0.395 | -18% | 1% | 4% | $15,644,788 |

| EFE | Eastern Resources | 0.033 | -28% | -13% | -3% | $33,810,845 |

| MQR | Marquee Resource Ltd | 0.105 | -19% | 5% | 0% | $32,754,591 |

| SRZ | Stellar Resources | 0.021 | -28% | -9% | 0% | $17,625,355 |

| LSR | Lodestar Minerals | 0.0105 | -25% | 5% | 5% | $17,384,373 |

| NWM | Norwest Minerals | 0.043 | -22% | -7% | 2% | $7,585,510 |

| AOA | Ausmon Resorces | 0.008 | -27% | 0% | 0% | $6,858,315 |

| VKA | Viking Mines Ltd | 0.009 | -18% | 13% | 0% | $9,227,326 |

| IPT | Impact Minerals | 0.011 | -8% | 10% | 10% | $21,904,616 |

| SRI | Sipa Resources Ltd | 0.037 | -24% | -5% | 0% | $7,585,918 |

| VMC | Venus Metals Cor Ltd | 0.2 | 5% | 18% | 5% | $28,704,950 |

| RGL | Riversgold | 0.042 | -45% | -11% | 0% | $24,000,736 |

| ZNC | Zenith Minerals Ltd | 0.42 | -2% | 17% | 9% | $132,403,100 |

| RAS | Ragusa Minerals Ltd | 0.17 | 91% | 70% | -11% | $23,874,988 |

| G88 | Golden Mile Res Ltd | 0.053 | -18% | -4% | 0% | $10,797,829 |

| EPM | Eclipse Metals | 0.027 | -16% | 4% | 4% | $49,949,287 |

| EVR | Ev Resources Ltd | 0.043 | -22% | -2% | 0% | $39,817,315 |

| WC8 | Wildcat Resources | 0.036 | -10% | 16% | 6% | $21,939,273 |

| MNS | Magnis Energy Tech | 0.4125 | -8% | 2% | -4% | $415,588,691 |

| RIO | Rio Tinto Limited | 114.6 | 2% | 5% | 1% | $42,244,405,153 |

| THR | Thor Mining PLC | 0.0135 | -10% | 4% | -4% | $14,811,180 |

| CZL | Cons Zinc Ltd | 0.023 | -15% | -4% | 0% | $8,081,230 |

| MXR | Maximus Resources | 0.066 | -33% | -7% | 0% | $20,981,781 |

| DRE | Dreadnought Resources Ltd | 0.043 | -2% | 0% | 0% | $122,063,393 |

| MM1 | Midasmineralsltd | 0.335 | -3% | 2% | 0% | $18,236,772 |

| M2R | Miramar | 0.125 | -31% | 4% | 4% | $7,667,105 |

| AOU | Auroch Minerals Ltd | 0.091 | -17% | 5% | 2% | $32,155,860 |

| XTC | Xantippe Res Ltd | 0.011 | -21% | 0% | 10% | $76,830,569 |

| MMG | Monger Gold Ltd | 0.32 | 14% | 3% | 7% | $7,500,000 |

| LRD | Lordresourceslimited | 0.295 | -22% | -11% | -2% | $9,235,386 |

| WMC | Wiluna Mining Corp | 0.48251 | -24% | 0% | 0% | $101,961,574 |

| AUN | Aurumin | 0.18 | -14% | 3% | -3% | $20,206,302 |

| ZEO | Zeotech Limited | 0.057 | -10% | 12% | 4% | $83,870,351 |

| ALY | Alchemy Resource Ltd | 0.025 | -34% | -7% | 4% | $22,873,777 |

| LIS | Lisenergylimited | 0.645 | 1% | 3% | 2% | $104,525,938 |

| GW1 | Greenwing Resources | 0.32 | -28% | 0% | 2% | $38,822,915 |

| KTA | Krakatoa Resources | 0.078 | -32% | 4% | 1% | $26,542,664 |

| TYX | Tyranna Res Ltd | 0.022 | 300% | 144% | 22% | $27,582,492 |

| DAF | Discovery Alaska Ltd | 0.088 | 151% | 6% | -7% | $21,207,296 |

| FTL | Firetail Resources | 0.33 | -19% | 3% | 0% | $20,388,225 |

| IR1 | Irismetals | 0.38 | -40% | -40% | 0% | $19,228,000 |

| LNR | Lanthanein Resources | 0.025 | -26% | -7% | 4% | $20,107,814 |

| DAL | Dalaroometalsltd | 0.11 | -29% | -12% | -8% | $3,585,000 |

| TKM | Trek Metals Ltd | 0.087 | -1% | 23% | 2% | $26,389,113 |

| CY5 | Cygnus Gold Limited | 0.175 | 13% | 21% | 0% | $20,647,430 |

Today, a total of 37 lithium stocks ended up in the green, 49 flat lined and 42 ended in the red.

Who’s got news out today?

Lithium Australia (ASX:LIT)

LIT says it is about to enter a new phase in terms of its LFP cathode powder production, which it claims is the “most significant commercial opportunity” for the company.

To reposition the company for its next phase of development, Adrian Griffin will retire as managing director, but stay on as technical advisor.

Effective from today, the company says the timing of Griffin’s redeployment aligns with the commercialisation of its lithium ferro phosphate cathode powder production by its Batteries division.

An accelerated strategy is being deployed and realised through planned construction of a pre-qualification LFP pilot plant likely to be located in Queensland.

Argosy Minerals (ASX:AGY)

Around 83pc of total construction works at the company’s Rincon Lithium Project in Argentina have been completed for the development of the 2,000tpa lithium carbonate production.

The company says it remains on schedule to achieve first production of >99.5% battery quality lithium carbonate product during Q3 CY-2022, following completion of these works.

AGY managing director Jerko Zuvela has been at the site over the past two weeks and says, “We are getting close to completing construction works and progressing final stage commissioning.

“Argosy’s transformation into a cashflow generator is nearing, whilst also progressing toward the next stage 12,000tpa scale operations.

“The lithium market remains very positive and current lithium carbonate prices should see very robust product sales revenues.”

Firefinch (ASX:FFX)

FFX’s spin off Leo Lithium has raised $100 million an IPO with more than 90% of the offer allocated to existing Firefinch shareholders.

Those investors who took up the offer will benefit twice from Firefinch’s $20 million allocation in the Leo IPO, which will leave Firefinch with a big investment in the future lithium producer.

FFX managing director Mike Anderson branded the closure of the IPO an important milestone for the company, with its 20% stake in Leo giving exposure to Goulamina while the company expands its Morila gold mine.

Critical Resources (ASX:CRR)

Critical Resources has intersected “significant spodumene-bearing pegmatites” at its Mavis Lake Project in Canada in another six step-out holes following the drilling of another 21 holes.

The company said 2,500m has now been drilled as part of the inaugural 5,000m drill program.

CRR managing director Alex Biggs said new areas of mineralisation are being identified both along strike, at depth and in shallow intersections.

“The Company is focused on developing a JORC compliant Resource for Mavis Lake which requires both infill and extensional drilling.

“These results are crucial in achieving this goal and demonstrating continuity of mineralisation at the project.”

Zeotech (ASX:ZEO)

Zeotech’s pilot program has achieved a continuous closed-loop circuit, successfully producing pure Linde Type A manufactured zeolite using leached spodumene, a by-product of the battery-grade lithium production process.

While the circuit had previously produced zeolite using kaolin feedstock, its ability to do the same using leached spodumene validates the company’s proprietary flowsheet while opening up the available feedstock options, potentially offering lithium refiners a value-add circular solution for managing their process tailings.

ZEO says that it can now start project planning with The University of Queensland (UQ) and industry partner Covalent Lithium for The Trailblazer University Program.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.