Extra ounces in Eureka mining plan boost Javelin Minerals’ early cashflow plan

Javelin’s Eureka mining plan has more recoverable gold ounces at higher grades. Pic: Getty Images

- Javelin’s revised Eureka mining plan increases recoverable gold by 15% to 39,000oz

- The lift is marked by an increase in gold grade and reduction in mined ore tonnage

- Upgrade expected to increase margins and cashflow due to high gold price

Special Report: Javelin Minerals has boosted the likelihood of early production and cashflow from its Eureka project in WA’s Eastern Goldfields after its revised mining plan increased recoverable gold ounces by 15% to 39,000oz.

In mid-July 2025, the company upgraded indicated resources at the project by 27% to 78,768oz with most of the gains concentrated in the existing pit area.

This upgrade has provided the fuel for Javelin Minerals (ASX:JAV) to increase the number of ounces recovered under the mine plan to 39,000oz due to an increase in grade from 1.5g/t to 1.9g/t while reducing the tonnage mined by 20% to 698,887t.

It is expected to deliver substantial increases in margins and cashflow due to the strong Australian gold price, which is currently trading close to the $5200/oz mark.

“This increase in recoverable ounces will deliver a major windfall for Javelin,” executive chairman Brett Mitchell said.

“The combination of the increased ounces and the higher grade will significantly boost the margins and overall returns from our mining plan.

“With the very strong Australian-dollar gold price, the good condition of the open pit and the ability to process the material at one of the nearby mils, our mining plan is looking extremely attractive, particularly against the backdrop of the company’s market capitalisation.

“We are also planning a follow-up drilling program aimed at achieving further growth in the Eureka resource and upgrading more of the inferred resource to the indicated category.”

Eureka and mine plan

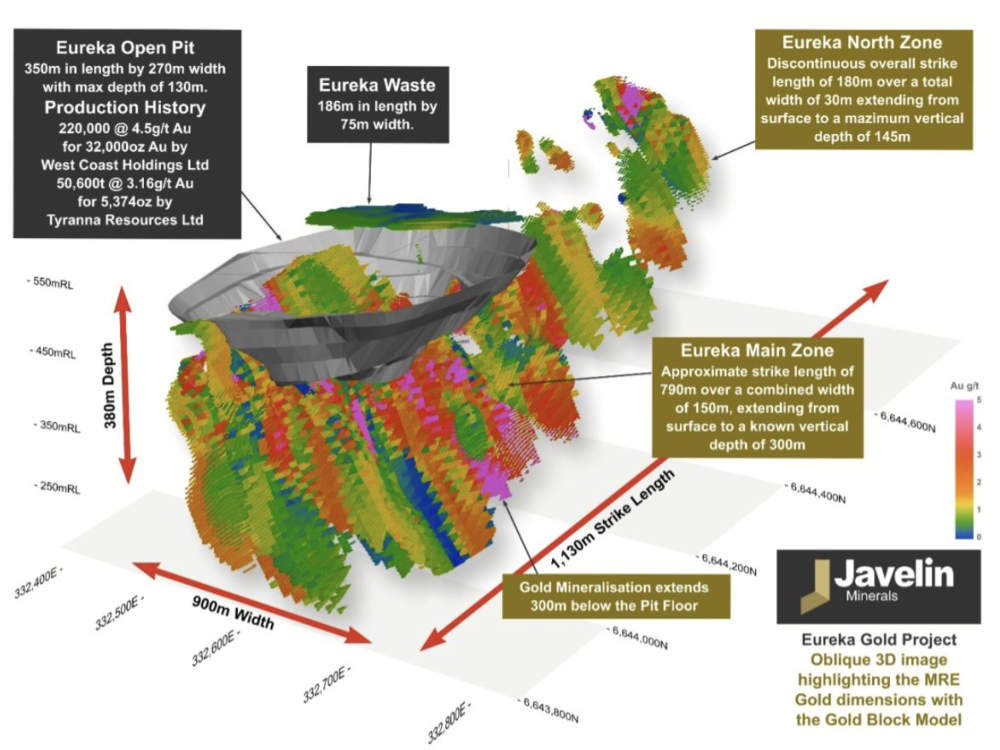

The Eureka project is just 54km north-northwest of Kalgoorlie with the resource of 2.04Mt grading 1.69g/t, or 110,687oz of contained gold, sitting within a granted mining lease.

It is close to several operating mills including the Paddington mill just 20km to the south.

The existing pit is in good condition and is well placed for the resumption of mining.

Most of the indicated resources added in the mid-July update sit below the southern end of the existing Eureka pit where the company planned to start near-term contract mining operations.

Mining studies underway will take into account the additional recoverable ounces.

JAV is planning to carry out drilling to target the potential downdip extensions to increase overall resources.

It is in advanced discussions with mining contractors and nearby processing plants while progressing approvals and permitting.

Additionally, recent reverse circulation drilling has confirmed extensive mineralisation beyond the current resource envelope with multiple intersections highlighting both lateral and depth potential.

These results support the company’s view that Eureka hosts significant upside and provide a strong foundation for ongoing resource growth and mine planning work.

This article was developed in collaboration with Javelin Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.