Explorers are raising piles of cash as gold finds support above $US1,800/oz

Pic: Tyler Stableford / Stone via Getty Images

After a dip below the $US1,800 ($2569.86) an ounce mark over the weekend, spot gold prices have bounced back to $US1,810.9 an ounce as it resumes its march towards all-time highs.

Gold for August delivery also rose 80c an ounce to $US1,814.20 with Kitco News quoting Commerzbank analyst Carsten Fritsch as saying that the US economic recovery might be slower than in other countries due to rising COVID-19 cases.

“Recently, the U.S. even overtook Brazil in terms of the number of new cases per 100,000 inhabitants,” he noted.

“The economic recovery is therefore likely to be sluggish despite the positive US economic data and rising US stock markets of late.”

>> scroll down for ASX small cap gold news from Challenger, Genesis, Gibb River, Rumble and White Rock

Ongoing geopolitical tensions between the US and China over Hong Kong have also contributed to the gains that the go to ‘safe haven’ asset has made this week.

The World Gold Council noted that investors have embraced gold as a hedging strategy this year as expectations of a swift recovery from the pandemic shifts towards one of a slower recovery.

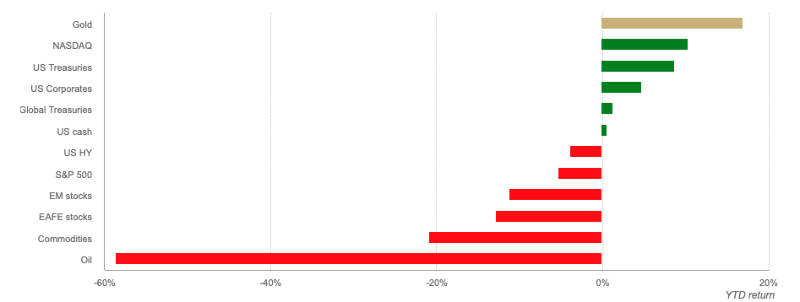

It added that gold increased by 16.8 per cent during the first half of 2020, outperforming all other major asset classes.

Meanwhile, spot silver climbed 4 per cent over the week to $US19.41 an ounce.

Credit Suisse is bullish about silver’s prospects, noting that its price action now has clear similarities with that of gold last year.

It suggested that should the other precious metal break past the $US21.14 an ounce mark, it could flag a rise up towards $US26.22 an ounce.

Small companies raising big cash

The high gold price has undoubtedly played a role in the ongoing ability of ASX gold companies to secure funding, with White Rock Minerals (ASX:WRM), Genesis Minerals (ASX:GMD) and Challenger Exploration (ASX:CEL) raising piles of cash today.

White Rock successfully completing the second tranche of its $5.85m share placement.

Shareholders gave the nod to the issue of almost 1.48 billion shares priced at 0.3c each to raise the remaining $4.4m of the placement.

Proceeds will be used to drive exploration at the recently discovered Last Chance gold stream sediment anomaly at its Red Mountain project in Alaska.

Last Chance is situated in a gold belt that hosts some true multi-million ounce giants such as Donline Creek and Pogo.

Genesis Minerals has raised $9.5m in a rights issue, with major shareholder Alkane Resources (ASX:ALK) acting as the priority sub-underwriter to the offer.

Alkane will hold a 15.32 per cent interest in the gold explorer following the issue of new shares.

This rights issue — together with the recently completed $10 million share placement to institutional and sophisticated investors — has put Genesis in a very strong financial position, Genesis managing director Michael Fowler said.

“We have already commenced work on a Feasibility Study targeting the development of a standalone operation at the enlarged Ulysses Project, scheduled for completion in the first quarter of 2021,” he says.

“This study will incorporate the newly acquired resources and assets from the Kookynie Gold Project and build on the significant work Genesis has already completed on mining the Ulysses Deposit.

“In addition, we are looking forward to getting the first drill rig into the field in the coming week and launching a large exploration campaign across the Kookynie Project, which should see us generate substantial news-flow over the coming months.”

And Challenger Exploration has completed a big $20m raise at 20c per share – which is a 13 per cent discount to the last closing price.

The explorer says it can now rapidly advance both the high-grade flagship Hualilan gold project in Argentina and the El Guayabo gold-copper project in Ecuador.

The White Rock Minerals, Genesis Minerals, and Challenger Exploration share price charts

From diamonds to gold

Gold’s allure has proven to be irresistible for Gibb River Diamonds (ASX:GIB), which has secured an option to purchase the historical and high-grade Edjudina project in Western Australia’s Eastern Goldfields region from Nexus Minerals (ASX:NXM).

Edjudina comprises multiple parallel lines of nearly continuous historic gold workings over 13km in which high grade veins have been worked.

It produced 39,476 ounces of gold at a grade of 41 grams per tonne (g/t) leading the company to say that it remains highly prospective for high grade gold vein targets with further potential for bulk tonnage open pit targets.

The six month option cost $110,000 and can be exercised for $330,000 in cash, 5.5 million GIB shares and 5.5 GIB options.

Rumble Resources (ASX:RTR) has increased its Western Queen landholding within WA’s Yalgoo Mineral Field by 500 per cent after securing two tenements.

The new tenements cover the entire Warda Warra north-south trending mineralised greenstone belt, which expands the strike from 5.5km to 35km.

Notably, they are prospective for high-grade deposits similar to the Western Queen Central Open Pit Mine that produced 189,500 ounces of gold at a grade of 8.9g/t..

No previous drilling has tested the new inferred position of the Western Queen Shear Zone north and south along strike from the main Western Queen project area.

The Gibb River and Rumble Resources share price charts

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.