Explorer spirit drives Great Western’s greenfields pursuits

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

The importance of method and structure in exploration was engrained in the mind of Great Western Exploration managing director Tom Ridges from his early days as a greenfields geologist.

It’s a lesson from mentors which proved itself true right throughout Ridges’ 14 years’ experience across the mining spectrum, from exploration to development to mine management, before his joining Great Western (ASX:GTE) late last year.

Ridges’ previously spent more than 12 years with Regis Resources (ASX:RRL) where he was a key member of the geological team that drove outstanding growth in shareholder value from greenfields discoveries, to fast paced project development to low cost gold production.

It is also a lesson that should give Great Western shareholders a great deal of confidence in the company’s well-funded approach to a highly prospective, multi-commodity portfolio which is showing early signs of bearing fruit.

Many high profile investors have backed Ridges’ and GTE to make a greenfields discovery. On the long list of shareholders of GTE you will come across a number of MD’s and Chairmen of resource companies past and presently listed, along with well-known mining identities, and high profile brokers and fund managers who have personally invested.

“I started in greenfields – that’s my grounding, I then spent a number of years in resource development, project development and production with Regis before most recently holding the role of Exploration Manager at Mineral Resources Limited (ASX:MIN) where I led the Mineral Resources’ team in exploration, new project evaluation, resource modelling and mine geology.” Ridges, who now heads a company with more than 5000km2 of greenfields ground in highly fertile regions of WA, told Stockhead.

Greenfields exploration means looking for mineralisation in relatively untouched areas based on a concept, rather than having existing resources to work with (brownfields).

“To me that’s the most exciting part of exploration. There’s a risk-to-reward element because targets often fail, but we are chasing large, greenfields, company making targets that if they come in will make shareholders life changing sums.” Ridges says.

“Past that, it is just far more exciting, it is exploration in its truest sense. You’re going out into these areas where the ground is seriously under-explored or not tested at all, and with this thought in mind that you could make the breakthrough at any time with a discovery that’s substantial.”

“That’s what excites me, it excites our team and our board, and it’s what our shareholders are onboard for as well.”

The company is driven to succeed and make sure that the money raised from our shareholder is spent on the ground. The company is operating with some of the lowest overheads you will see in the exploration space in Australia.

“Our directors are so committed to growing shareholder value through quality exploration that they don’t take directors fees and GTE are currently operating out of our St Georges Terrace office free of rent because a director provides the office space for free. The board are all large shareholders (the board hold ~50% of GTE) and want all the monies into the ground for greenfields exploration success.”

So far, the results of GTE’s method have been nothing if not eye-catching. Coming off a $5 million raise in February 2021 the company has been very busy in the field.

Results from this field work have defined a potential volcanogenic massive sulphide (VMS) style copper-gold target called Thunder.

As its name implies, it’s a target with potential to make a lot of noise.

“Thunder, we believe is a VMS-style target – we’ve picked up mafic units on Geological Survey of WA data which we can also see on the magnetics,” Ridges said. “It has also got a really nice structural setting, and a really nice geochemical signature that was picked up using the innovative ultrafine soil sampling method which was developed by the CSIRO.”

“The other thing is the work the team has done on the ground – the field mapping, the scale and the location, make Thunder a very exciting early stage drill target.

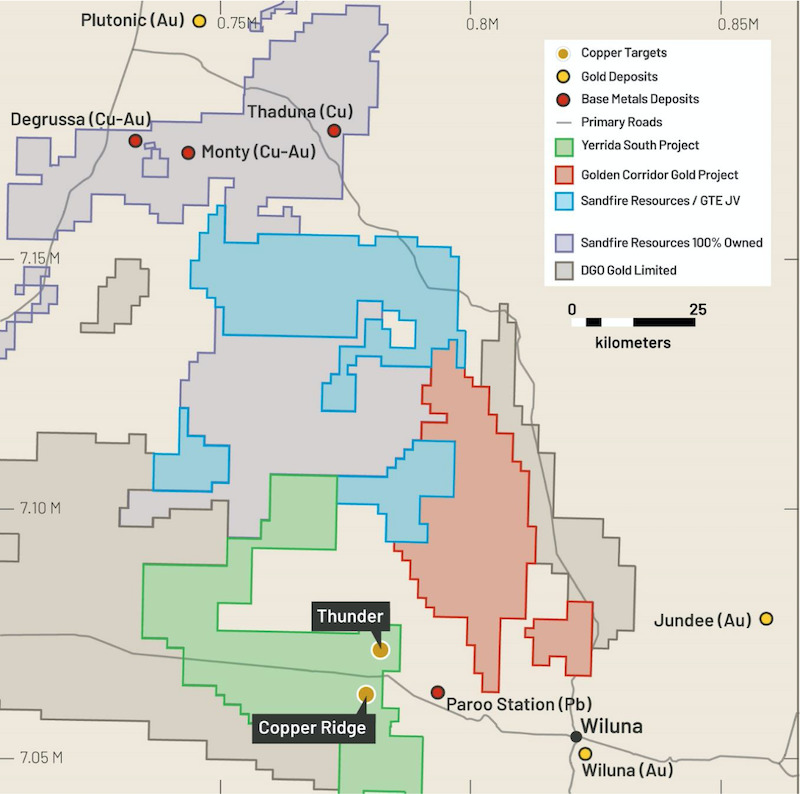

Near to Thunder we also have some very busy neighbours who are targeting the edge of the Yerrida and Bryah Basins. Our neighbours include DGO Gold (ASX:DGO) and Sandfire Resources (ASX:SFR). GTE is also part of a JV with Sandfire over the Yerrida North copper project to the north of Copper Ridge, in which the Sandfire is earning up to a 70% stake.”

A maiden drilling campaign is currently underway at Copper Ridge, testing the very large Copperhead and Taipan copper-gold targets to the south of Thunder. Assay results are expected in late July 2021

Multi-track plans

Great Western holds expansive, gold-prospective terrain across its Golden Corridor and Atley gold projects.

“We’ve got a very large tenement holding, and we need to make sure that while we’re working one area, we’re also bringing up targets in another,” Ridges said.

“The aim is to have a methodical and strategic approach to greenfields exploration that will continue to provide us with really exciting targets to drill test.”

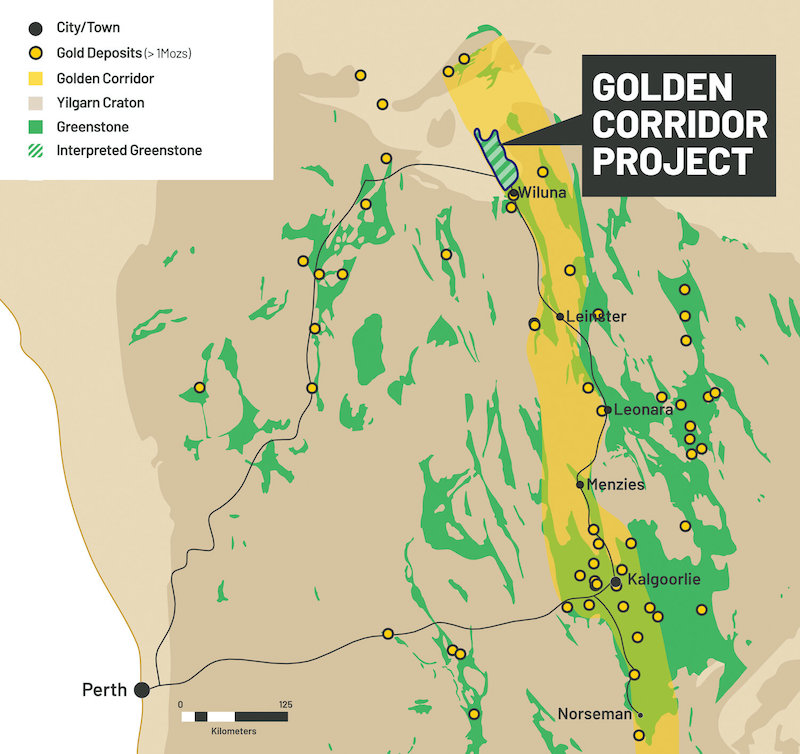

GTE’s Golden Corridor Project spans more 60km worth of strike of the Agnew-Wiluna greenstone belt within the greater Kalgoorlie Terrane, also known as the Golden Corridor.

Drilling was carried out here at the Finlayson target during the March 2021 quarter, intersecting a sequence of dolerite, diorite and ultramafic with zones of shearing and strong alteration including sulphides.

Ongoing work resulted in a focus on a further four gold targets along strike of Finlayson.

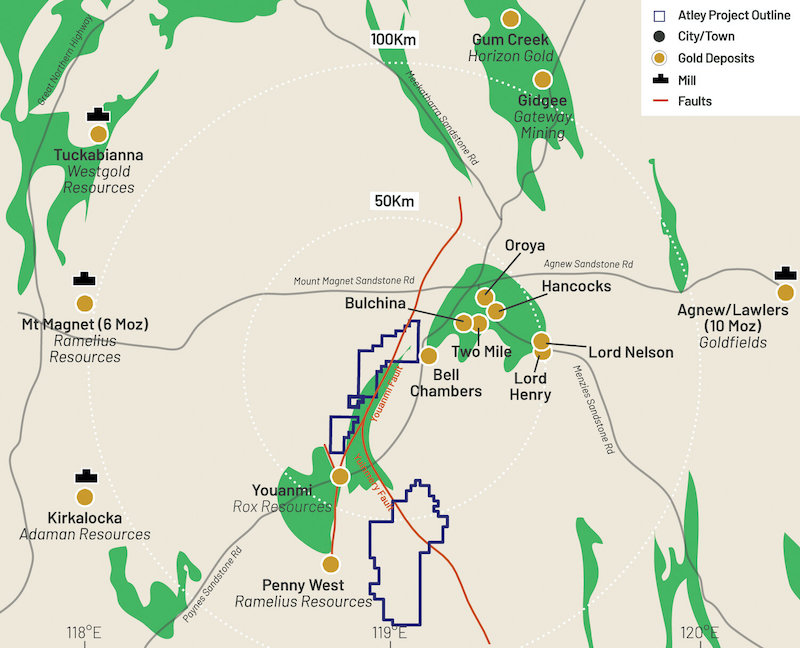

At Atley, Great Western holds more than 1000km2 of the Sandstone-Youanmi greenstone belt, where a number of significant discoveries have recently been made.

Seven new drill targets have been defined from the results of a second soil sampling program at Atley. These targets are expected to be drilled in the second half of 2021.

And while the bulk of the projects on the Great Western books are prospective for metals, the company also holds an intriguing potash project.

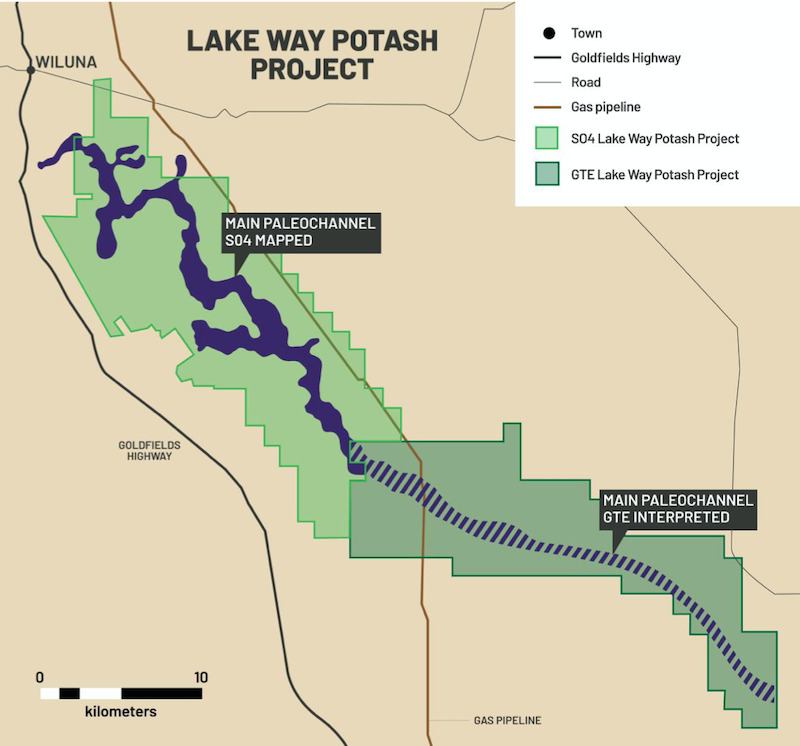

Great Western’s Lake Way Potash Project (on live and granted tenure ) covers the downstream continuation of the main basal paleochannel that Salt Lake Potash Limited (ASX: SO4) is currently developing

Historic work by WMC in the 1990s indicates the potash brine within the paleo channel which runs through both projects remains high grade as it enters the company’s area.

Well renowned hydrogeologist Kevin Morgan of KH Morgan and Associates has been engaged to assist with assessment of the project.

“Given that SO4 are our neighbours at Lakeway and they are very shortly going to be producing, this project has the potential to be quite significant to us,” Ridges said.

With an experienced board and MD, backing by so many great investors who are looking for greenfield discoveries, and a long list of prospective projects on its plate and a bank balance to fund the type of exploration that makes companies great, Great Western will be a junior play to watch with interest in 2021 and beyond.

This article was developed in collaboration with Great Western Exploration, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.