Expert view: What’s the better investment – bitcoin or gold?

Pic: Schroptschop / E+ via Getty Images

After a reality check on bitcoin investors may be asking ‘do I put my money in gold or bitcoin?’ Expert Mathew Walker — founder of the Cicero Group and owner of both gold and various cryptocurrencies — has the answers.

Where would you put your money: gold or bitcoin?

It really is gold versus bitcoin because there is no direct link between the two.

Whereas conventional currencies used to be asset-backed by either US dollars or gold, bitcoin itself is not asset-backed.

That physical and historical measure of wealth was used to underpin utility in each of those currencies. For an example of what happens to a currency when it isn’t backed, you can’t go past chatting to Rob Mugabe.

Gold, and other safe haven assets, such as US dollars (in the form of US treasury bonds) have historically always provided integrity to conventional currencies.

But let me first explain my take on the crypto phenomenon and some of the big names, and emerging names within the crypto community — and why I believe some will continue their meteoric rise, and others (most) will end in tears.

The inevitability of the tears to follow is one (of many) reasons I am a firm believer in the gold sector now.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

What is your take on cryptocurrencies, especially bitcoin?

Think of crypto currency like any other conventional currency.

The utility of the currency is in the integrity of its ecosystem. The real utility is in the technology. Success or failure of the currency will depend on its fundamental value — ie currencies backed by real world usage.

Let’s start with bitcoin.

Bitcoin is the grand-daddy of all Crypto currency. It is also a single-purpose blockchain. It can transfer bitcoins between addresses. That’s pretty much it.

Insert crickets.

It has been known for years that the performance of bitcoin was suboptimal.

For some time, its capability hovered around three to four transactions per second. Yet, the core developers ignored its limitations and built solutions that were circumventing the problem (Blockstream). After some years, they deployed a “scalable solution” (Segwit).

It was heralded as the second coming of the Messiah, yet it only provided a circa 1.7 multiple performance benefit. Today bitcoin can do about 7 transactions per second.

Now they are heralding a new Messiah (Lightning Network). It is supposed to be a further scalability solution for bitcoin. The inconvenient truth is that Lightning Network is yet another independent solution that will transact externally to blockchain.

This defeats the purpose of its very existence.

There are some obvious ways to improve performance. Bitcoin Cash was created, to fork (separately) from bitcoin and implement those scalable solutions.

Despite its poor track record of technological advancement it does have a vocal and fanatical fan base.

These are those folk that speak the loudest and longest at your BBQ and baby shower.

It’s also why I own one solitary Bitcoin.

Do you see value in having cryptocurrencies in your portfolio?

It is not all bad news though in the crypto cyber world.

The next biggest name is Ethereum. Unlike bitcoin, Ethereum is a framework.

One can implement any user case on it, and all the complexity of the blockchain comes with it. For example, a coin that has the functionality of bitcoin is not more than a few lines of code.

Any code writer worth his salt could do that on his first can of Dr Pepper.

More importantly, Ethereum is already being used for real business. The Ethereum enterprise alliance has many members, like Deloitte, JP Morgan, Intel, Microsoft, ING, etc.

Also, if you check coinmarketcap.com, many of the top tokens are actually on Ethereum. So the token, the user case and everything that follows is on top of the Ethereum blockchain. Ethereum has a strong, no-nonsense, pragmatic leadership. It’s why I own plenty.

Although Ethereum is the strongest by user case, and indeed actual usage, there are other credible contenders.

Neo, Qtum, Cardano, EOS and NEM to name a few. They are all infrastructure blockchains that have the capability to house other projects and may prove to be a success.

Of particular interest is Qtum and Neo which have a presence in China — and will be spectacular if they are able to secure political support from the Chinese government.

Other tokens I see value in are the ones with staking systems, like OmiseGo or Neo.

The last category are the tokens with strong privacy features like Zcash, Dash and Monero. These can be used to transfer funds in absolute secrecy. Social issues aside, the user case and the demand, the good, the bad and the ugly, is there.

What is behind the drive towards investing in cryptocurrencies?

A fear of missing out is what is ultimately is driving the move to invest in bitcoin. Whenever you have people in your social circle telling you stories of their 10, 20 or 30 “baggers” returns then you want to be involved.

Gold simply can’t compete with those returns. If you have a stock that is driven on fundamentals that can give you an annualised return of between 5 and 10 per cent, it just doesn’t have the same sizzle.

This is called greed and humans are greedy.

The challenge is to educate yourself and be a winner in the long term, gold has always been safe haven investment and when things go pear-shaped and will continue to be when the music stops.

Bitcoin and gold are the antithesis of the other.

Proponents of gold are proud of their tangible value, while bitcoin is proud of the fact that it does not require physical asset backing.

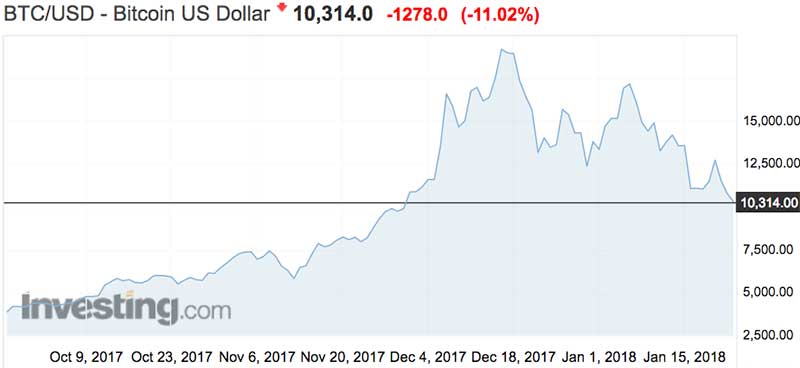

An ounce of gold was priced at $1671 on Tuesday, compared to $12,960 for one bitcoin.

That being said, I don’t think gold will ever lose its lustre. Since the beginning of the financial system it has had a value and there is no reason to believe it won’t continue to do so in the future, as both a financial and consumption instrument.

Both your wife and your favourite rapper will continue to wear gold.

When bitcoin blows up this will be wonderful for the gold stock that you own.

People will go back to what has worked for decades or centuries and we will be listening to those who have been successful in the long term.

So how does the crypto story end?

In my view, for those currencies that have developed a strong user case based on a blockchain framework, it ends just fine.

Ethereum, and a select few of the others, will continue to prosper post any Bitcoin implosion. Regrettably for the baby shower set, the story ends poorly. And although I think the case for gold extends well beyond the demise of Bitcoin and the baby shower set, it’s going to be nice to own some when it inevitably blows up.

In my humble opinion, you’ve got less than six months folks.

Tick tock.

Mathew Walker is a businessman and entrepreneur with extensive experience in the management of public and private companies, corporate governance and the provision of corporate advice. In a management career spanning three decades, Mr. Walker has served as executive Chairman or Managing Director for public companies with operations in North America, South America, Africa, Eastern Europe, Australia and Asia.

He is Co-Founder and Chairman of the Cicero Group (Cicero) www.cicerogroup.com.au, Co-Founder and General Partner of technology incubator Alchemy Venture Capital and Founder and Director of beef cattle enterprise the Stone Axe Pastoral Company.

Get in contact with him on Twitter @realMDubbya.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.