Expansion Alert: European Lithium secures new lithium venture in Ireland with CRML’s shares

European Lithium moves into the Irish lithium sector with the Leinster project. Pic via Getty Images

- As a part of its global expansion strategy to address the rapidly growing European demand for critical raw materials, European Lithium Ltd enters into binding agreement with UK-based Technology Metals plc to acquire Leinster Lithium Project using CRML shares for the transaction.

- Technology Metals plc owns 100% of LRH Resources, that holds the rights, title, and interest in the Leinster lithium project.

- An initial exploration program covering 23 prospecting licenses of ca. 761 km2, highlighted 24 intervals of lithium bearing spodumene pegmatites with grades of up to 2.57% Li2

Special Report: European Lithium is looking to bolster its lithium exposure using its balance sheet and shares held in Critical Metals Corp (NASDAQ: CRML) to acquire the Leinster project in Ireland to advance the development of Europe’s critical minerals supply chain.

“This acquisition shows our commitment to continue expanding in the European lithium sector and illustrates our capability to identify and secure ground in highly prospective lithium provinces,” EUR Executive Chairman Tony Sage said.

“This also demonstrates the value of our investment in Critical Metals Corp – as we move forward, we can utilise the investment again and again without depleting our cash reserves”.

European growing demand on critical metals

Europe’s demand for base metals and battery materials is expected to increase exponentially as it divests from fossil fuels and towards clean energy systems, leading to the formation of the Critical Raw Materials Act (CRMA).

The CRMA, which was adopted in March this year, seeks to increase and diversify the EU’s raw materials supply chain and reduce the risk of supply disruptions, granting a competitive advantage to ASX companies, that are pursuing the resources development opportunities on the continent.

It is designed to ensure Europe is a key player in the manufacturing of green energy technologies such as electric vehicles and wind turbines and is a key element of its decarbonisation long-term program.

While European Lithium (ASX:EUR) already has exposure to the CRMA via its Wolfsberg and other hard rock lithium projects in Austria, it has now expanded its position in Europe’s lithium supply chain further with the potential acquisition of the Leinster project in Ireland.

Expansion into promising European lithium sector continues

EUR has entered into an agreement with UK’s Technology Metals plc to acquire its fully owned subsidiary, LRH Resources – the owner of the Leinster project in Ireland.

LRH Resources owns 100% of the rights, title and interests in the Leinster lithium project in Ireland, along strike from the Avalonia project – a project under joint venture with Ganfeng (55%) and the TSXV-listed International Lithium (ILC).

Under the agreement, EUR will settle the US$10m for the acquisition through the transfer of

1,234,568 shares held by EUR in Critical Metals Corp (Nasdaq: CRML) at a deemed share price of US$8.10/share.

Targeting lithium prospects in the underexplored Leinster lithium province

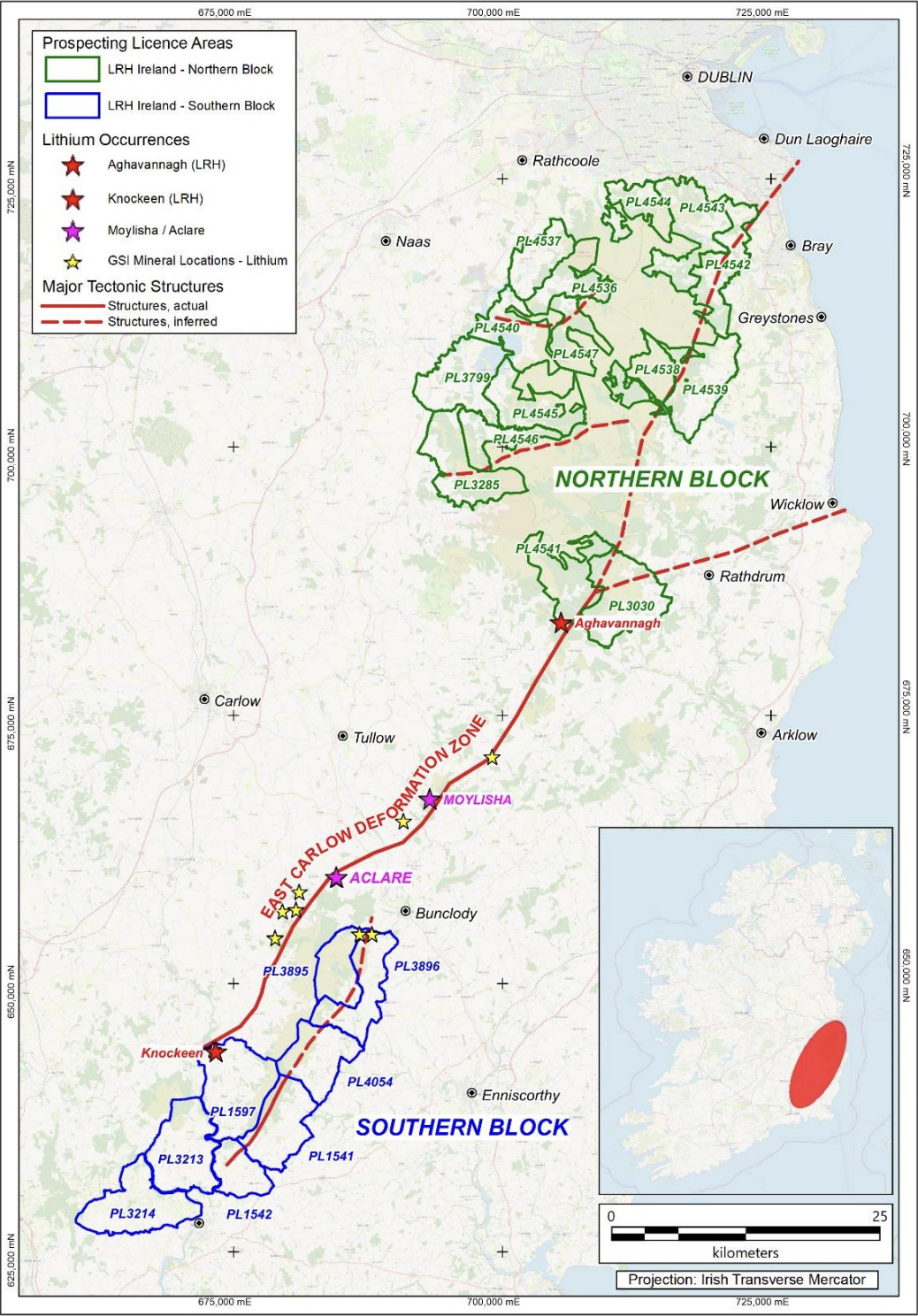

The project, south of Dublin in the Leinster Granite Massif, is divided into a North and South block, each containing several developing prospect areas where lithium spodumene pegmatites have been located via surface sampling and diamond drilling.

The Leinster project sits on a 135km long highly prospective trend (the East Carlow Deformation Zone) along strike from the Avalonia project, the subject of recent high-grade lithium pegmatite drilling at the Aclare and Moylisha occurrences.

All of the licence holdings are located within or along the important regional tectonic structure termed the East Carlow Deformation Zone, which is interpreted to control the emplacement of most of the existing LCT pegmatite occurrences within the Leinster Granite Massif.

EUR says, the project is considered to be at the exploration stage of development with significant geological exploration surveys and several localised prospect areas.

Interestingly, spodumene bearing pegmatites have been located at all the prospects in surface float material and at one locality in a series of echelon pegmatites forming a closely spaced dike swarm in diamond drilling conducted by LRH Resources in 2023.

An initial exploration program, covering 23 prospecting licenses of ca. 761 km2, highlighted 24 intervals of lithium bearing spodumene pegmatites with grades up to 2.57% Li2O at Knockeen, one of many historic prospects across the project area.

Study outlines key 6,000km2 area

A previous regional structure and remote sensing study defined a 6,000km2 area covering the northern and southern licence blocks, including the Knockeen prospect lithium area.

The results confirmed key structural features across the Leinster Massif, which are interpreted to be associated with mineralising fluid flow key to the anatectic model for the localisation and emplacement of the lithium bearing pegmatites.

Upcoming exploration work

Interpreted splays from this structure pass across several other of the company’s licences and in particular through the Scurlocks, Sorrell and Knocknaboley target areas. This work has provided extensions of all these structural corridors which can now become part of a focused ground exploration program.

A second highly prospective trend (passing along PL 1597) was also confirmed in this study and will be the focus for upcoming ground exploration activities with several other targets identified for prospecting and mapping.

This article was developed in collaboration with European Lithium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.