Evion raises $3.4m to fast track vertically integrated graphite business plans

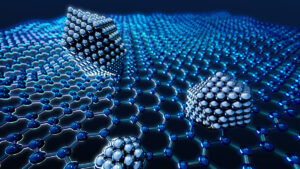

Evion raises $3.4m to progress graphite business. Pic via Getty Images.

Investors have demonstrated their support for Evion’s plan to become a significant and vertically integrated graphite business by making firm commitments for a $3.4m placement.

The strong response from existing shareholders as well as new domestic and institutional and sophisticated investors will provide funds to expand resources and further develop the company’s flagship Maniry project.

Proceeds from the placement of nearly 63 million shares priced at 5.4c will also be used by Evion Group (ASX:EVG) to finalise statutory licensing and permitting for the project’s development, early stage development with the commencement of pre-construction engineering works, and progress the feasibility study into the downstream battery anode materials plant in Europe.

Additionally, the company’s expandable graphite project in India is fully funded with plans for commissioning by the end of this year.

Meeting increasing demand

Managing director Tom Revy said strong support for the raising reflects the company’s vision to capitalise on the forecast sharp increase in graphite demand on the back of massive growth in EVs and the recognition of Evion’s emergence as a near-term producer of graphite.

“The fundraising will enable us to complete the final elements of our plans to commence construction at our flagship graphite project in Madagascar and undertake pre-construction engineering works,” he added.

“Following our Scoping Study confirming the viability of our proposed BAM plant in Germany, we also plan to complete an advanced pre-feasibility study with leading BAM technology company, Urbix Inc., USA. This study reflects the strong collaboration between our two companies.”

The placement includes the issue of one option exercisable at 7.5c and expiring 12 months from the date of issue for every two shares subscribed for.

This article was developed in collaboration with Evion Group, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.