Vector’s return to the ASX has been a bit of a fizzog so far

Pic: Tyler Stableford / Stone via Getty Images

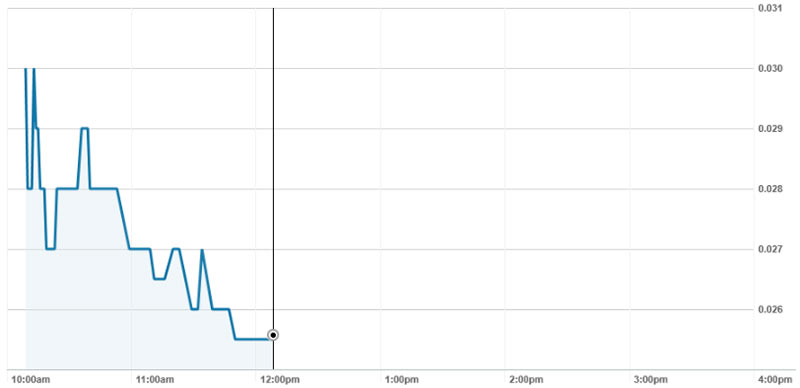

So, what did the mammoth Adidi-Kanga gold project deal going to do for the Vector Resources’ (ASX: VEC) share price?

Not much so far.

After it was reinstated to official quotation in morning trade for the first time since (very late) 2018, Vector leapt out of the blocks, opening at 3.1c – a 55 per cent premium to the last closing price of 2c.

After that, it settled to be selling for around 2.5c at lunchtime (EST).

Almost 40 million shares had changed hands in 304 trades, worth a cumulative $1.12 million.

Despite the deal going ahead last Friday, Vector shares remained suspended pending the result of the waiver application to the ASX, which was refused yesterday.

Vector applied for a waiver because shareholders had approved the issue of about $7 million worth of shares to seller MGI more than three months ago.

Vector told investors that if the ASX doesn’t approve the waiver, the company will seek shareholder approval ASAP – but either way, it won’t have an impact on the acquisition.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Adidi-Kanga has an initial JORC (2012) resource estimate of 15 million tonnes at 6.6 grams per tonne (g/t) of gold for 3.2 million ounces all up.

JORC refers to the mining industry’s official code for reporting exploration results, mineral resources and ore reserves, managed by the Australasian Joint Ore Reserves Committee.

A deposit grading above 5g/t is usually considered pretty high grade.

Former owner – global gold producer AngloGold Ashanti – sank more than $722 million into the project between 2005 and 2013.

The miner had even started mine construction before suddenly pulling the pin on development as part of a company-wide restructure.

Vector (ASX:VEC) chairman Gary Castledine called the acquisition process “exhaustive” but “one well worth the wait” as the junior looks to make the leap into production.

Vector has a pretty aggressive development strategy mapped out, which includes completing a definitive feasibility study in the next nine months before launching immediately into development.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.