Equus uncovers additional brownfields gold-silver targets for drilling

Equus has its eyes on more gold and silver with the identification of brownfields target at Cerro Bayo Pic: Getty

Special Report: Equus has identified new ‘brownfields’ targets at its flagship Cerro Bayo silver-gold project in southern Chile after reviewing historical data.

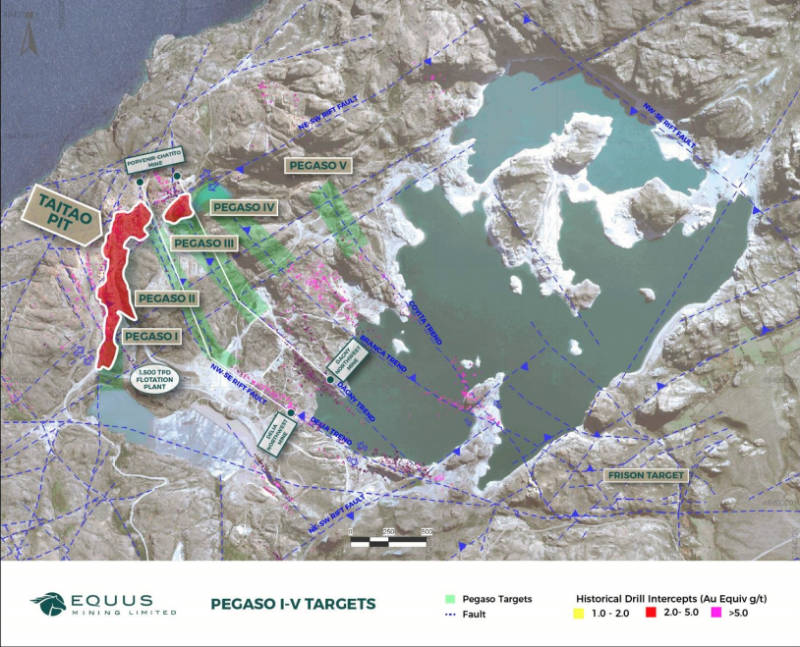

The five new Pegaso I-V targets cover a cumulative strike length of 3.5km and are within 2km of the project’s 1,500 tonne per day flotation plant that is currently on care and maintenance since June 2017.

Equus Mining (ASX:EQE) has designed a 25 hole diamond drilling program to test the Pegaso II, III and IV targets as part of its dual-track strategy to advance both greenfields and brownfields exploration in parallel with re-evaluating existing resource potential near the plant.

Equus Mining (ASX:EQE) share price chart

Historical data points to new gold-silver targets

The Pegaso II target is a 1km long trend that extends along strike of host faulting between the Delia NW and Porvenir-Chatito mines.

Historical drill results include 7.04m at 3.37 grams per tonne (g/t) gold and 153.6gt silver from a depth of 69.51m, as well as 4.1m at 6.74g/t gold and 40.1g/t silver from 156.8m.

Meanwhile, a top hit of 5.05m at 19.45g/t gold and 302.69g/t silver from a depth of 87.95m was amongst the intercepts that helped identify the Pegaso III target, another 1km long trend between the Dagny and Porvenir-Chatito mines.

More gold and silver to be found

Cerro Bayo has been through several production phases over the years with the nine historical mines having produced 650,000 ounces of gold and 45 million ounces of silver to date.

The company recently engaged Cube Consulting to undertake a JORC 2012 compliant resource (a must-have for ASX-listed miners and explorers) for the Taitao pit and adjacent greenfields mineralisation.

While Taitao was mined between 1995 and mid-2000 when the gold price averaged ~US$300/oz and silver ~US$5/oz, current prices make it a compelling opportunity for early development.

###

This article was developed in collaboration with Equus Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.