Equus Mining prepares to drill three very high-grade silver targets at Cerro Bayo

Pic: Schroptschop / E+ via Getty Images

Special Report: Sampling returns super high-grades — including a peak value of 17.8g/t gold and 4,350g/t silver — ahead of drilling at Equus Mining’s (ASX:EQE) advanced Cerro Bayo project in Chile.

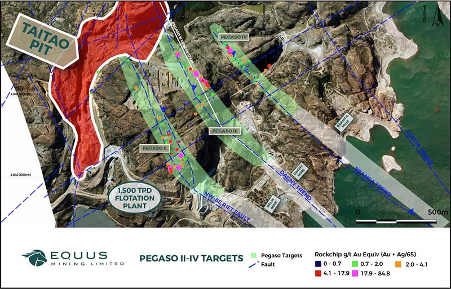

The most recent rock chip results come from the Pegaso group of brownfields targets, which includes five underexplored trends along ‘strike’ from historic mines in the margins of a 3.5km by 5km ‘caldera’ structure.

Calderas — large, cauldron-like, collapsed structures formed by ancient volcanoes — are known to host rich ore deposits.

Here, Equus has defined at least three juicy drill targets around numerous shallow (less than 100m depth) high-grade historic drill intercepts and recent high-grade surface rock chip samples.

The company is now dialling in on the Pegaso II, Pegaso III and Pegaso IV silver-gold targets ahead of a planned 25-hole, 5,500m diamond drilling program.

“The high-grade rock chip results returned from the Pegaso targets report to portions of vein structures that sit along strike from high-grade historical mines, and within close proximity to the Cerro Bayo flotation plant, but importantly remain underexplored by historical drilling,” Equus managing director John Braham says.

“The Pegaso targets form part of the company’s dual-track strategy leveraging evaluation of existing resources and brownfields and greenfields discoveries to provide resource ounces for a near-term mine restart.”

A ‘dual track’ development strategy

Late last year, Equus Mining signed a binding deal with TSX-listed miner Mandalay Resources to acquire the Cerro Bayo mine district and infrastructure in Southern Chile.

The option agreement means Equus has up to three years to finalise the acquisition, but it can also take over the project at any time.

The company has a ‘dual-track’ development strategy for Cerro Bayo — explore the numerous ‘greenfields’ gold and silver targets while re-evaluating existing brownfields resources close to the Cerro Bayo processing plant for near-term production.

This processing plant, which has produced about 600,000oz of gold and 45 million ounces of silver since 1995, has only been in care and maintenance since mid-2017.

With gold and silver ripping to fresh highs, current owner Mandalay Resources has now decided to resume production at Cerro Bayo.

Mandalay plans to commence processing of low-grade stockpiles in early Q4 2020 at an initial rate of 40,000 tonnes per month.

This gives Equus a ‘free look’ at the plant in operation and, given it can take over the operations at any time, could transform this $30m market cap explorer into a low-cost, low-risk, near-term producer with plenty of upside.

This story was developed in collaboration with Equus Mining, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.