Equinox Resources eyes Canadian project with historical mining of up to 59.5% antimony ore

That’s a lot of antimony. Historical production at Alps Alturas yielded 105t of ore an average grade of 57.2% antimony. Pic: Getty Images

- Equinox Resources secures binding option to acquire historically ultra-high-grade Alps Alturas antimony project

- Mine produced about 105t of ore averaging 57.2% antimony between 1915 and 1926

- Also features strong potential for silver with grades of up to 1595.7g/t Ag

Special Report: Equinox Resources is tapping into growing interest in antimony with a binding option agreement to acquire the ultra-high-grade Alps-Alturas project in British Columbia.

The 3km2 project consists of three tenements in the Slocan Mining Division and hosts the historical Alps-Alturas antimony mine that produced about 105t of ore with an average grade of 57.2% antimony between 1915 and 1926.

Mineralisation is hosted within an east-west striking shear zone with stibnite veins up to 1.2m wide and antimony grades reaching up to 59.5% that remain open along strike and at depth.

Adding further interest for Equinox Resources (ASX:EQN), the 1.3km mineralised zone also features silver grades of up to 1595.7g/t near the Jurassic Kuskanax Batholith intrusions that highlight strong potential for expanding polymetallic mineralisation.

Historical exploration appears to be limited to near surface adits and shallow workings, leaving deeper and lateral extensions unexplored.

EQN managing director Zac Komur said the historical mine is characterised by exceptionally high antimony grades and had significant underexplored potential.

“Initial assessments indicate untapped exploration upside along strike and at depth,” he added.

“This project aligns with our strategic focus on scalable projects in favourable jurisdictions, enhancing our growth prospects.

“The favourable option terms also provide us with the flexibility to conduct thorough due diligence, ensuring the project meets our investment criteria before committing to full acquisition.”

Option agreement

Under the option agreement with private individual J Bakus, EQN has 12 months to decide on acquiring the three tenements that make up the Alps-Alturas project.

It will pay the vendor $29,563.93 in cash on execution of the option agreement and can acquire the project by paying $184,774.57.

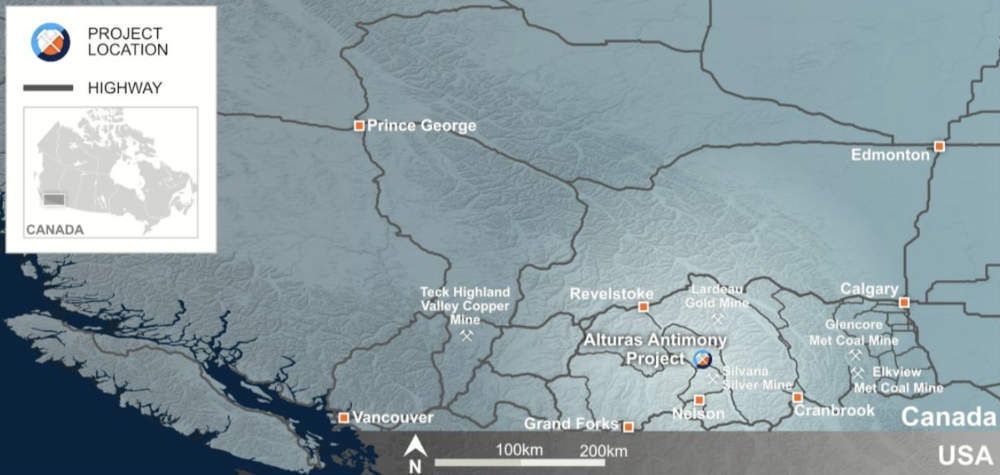

Alps-Alturas is characterised by rugged terrain with elevations ranging from 500m to over 2000m, 15km north-east of New Denver in the Slocan Mining Division of south-east British Columbia.

It benefits from excellent infrastructure and accessibility including sealed roads that connect directly to major highways.

The Canadian Pacific Railway network is just 105km away, which facilitates efficient transport of mined materials to major ports along the west coast of British Columbia including the port of Vancouver, while the project is also proximal to existing power lines.

The geological setting includes extensive metamorphism and the presence of late-stage intrusive rocks such as granite batholiths and smaller dykes and aplite stringers, which are likely sources of the hydrothermal fluids responsible for the mineralisation.

EQN noted that the favourable geological setting, including late igneous intrusions and extensive metamorphism, meant there is strong potential for discovering additional high-grade antimony mineralisation.

The Slocan area has been known for a long history of mineral production, including silver, lead, zinc and antimony.

The area also hosts significant silver mineralisation within quartz veins associated with the same structural features.

It has mobilised local geologists to perform due diligence via a field survey, detailed mapping, and a rock chip sampling program to identify the extent of antimony and silver mineralisation.

Antimon(e)y

Antimony has become one of the hottest commodities in the world lately, with China’s decision to restrict exports prompting concerns it could strangle supply of the previously obscure critical mineral.

Prices have doubled this year to ~US$24,000/t amid concerns of a shortage in the west.

Among its versatile applications spanning various industries are its significant use in flame retardants, lead-acid batteries, glass manufacturing, and as a critical alloy in ammunition.

“Its strategic importance extends to military applications such as infrared missile guidance systems, night vision equipment, and nuclear weapons, positioning it as a vital element in national security frameworks,” Equinox noted.

This article was developed in collaboration with Equinox Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.