Equinox looks to extract 10,000 tonnes of antimony as prices hit US$38,500/t

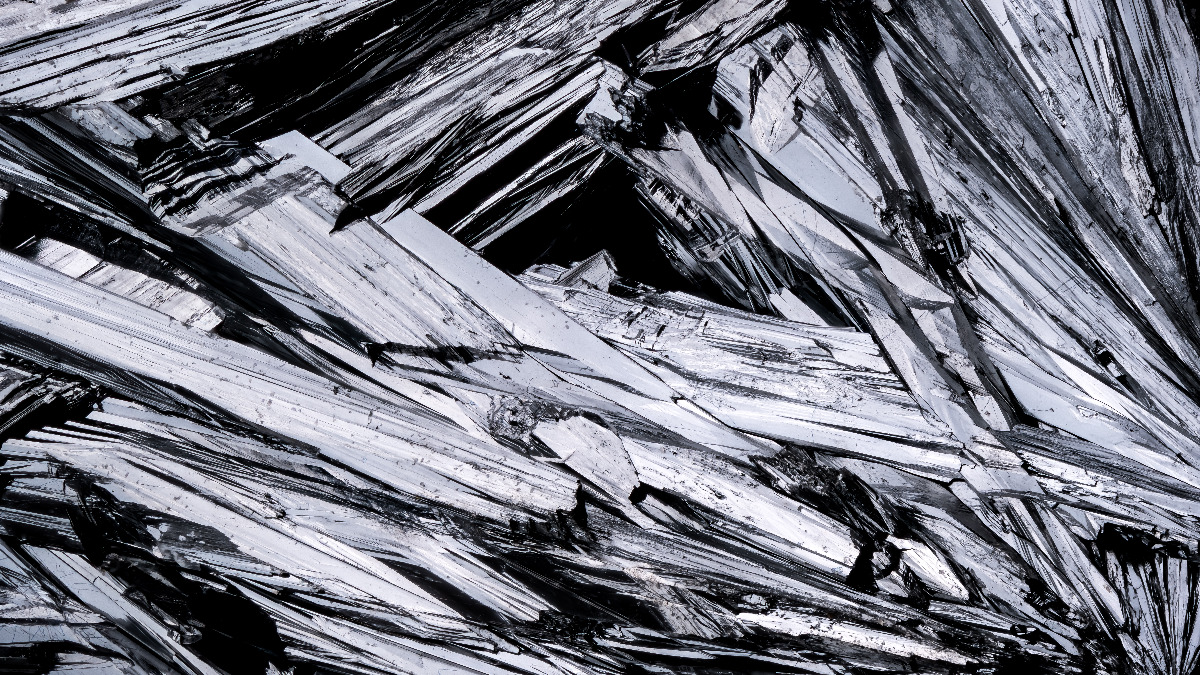

Antimony is a critical mineral in defence and renewable energy applications. Pic: via Getty Images

- Equinox progresses permitting for extracting 10,000 tonne bulk sample from Alturas antimony project

- Since Chinese export restrictions antimony prices have soared to US$38,500/t

- Sample will be sent to potential customers for metallurgical testing

Special Report: Equinox Resources is progressing permitting applications to extract a 10,000t bulk sample from its Alturas antimony project in Canada for downstream testing and processing.

This comes after the company completed a comprehensive independent geological review of the project’s results – which include high-grade rock chip assays up to 69.98% antimony – and confirmed its significant exploration potential.

Antimony is a critical mineral in the production of ammunition, infrared missiles, nuclear weapons, and night vision technology and is also essential in manufacturing fire retardants, lead-acid batteries and photovoltaic solar cells.

And the timing couldn’t be better to get the ball rolling on downstream production. The antimony market has experienced unprecedented growth and volatility, largely driven by China’s export controls on antimony. The Middle Kingdom produces around 48% of global supply.

This has tightened market conditions, with prices soaring from US$24,000 per metric tonne in September 15 to US$38,500 per metric tonne on December 1.

Equinox Resources (ASX:EQN) managing director Zac Komur said the permitting process is a major step forward for the project at a time when demand is surging for antimony.

“The combination of ultra-high-grade antimony mineralisation, exceptional recent results, and plan to extract 10,000 tonne of antimony bulk sample for downstream processing opportunities positions Alturas as a transformative asset in the tightly supplied antimony market,” he said.

“Our team is advancing this project with pace and precision, leveraging the region’s rich geological history and innovative methods to unlock its full potential.

“At a time when global antimony markets face unprecedented demand, we are committed to becoming a key supplier of this indispensable commodity.”

Permitting process underway

The exploration permit application progressing under the British Columbia Notice of Work system, which would enable advanced exploration activities including extraction of up to a 10,000 tonne bulk sample for downstream testing and processing.

The bulk sample will be processed and sent to downstream customers for metallurgical testing.

The permit will also enable the company to conduct comprehensive exploration activities, including mapping, sampling, and drilling.

Along with the bulk sampling for downstream metallurgical testing, planned future work at the project includes conducting high-resolution airborne magnetic and LiDAR surveys to refine targets for further exploration.

Soil and talus fine sampling is also planned across difficult terrain to delineate anomalies, along with mapping and prospecting to identify additional mineralised zones and structurally connected sub-targets.

The aim is to prepare a systematic drilling program focusing on the eastern half of the property, which the company expects will thoroughly evaluate the project’s high-grade mineralisation potential.

In the meantime, assay results are pending from EQN’s ongoing drilling programs at its Mata de Corda and Campo Grande rare earth projects in Brazil.

This article was developed in collaboration with Equinox Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.