Equinox is lighting up in one of the hottest REE districts on the planet

Equinox has is poised to accelerate exploration at its Brazilian REE projects. Pic via Getty Images.

- Equinox Resources is accelerating exploration and drill campaigns across its recently staked Campo Grande and Mata da Corda REE projects in Brazil

- Exceptional REE grades over 5000ppm TREO have been sampled

- Campo Grande lies in and around Gina Rinehart-backed and fellow ASX explorer Brazilian Rare Earths’ project

- The South American nation is positioning itself to become a global hub of rare earths production

The burgeoning Rocha da Rocha rare earths district in Brazil is poised to light up the globe – literally – through its riches of minerals required for the world’s booming technological advances.

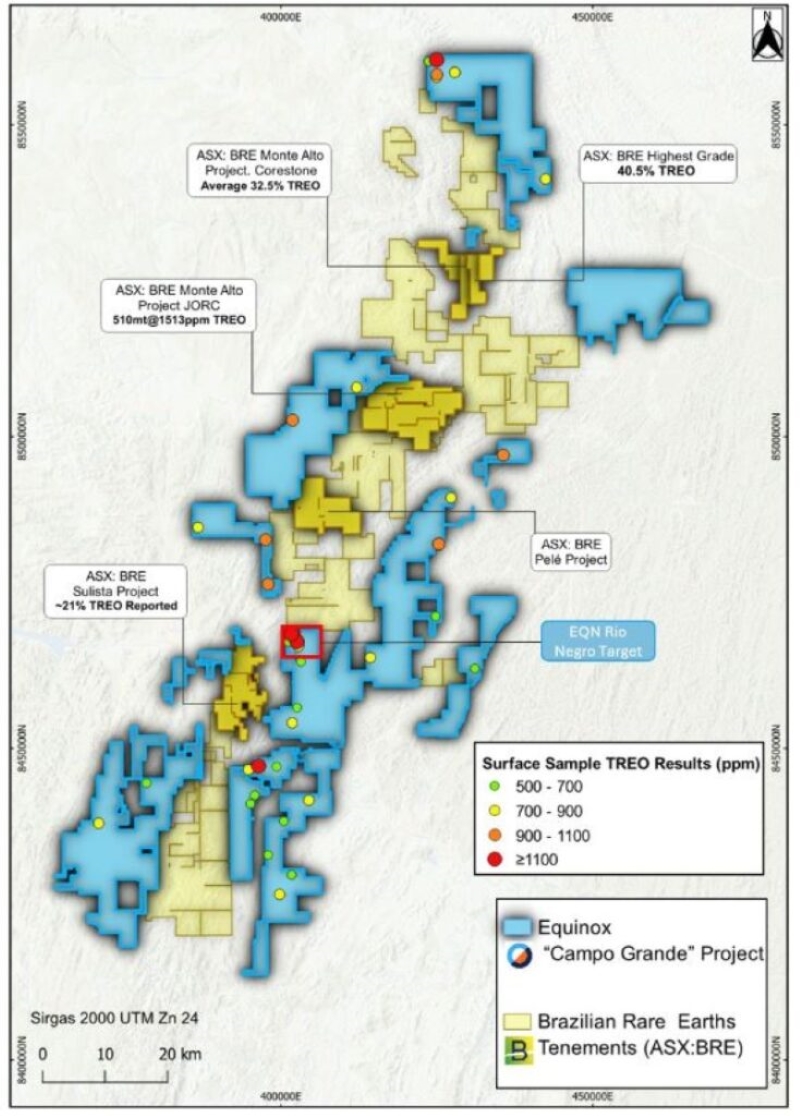

Right in the thick of the action is ASX junior Equinox Resources (ASX:EQN), proving up its Campo Grande and Mata da Corda REE projects in and around Gina Rinehart-backed Brazilian Rare Earths’ (ASX:BRE) own rare earths portfolio.

The region is home to in-vogue ionic adsorption clay-hosted (IAC) deposits, as well as the more traditional hard rock style mineralisation.

So what?

Well, because Rocha da Rocha’s IAC and hard rock deposits are proving to contain veritable treasure troves of the more valuable magnetic rare earths, which include neodymium (Nd), praseodymium (Pr), dysprosium (Dy) and terbium (Tb).

These elements are, and will, continue to be in high demand from OEMs such as carmakers, semiconductor and chip manufacturers, aerospace and other high-tech industries due to their outstanding performance and durability.

What makes the Rocha da Rocha REE district so special is the percentages of total rare earth oxides (TREO) – and the magnetic rare earth oxides (MREO) within them, as well as high grades of niobium and scandium – we’ll get to that.

No idea what we’re talking about? We’ve got your back: REE Survival Guide Part 2 – How metallurgical wizardry can make or break a project

On top of that, ex-China markets are looking to create new supply chains for the 17 rare earth elements on offer, ever since the Middle Kingdom started cutting exports of other rare commodities such as graphite and germanium last year.

(Oh, and the rest of the world barely has any production or refining capacity of rare earths outside China either.)

Those factors signal huge upside potential for the region, as Brazil’s REE output is currently just a fraction of its overall potential. It shipped out just 80t of REEs in 2022 – a drop in the ocean compared to the ~300,000t produced globally.

Backing into Brazil

Investor sentiment is high in the region. And why not – low labour costs and a pro-mining government are two very attractive markers.

Back in March, Brazil’s mining ministry and the Brazilian Development Bank announced a US$200m strategic minerals investment fund to back junior and mid-level miners in the country.

BRE recently raised a cool $80m to advance its Monte Alto, Velhinhas, Sulista and Pelé projects which have a combined 510Mt resource of ultra-high grade REE-niobium-scandium mineralisation at depth across its +4000km2 tenement package.

It was only asking for $66m.

And though EQN is at an earlier stage than its adjacent neighbour in Bahia State, it’s already raised $4m to accelerate exploration.

Since February, both Rinehart’s BRE and EQN have seen a ~100% increase in their share price – impressive for such early doors projects.

Proving up Rocha da Rocha’s riches

The grades don’t lie though. Exploration by EQN has already returned exceptional grades of up to >5000ppm TREO from sampling clays across just 10km2 of its Mata da Corda IAC project.

On the back of those impressive samples, the junior decided to stake an additional 127.80 km2, expanding Mata da Corda by 15%.

The company is awaiting results from grab samples it sent to the lab for analysis that will help define targets for inaugural drilling across the project.

Over its the more advanced Campo Grande project, assays are pending for 126 auger and three RC holes across 1432m as part of a maiden drill campaign at the Rio Negro prospect, reaching into magnetic clays and hard rock to a depth of 120m.

The first RC hole intersected a 41m-thick layer of predominantly reddish, magnetic clay, transitioning to hard rock with varying magnetic intensities, reaching a depth of 120m below the surface.

“Exceptional progress continues to be made by our team as we continue to build a comprehensive geological profile of the prospect and region,” EQN MD Zac Komur says.

“We eagerly anticipate the drill assay results which are expected in about four weeks, along with additional surface sample results from the region, to help us identify our next prospect.

Further mapping is being carried out at the northern part of Campo Grande, which is just 10km from BRE’s Monte Alto discovery where assays returned the highest grades to-date – a whopping 40.5% TREO.

At Stockhead, we tell it like it is. While Equinox Resources is a Stockhead advertiser, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.