Emmerson finds high-reward, low-risk in royalty streaming model

Emmerson Resources finds success with gold royalty streaming: Getty Images

Special Report: Emmerson Resources’ royalty streaming model means it captures the rewards of gold mining at its Tennant Creek operations with little downside risk.

Emmerson Resources’ (ASX:ERM) business model may be unique among gold companies in Australia as it does not perform any mining itself at its Tennant Creek operations.

Mining operations are handled instead by Emmerson’s joint venture partners, and they pay Emmerson percentage-based royalty streams for gold they mine at its assets.

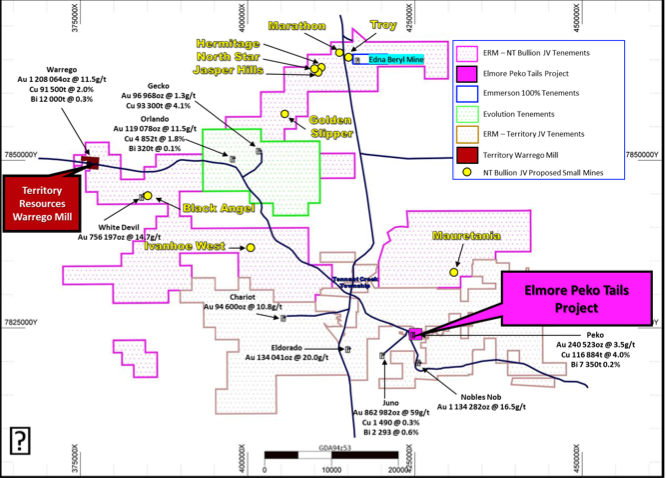

Whilst Emmerson retains 100 per cent ownership of its Edna Beryl mine and its extensive package of tenements across one of Australia’s highest grade gold provinces at Tennant Creek in the NT, our Joint Venture partners are responsible for the planning, mining and processing of the resources.

“I think we are unique in the smaller end of town to have an emerging royalty-type streaming business,” managing director and chief executive Rob Bills told Stockhead.

Royalty streaming low-risk, high reward model

The royalty streaming model fits well with Emmerson’s business philosophy and allows the company to stick to what it is good at, exploration and finding new gold discoveries such as its recent discovery of the ultra-high grade gold, Mauretania project, he said.

“We saw this [royalty streaming] as a terrific model and a low risk path to monetising the Tennant Creek assets.

“The benefits include mitigating the risks around moving from discovery to mining, which is where many companies fail. Moreover, the royalties are aimed to self-fund our exploration, which is where the Emmerson see the biggest driver of value (providing it is successful).

Franco-Nevada prototype inspires

Royalty streaming companies such Franco-Nevada are well-known in North America, but less so in Australia, and grew up in lean times for mining industry finance in the early 2000s.

“Royalties providean alternative source of financing when equity and debt markets were disinclined to fund miners,” Bills said.

The business model of outsourcing its mining and processing for a royalty stream has been reinforced by one of Emmerson’s major shareholders who has board-level experience with other royalty companies.

Clearly the lifeblood of gold royalty companies is establishing royalties across new or if possible, existing mines and thus by definition is a finite and sought-after business.

Refurbishment of the Territory Resources owned, Warrego mill is the key to unlocking the value in Tennant Creek

Territory Resources is currently refurbishing and modernising the Warrego gold mill in the southern area of Emmerson’s Tennant Creek operation, and this is set to return to operation before the year’s end.

“At the moment, all of our assets in Tennant Creek are stranded because there is no mill to process gold. Once that [Warrego] is up and running it will enable the assets to be monetised,” Bills said.

Once the mill is completed, it will treat ore from across many of Emmerson’s deposits in the Tennant Creek district and thus generate multiple gold royalty streams. A trial of this business model was conducted from the Edna Beryl Mine in late 2019, where a small parcel of 30g/t gold ore was trucked and toll treated (at Territory Resources expense) at Cloncurry. Emmerson’s 12% gold royalty on this parcel yielded circa $460k to our coffers, testament to the potential of this royalty business to Emmerson shareholders.

This 12 per cent gold royalty at the Perth Mint for gold mined by Territory from its Edna Beryl mine, is one of the best gold royalty rates in the world.

Other royalty rates negotiated with Territory Resources include a 6 per cent gold royalty from the Chariot Mine plus a profit share across the rest.

At Peko in the eastern area of Emmerson’s Tennant Creek lease, NT Bullion and Elmore Proprietary Limited are planning to construct a portable, modular processing plant to treat the Peko Tails and potentially ore from Emmerson’s Mauretania project.

Under this deal (still subject to shareholder approval), Emmerson will receive a 12 per cent gold royalty at both Mauretania and Jasper Hills plus a 25 per cent profit share arrangement across any other mines.

Exploration plans for Tennant Creek, NSW assets

Funds from Emmerson’s recent heavily oversubscribed placement will be deployed across both Tennant Creek and NSW. We believe that small mines such as Edna Beryl have excellent potential to grow with further drilling – the key is to first establish underground access to better understand the geology and structural controls of the gold mineralisation, then undertake close spaced drilling.

“But like a lot of these historic mines in Tennant Creek it is not until you get underground that you realise that potential”Bills said.

Apart from the Gold Royalty with Territory (under the Small Mines Joint Venture), Emmerson also has an Exploration Joint Venture, whereby Territory fund $5m of exploration over 5 years to earn 75% in the Southern Project Area. Emmerson remain the operators and managers during the earn-in period.

“That money will go into extensional drilling around existing deposits with the aim of growing and building the resource bank. In the longer term, some of the $5m will also be spent on discovering new deposits. After discoveries such as Mauretania, Edna Beryl and Goanna – the first discoveries for over a decade in the Tennant Creek Mineral Field, Emmerson strongly believe they have the recipe for more!

In addition Emmerson has exploration underway at some of its five projects in southern NSW’s Macquarie Arc, host to Alkane Resources’ (ASX:ALK) copper-gold Boda discovery.

“Our ground is in one of Australia’s exploration ”hot spots“ where we are hunting for elephant size deposits such as those discovered by Newcrest Mining at Cadia.

Strong relationship with traditional owners

Tennant Creek is a challenging environment for the mining industry, given its remoteness and location within an indigenous community, heightened more so by COVID-19.

“Tennant Creek is within an indigenous community and there are issues around having a rostered workforce in an isolated area,” Bills said.

Over the many years, Emmerson has developed a good working relationship with the local traditional owners and recently signed a landmark agreement to carry out exploration in some previously restricted areas in our Northern Project Area.

This agreement with the Marnturla Aboriginal Corporation covers the Jasper Hills, Golden Slipper and Hermitage copper-gold-cobalt projects.

“We have negotiated a commercial joint venture with the traditional owners on these projects where we anticipate gaining access and drilling in the not too distant future. The traditional owners not only get direct equity in the projects but also employment opportunities which is a win-win for both parties.

A high gold price is a bonus for the company, but not a prerequisite, because Emmerson has very high-grade resources and is not a marginal producer.

“I think we are in the early stages of a gold boom, if you take into account the volatility around the world ,” Bills said.

This article was developed in collaboration with Emmerson Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.