Emerging Chilean explorer Tesoro Gold ‘on the cusp’ of proving a +100kozpa operation at El Zorro

Tesoro Gold’s El Zorro project is in the coastal Cordillera region, host to multiple world-class copper and gold mines with infrastructure and an established workforce. Pic via Getty Images

With more than 100,000m of drilling completed and a 1.3Moz gold resource already defined, Tesoro Gold has achieved more than most juniors have since its listing in 2020 but a pipeline of high priority targets shows the story is only just beginning at El Zorro.

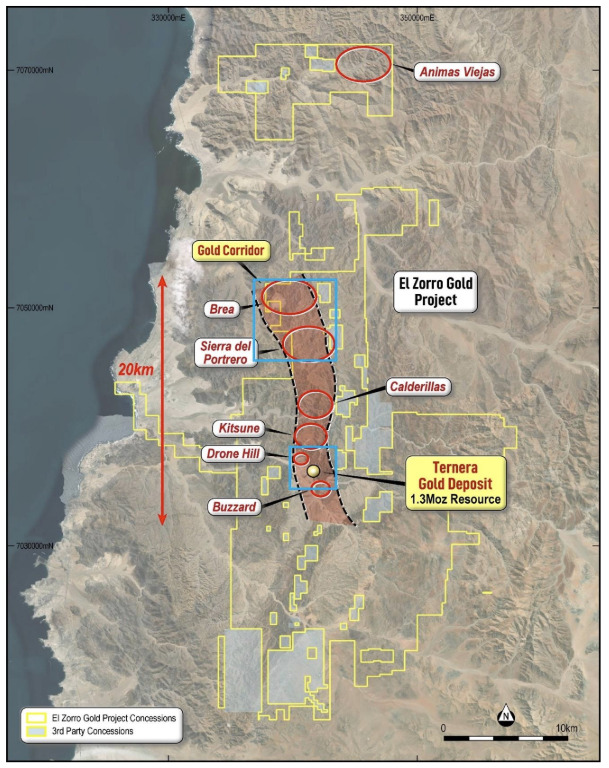

After making its ASX debut four years ago on the back of some impressive gold results at the El Zorro project, junior goldie Tesoro Gold (ASX:TSO) has been busy discovering new targets along a prospective 20km gold corridor in Chile’s coastal Cordillera region.

The company is setting out to develop a district-scale mining project, 15km from the Pan Pacific Highway and 60km from the port town of Caldera, where original and historical work have identified Chile’s first-ever intrusive related gold (IRG) system at the Tenera deposit.

IRGs are a common style of gold mineralisation, geologically renowned for their multi-million ounce scale and Tier 1 asset potential such as De Grey’s (ASX:DEG) 10.5Moz Hemi discovery in WA’s Pilbara region.

Yet in Chile they are few and far between, with TSO’s managing director Zeff Reeves describing the closest analogues to El Zorro as being the 50Moz Tintina province that extends from British Columbia through the Yukon Territory and into southwestern Alaska.

It is regarded as one of the great gold provinces for multi-million ounce deposits, hosting the likes of Northern Star’s (ASX:NST) Pogo gold mine – one of the top three gold producing projects by grade and size in North America (20Mt at 10.1g/t gold) – as well as the undeveloped 30Moz Donlin Creek deposit.

Big and getting bigger with targets like Drone Hill

“But there’s absolutely nothing like this in Chile or in this region,” Reeves tells Stockhead.

“Geologically, El Zorro is very rare and putting my geologist hat on, that is probably the most exciting part – the potential for the district to host multiple, very large deposits.

“The Ternera deposit is not closed, it’s open at depth and along strike and we simply don’t know how big it could be,” he says.

“We are also beginning to realise it could join up with another target to the northwest called ‘Drone Hill’ and are starting to see more targets with all the same ingredients as Ternera, so we firmly believe El Zorro could be multi-million-ounce gold district.”

Beyond the 1.3Moz for 1.18g/t gold resource, Ternera boasts an exploration target of 48.5Mt to 101Mt at 0.91g/t gold to 1.45g/t gold which is restricted to the area by existing drilling.

TSO estimates the drilled footprint at Ternera could contain up to 1.6Moz to 3Moz of gold.

Drilling is currently underway to investigate the deeper potential at Drone Hill after surface sampling results expanded the gold anomaly there to 750m by 250m wide, a similar size to the surface expression at Ternera before drilling.

The 6-hole first pass diamond drilling program kicked off in March with results expected shortly.

Another two outcropping gold anomalies – La Brea and Sierra del Portrero – were also identified during the same program, about 15km north of Ternera within the 20km long gold corridor.

These ‘Ternera-like’ prospects returned up to 1m at 43.2 g/t gold and are outcropping gold occurrences associated with intrusive rocks and fault systems just like the 1.3Moz deposit itself.

Detailed, systematic channel sampling work is now underway to define drill targets ahead of near-term drilling.

The makings of a 200,000oz gold operation?

A scoping study in April 2023 indicated a 93,000ozpa ‘starter pit’ across a 7.4-year life with all in sustaining costs estimating a reasonable US$1,068/oz but Reeves reckons El Zorro could grow much bigger.

“We believe we could be looking at a potential 150,000oz to 200,000oz operation over a decade or more if results at Drone Hill come back positive,” he says.

“It is a significant piece in the puzzle.

“Another important point is that we firmly believe this project will be developed and we’re moving through that process now.

“El Zorro is located in the Atacama Desert where mining is the predominant industry, there’s a very clear pathway to get projects in this region permitted,” Reeves says.

“That has been demonstrated by Gold Fields and their Salares Norte gold mine which has just been commissioned and is in full production now.

“Several other companies are making inroads nearby like Canadian junior Rio2 and their Fenix project, which has just received approval for construction,” he says.

“We’re seeing a lot of advantages for where we are.”

Moving along the infrastructure development pathway

At the same time, TSO is pushing ahead with various infrastructure options after entering into an MoU with Aguas CAP, owners of a desalination plant 28km from El Zorro, for the advancement of water supply.

Aguas CAP’s desalination plant produces desalinated water and supplies services to industrial customers in the Atacama region.

As part of the desalination process, it produces wastewater (brine) which is currently discarded to the ocean.

Under the agreement, TSO will work with Aguas CP to turn that waste into a viable water source for gold ore processing at El Zorro.

The two parties will draft a business plan which considers areas such as construction of infrastructure, project funding, potential for future expansion and operating expenditure.

TSO is also in discussions with Chilean authorities regarding grid power and obtaining a maritime concession for accessing Punta Obispito’s shoreline for seawater.

Environmental studies and permits are required before construction and the operation of a seawater pipeline from the maritime concession area can be approved, however, the granting of the concession will provide a nearby alternative.

Backing of world’s fifth largest gold miner

Looking ahead, TSO’s two-pronged strategy for El Zorro involves growing the Ternera resource and eventually moving into an updated scoping study and direct feasibility phase while continuing to test other targets.

Gold Fields, the world’s fifth largest gold mining company, increased its stake in TSO in November last year from 14.86% to just under 19% alongside an additional cash injection of $1.2m.

At the same time, the company raised as additional $3m to fast-track project studies, metallurgical test work and for new target generation at El Zorro.

“It’s a very good validation of the project,” Reeves says.

“A lot of the funding that they’ve provided has been channelled into understanding the district a bit better and finding where the best targets are, and we’ve certainly seen some of those new targets come to the fore now.

“But ultimately for Gold Fields, regardless of where the gold is in the project, they will want to see something that’s between 3 to 5Moz that has a pretty clear pathway to production,” he says.

“They’re pretty supportive in us achieving that.”

Tesoro Gold (ASX:TSO) share price today

At Stockhead we tell it like it is. While Tesoro Gold are a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.