East Coast Research says Trigg is perfectly placed to be a key critical minerals player

Trigg Minerals has received a 12-month price target of 16.3c from East Coast Research, a 262% premium to its last traded price. Pic: Getty Images

- East Coast Research sets 12-month price target of 16.3c for Trigg Minerals, 262% higher than its last traded price

- This is due to the potential of its Wild Cattle Creek deposit – one of the Australia’s highest-grade undeveloped antimony resources

- Its Taylors Arm and Drummond projects offer a natural hedge against commodity-specific or project-specific risks

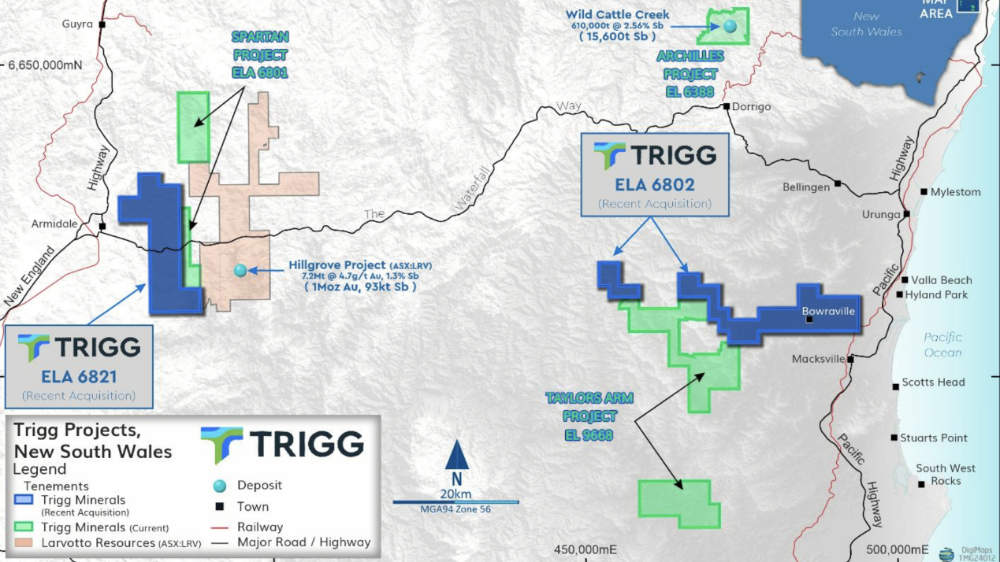

Special Report: East Coast Research believes Trigg Minerals’ flagship Wild Cattle Creek deposit – one of Australia’s highest-grade undeveloped antimony resources – positions the company as a key player in the critical minerals sector.

Wild Cattle Creek currently has a contained resource of 15,600t antimony at an average grade of 2.56%, placing it in a strong position to be a domestic producer of the metal used in ammunition, flame retardants and next-generation battery technologies.

Antimony supply chains have been disrupted by China placing export restrictions on the metal, sending prices above the US$33,000/t mark.

The metal has also been listed as a critical mineral in the US, European Union and Australia due to its importance in defence applications, with the US actively supporting the resumption of mining at historic domestic operations.

On the strength of the Wild Cattle Creek resource, its upside potential and market fundamentals, East Coast Research has initiated coverage of Trigg Minerals (ASX:TMG) with a 12-month price target of 16.3c, a 262% premium to its last traded price on November 29 of 4.5c.

“Our valuation for Trigg Minerals highlights its strong growth potential, supported by strong free cash flow projections and favourable market dynamics,” East Coast analyst Sasha Seaton said in a report.

“In the base case scenario, we project total FCF of $75.8m, leading to a firm value of A$60.5m and an implied share price of A$10.144c.

“In the bull case, higher antimony prices and optimised cost assumptions drive FCF to A$98.6m, resulting in a firm value of A$76.8m and an implied share price of A$0.182.

“Trigg’s strategic positioning in the critical minerals market, coupled with its high-grade antimony resources and competitive cost structure, positions the company for a potential re-rating as it advances its projects and achieves significant milestones.”

High-grade antimony and gold with promising growth

The research firm noted that the Wild Cattle Creek deposit within the Achilles antimony project in NSW’s New England Orogen – a region that hosts world-class deposits – features strong resource characteristics, 90% recovery rates and significant upside in exploration.

This includes untested mineralised trends that show promising signs for further resource expansion.

Nor is Achilles the only project of note. The company also holds the Taylors Arm and Drummond projects that are located near established mining regions with access to key infrastructure.

Taylors Arm project adds further antimony potential with over 88 historical workings spread across six mining camps including the Testers Mine, which recorded antimony grades of up to 63%.

Its proximity to the Hillgrove Mine and surrounding facilities supports potential toll-treating options and operational efficiencies.

Meanwhile, Its Drummond Gold project complements the portfolio with a focus on favourable low-sulphidation epithermal gold systems with rock chips returning up to 55.4g/t gold with a follow-up of 9.32g/t, and access to processing infrastructure.

Collectively, these projects grant TMG with a natural hedge against commodity-specific or project-specific risks as the exposure to both antimony and gold positions the company to balance exposure between critical minerals and precious metals.

Advancing towards development

Trigg’s near-term focus includes expanding the resource base at Wild Cattle Creek and advancing exploration at Taylors Arm and Drummond.

Planned drilling campaigns and ongoing geophysical surveys are expected to deliver key milestones, such as resource upgrades and maiden resource estimates, which will enhance project valuations and support a re-rating of the company’s stock.

East Coast notes that strategic positioning in the critical minerals space further opens opportunities for government funding and partnerships with end-users.

It adds that TMG is well-positioned to capitalise on the increasing demand for critical minerals and gold, leveraging its high-grade portfolio, exploration upside, and favourable market conditions to deliver long-term shareholder value.

A recent heavily supported $2.5m placement ensures the company has the financial strength to advance its projects while the strong response demonstrates investor confidence.

This article was developed in collaboration with Trigg Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.