Eagle Mountain takes bold steps at Oracle Ridge

Eagle Mountain takes a blocking position at Oracle Ridge and continues to advance its Silver Mountain and Wedgetail exploration projects. Pic: Getty Images

- Eagle Mountain takes strategic blocking position at the Oracle Ridge mine whilst focus shifts to exploration at its Silver Mountain and Wedgetail (formerly Oracle Ridge) projects in Arizona

- Drill testing the high-grade veins and large porphyry systems closer with permits received at Silver Mountain

- Potential sale of tailings material at Wedgetail could fund exploration work

Special Report: In a strategic move, Eagle Mountain has reduced its project holding costs whilst retaining an interest in the infrastructure at Oracle Ridge, allowing it to focus on exploring the Silver Mountain and Wedgetail projects.

In a calculated decision following negotiations with Oracle Ridge landowners, the company opted to relinquish ownership of less than 20% of its acreage over the project, thereby reducing its holding costs of the project.

The area relinquished holds the Oracle Ridge resource, but Eagle Mountain Mining (ASX:EM2) said it saw better shareholder value in using its funds on exploration activities rather than directing them to landowners.

Significantly, EM2 will retain control of key assets outside the immediate mine area such as the tailings dam and private/patented claims that are critical for any future restart activities at Oracle Ridge.

As such any future development at Oracle Ridge will still hinge on strategic negotiations with Wedgetail, EM2’s fully owned subsidiary, ensuring aligned interests moving forward.

At the same time, EM2 has successfully renegotiated the repayment terms of a loan-from Vincere Resource Holdings, reducing its first repayment significantly from US$1.5 million to US$250,000, and deferring payments by one year. A final payment of US$1.25m will be due in November 2029.

“The results of our negotiations with the secured lender are pleasing and we remain in good faith discussions with them, however we are truly disappointed that commercial terms with the landowner at Oracle Ridge could not be agreed at this time,” chairman Rick Crabb said.

“While we have an option to extend ownership of the mineral rights until 2040 by the payment of ~US$4.5m, we see it as important that any future ownership should be in perpetuity.

“The financial expectations of the landowner of certain patented claims are in our view excessive and to agree to their terms would not be in the best interests of our shareholders.”Crabb said while more than 30 companies expressed initial interest in the Oracle Ridge project when the company conducted a strategic review following the receipt of unsolicited approaches, they did not proceed further with many saying the expectations of the landowner were not commercially reasonable.

“Due to increased inflation in the US, a future mining operation is likely to require higher copper prices to support a decision to mine and to generate acceptable financial returns,” he added.

Focus on exploration

As such, EM2 has shifted focus to exploring at the Silver Mountain project, where it has recently received drill permits over an area targeting host large-scale porphyry-style mineralisation, along with the area surrounding Oracle Ridge that has been rebranded as Wedgetail.

The company previously identified large targets within the Scarlett area at Silver Mountain that are supported by multiple coinciding geophysical seismic, gravity and magnetic anomalies.

These feature outcropping porphyry-style phyllic alteration along with porphyry-style veining with similar orientations as other major projects in Arizona.

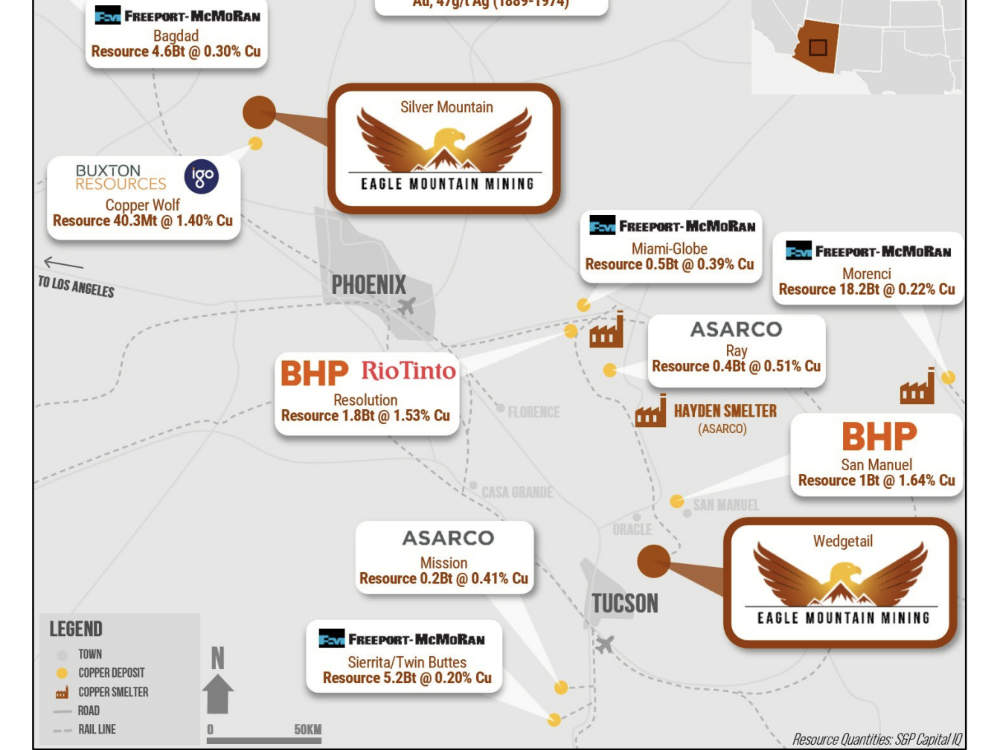

Silver Mountain is on the Laramide Arc, a northwest-southeast trending geological feature that hosts world-class porphyry copper mines such as Freeport-McMoRan’s Bagdad and Rio Tinto’s Resolution deposit. Surface samples has already returned high-grade assays including 64g/t gold, 445g/t silver and 15% lead across a 0.5m vein.

Eagle Mountain Mining (ASX:EM2) is also examining multiple prospective targets at the Wedgetail project.

At the 7km2 OREX target, outcropping mineralisation has returned grades of up to 9% copper while shallow geophysical electromagnetic anomalies have been identified at Red Hawk.

The company has also seen outcropping mineralisation of up to 10g/t gold at the Golden Eagle target where vectoring of previous drilling results points to the undrilled north-west area.

“Following Wedgetail’s recent decision to forego the extension of certain mineral rights at the Oracle Ridge mine, we remain committed to advancing exploration at both of our Silver Mountain and Wedgetail projects,” chief executive officer Tim Mason said.

“While we continue our exploration focus, we maintain a strategic ownership of the surrounding land and resource data relating to the Oracle Ridge mine without incurring ongoing landowner costs.”

Drilling permits at Silver Mountain were approved by the US Bureau of Land Management less than two months after applications were submitted and the company is carrying out the necessary roadworks to enable drilling of large untested targets there.

At Wedgetail, the company is investigating the use of seismic geophysical surveys to generate additional targets and guide existing drill designs and is also awaiting approval of drill permits.

Wedgetail tailings value

The company has also identified the potential sale of existing tailings from Wedgetail following a study by technology provider Auxilium Technology Group, which found they are benign and can be made into various marketable products.

This opens a unique and non-dilutive funding pathway for the company, which has been preserved amid the strategic shift.

The tailings’ high carbonate content make them suitable for use as an additive or filler for a variety of cemented products, including drywall boards, high strength concrete, mortar and road base.

EM2 has an estimated 1Mt of tailings within the existing storage facility while Auxilium has assumed selling prices of US$90/t for fine product and US$70/t for coarse product.

“We’re excited about the potential revenue stream from selling existing tailings with a simple screening process. Recent test work has confirmed their high abrasion resistance, temperature stability and near neutral pH,” Mason said.

“Leaching tests further demonstrate this material does not produce hazardous runoff. This project has the potential to provide revenue to support future exploration endeavours at both Silver Mountain and OREX, as well as covering the Vincere loan commitments.”

A Phase 3 study has started to produce enough test material for potential customers to assess its suitability for their needs and establish product pricing.

This article was developed in collaboration with Eagle Mountain Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.