Eagle Mountain gears up in pursuit of copper context

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Having recently raised $11 million on the back of some stunning copper hits at its Oracle Ridge project in Arizona and brought in experience to match, Eagle Mountain Mining is showing all the right signs at its Oracle Ridge copper project.

But while there may be more to find in the ground and further drilling to be done, Eagle Mountain (ASX:EM2) CEO Tim Mason said he wouldn’t quite put the company in the same category as a green or brownfields copper explorer.

“Oracle Ridge is a high-grade skarn project in Arizona, and it is really underdone from an exploration perspective,” he said.

“That’s something we’ve confirmed with the recent drilling we’ve done, where nearly all the holes we’ve drilled outside the current resource have hit some mineralisation.

“We’re really at the stage where we need to understand exactly how big this thing really is so we can right-size the mill, and to do that we need to know how big the resource is that we’re drilling out. “

“We have a JORC resource with decent grade, we have an existing underground mine , extensive local infrastructure and we are in a Tier 1 jursidcation – all these aspects really set us apart.”

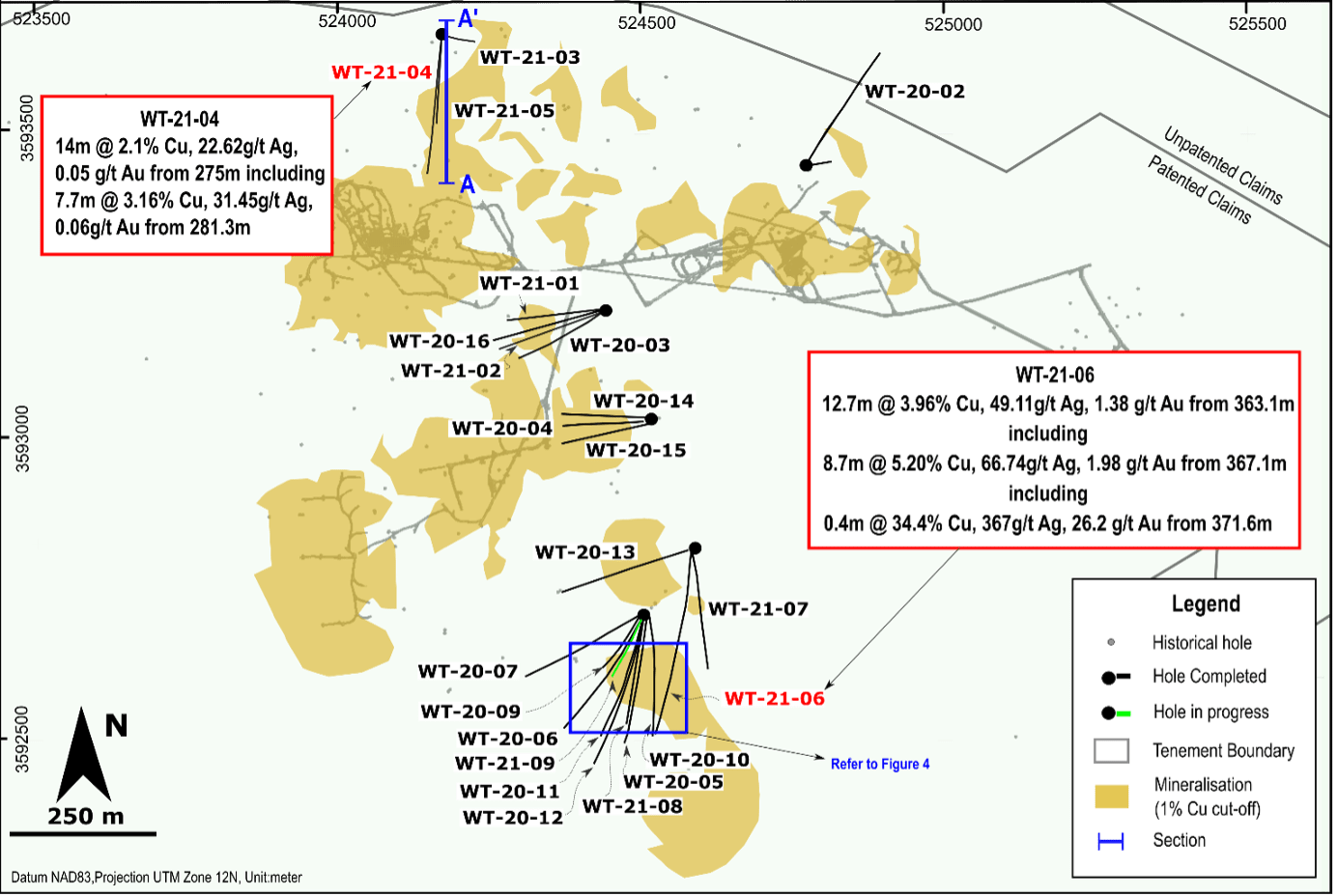

At present, the historic Oracle Ridge project has a JORC resource of 12.3 million tonnes grading 1.51% copper, 16.3 grams per tonne silver and 0.19g/t gold for 184,000t contained copper, 6.4 million ounces of silver and 73,000oz gold to a 1% copper cut-off. None of the drilling undertaken by Eagle has been incorporated into the JORC resource.

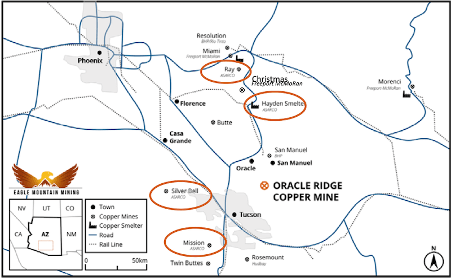

The project sits in an established copper district, with 18km of pre-existing underground workings close to its existing resources and kitted out with air, ventilation and water access and currently disconnected electrical reticulation services. It was last mined in the 1990s and acquired by EM2 in November 2019.

But it’s recent drill results which have really highlighted the full scale of red metal potential in the dirt at Oracle Ridge.

One hit reported in February came in at 12m at 3.47% copper and 50.22g/t silver at just 70m below surface and 40m west of the existing resource.

In March came the highest grade hit ever recorded at the project – 34.4% copper, 367g/t silver and 26.2g/t gold over 0.4m in a massive chalcopyrite zone within a broader intersect of 12.7m at 3.96% copper, 49.1g/t silver and 1.4g/t gold from 363.1m.

Critically, Eagle Mountain does not believe it has found the source of mineralisation at Oracle Ridge.

“Before we launch into our Studies, we need to understand the potential scale of the mineralisation so that we can right-size the production rate and processing plant,” Mason said.

“That’s the phase we’re in at the moment, we’re in the pre-studies phase. And the results have just been spectacular so far.”

Eagle Mountain is currently drilling at Oracle Ridge, with talks ongoing to expand the company’s drill capacity. With results like these, who could blame them?

“There’s really going to be a focus on upgrading the existing resource from indicated status to measured for parts of the orebody which will be early in the mine life,” Mason said.

“But we will also put some holes into some of those other really good targets around the existing mine, which have the potential to really expand the resource base out.”

More than 700 historic holes having been drilled onsite, but none have ever been oriented core, which means no structural, three-dimensional models of the project has ever been created.

“We’re looking at this project through a different lens, trying to vector in towards hotspots and the potential source of the mineralisation,” Mason said.

Having completed an $11 million placement last month, the company is well funded to pursue its exploration goals.

Experience to the fore

Further boosting the American arm of its business, EM2 announced in February that it had secured the services of Manuel Ramos as CEO of US operations.

The appointment was a serious coup – Ramos is best known as the former president and COO of Arizona’s prolific copper producer ASARCO LLC between 2009 and 2018.

ASARCO runs the Mission, Silver Bell and Ray copper mines and the Hayden and Ray copper smelters nearby, and Ramos is billed as a significant addition to the company’s knowledge and networks on the ground.

Mason said the addition of such an experienced head to the US team highlighted the quality of the asset and the company.

“We’re looking to expand our business both at Oracle Ridge and further afield and having someone of Manuel’s calibre joining our team really shows the potential he sees in the company, project and team,” he said.

“I think it’s a great bit of kudos for the team and to have someone with such a detailed knowledge of the resource sector in Arizona – it’s really exciting.”

King of the hill

Looking down the track, when it does come time to take Oracle Ridge into production Mason said the location of the mine at the top of a hill had the potential to lend itself to lower costs and an environmentally conscious project.

“Being located at the side of hill, means that you can use gravity to help lower your energy requirements, which in turn will lower your emissions,” he said.

“The mine is more amenable to battery electric types of vehicles, as opposed to if you’re mining at depth where you’re really limited at this stage to diesel equipment or shaft haulage.

“There are studies to be done, but the potential to become a lower emission mine is real, and something we are really excited about.

“We have this vision to be a copper producer supplying the green energy markets, reducing carbon globally, but also doing so in a sustainable and low emission way.”

This article was developed in collaboration with Eagle Mountain Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.