DY6 Metals on a tear as new rutile projects have explorer running hot

DY6 is stacking up more rutile projects in Cameroon, West Africa. Pic: Getty Images

- DY6 Metals shares run hot as investors deliver hero’s welcome for exiting trading halt with a fresh acquisition

- Six exploration licence applications in Cameroon will expand Central rutile project to almost 5000km2

- Due diligence sampling shows potential heavy minerals assemblages including rutile

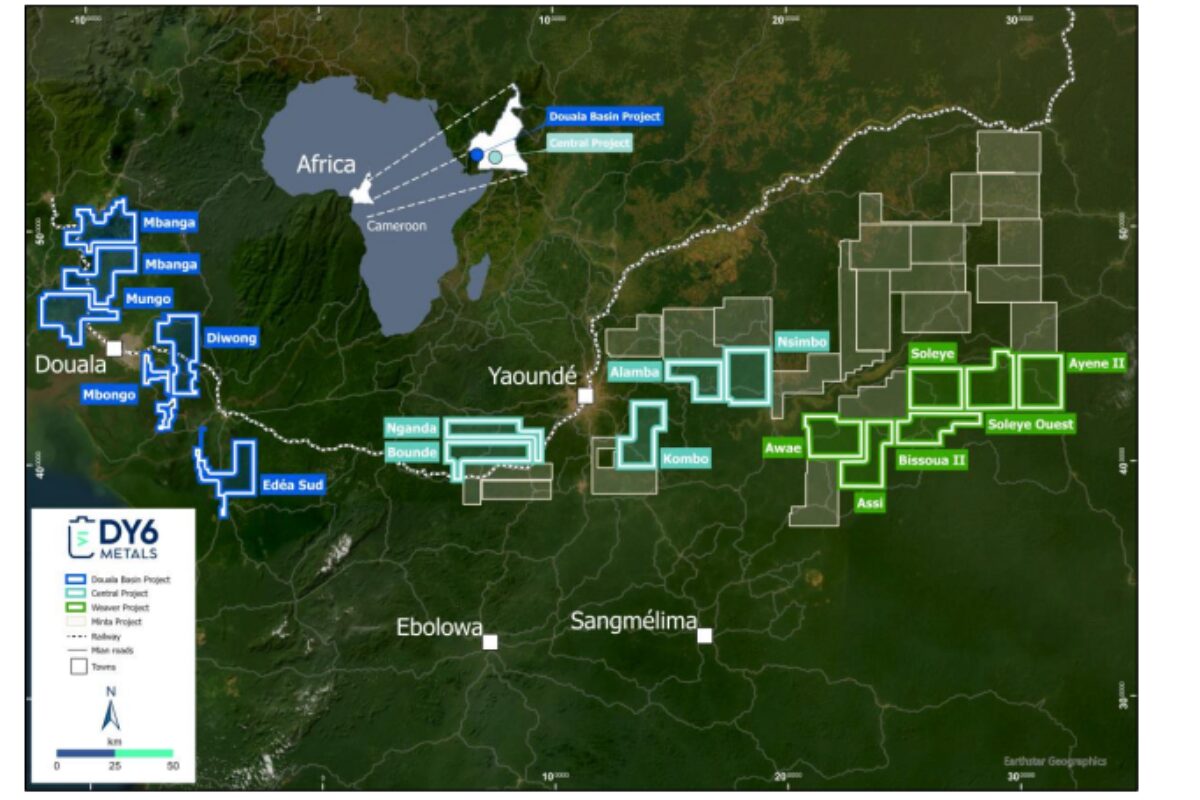

Special Report: DY6 Metals has enjoyed a hero’s reception on its exit from a trading halt, after picking up six exploration licence applications that will take its bounty of mineral sands assets in Cameroon to more than 7500km2.

The six new licence applications which make up the Weaver project will be added to DY6 Metals’ (ASX:DY6) Central Rutile project, lifting its landholding from 2124km2 to 4974km2.

The six contiguous licences are underlain by a bedrock of kyanite-bearing mica schist, thought to be the primary source of rutile mineralisation, which has been concentrated and upgraded with shallow saprolite via in-situ weathering.

The most eastern licence Ayene II bears similarities to the separate Minta rutile project and has returned high grades of zircon (up to 28%) and monazite (up to 73%), a mineral increasingly prized as a feedstock for rare earths.

“The acquisition of this new licence package more than doubles our landholding in this highly prospective area of Central Cameroon,” DY6 executive chair Dan Smith said.

“Desktop work as well as a recent due diligence site visit, indicates that the Weaver project area is underlain by the same favourable geology that we have seen at our existing Central rutile project.

“We are also highly encouraged by the results that Peak Minerals has reported to date from their Minta project which borders us to the north and look forward to getting back in the field.”

DY6 shares charged 12% higher on its return to trade on Tuesday morning.

History and potential

DY6 now has 11 licences surrounding and stretching east from Cameroon’s capital Yaounde in an area known to contain the high-grade titanium feedstock rutile, with alluvial deposits scratched by artisanal miners around Nanga-Eboko between 1935 and 1955.

Recent studies, the company said, had highlighted the similarities of the region to another virgin mineral sands district in the Lilongwe Plain of central Malawi, where Sovereign Metals (ASX:SVM) has uncovered the world’s largest rutile resource at Kasiya – 1.8Bt at 1% rutile.

That discovery, also a major natural graphite find, has pulled in Rio Tinto (ASX:RIO) as Sovereign’s largest shareholder.

“Similar to Kasiya, the Central Cameroon region has the same high-grade metamorphic bed rock geology, in the form of a kyanite-bearing mica schist, as well as a deep in-situ saprolitic weathering profile,” DY6 explained.

“These factors make this region highly prospective for residual, in-situ, saprolite hosted natural rutile deposits, analogous to Kasiya.

“Central Cameroon is fast emerging as a globally significant rutile province and DY6’s newly expanded Central rutile project comprises just under 5000km2 of world-class tenure directly within the heart of it.”

DY6 has already completed due diligence sampling at Weaver, including one auger drill hole which collected four samples, along with 22 channel samples from four road cutting exposures.

The reconnaissance drill hole returned a maximum visual estimate of 2% fine grained heavy minerals.

Channel samples included visual estimates of up to 10% fine-grained HM including 5% rutile and panned concentrate from four stream sediment samples that contained a maximum visual estimate of 5% dark, fine heavy mineral concentrate and fine-grained HM.

While visual estimates don’t hold the weight of lab assays and can’t be relied on as indicators of mineral abundance, that all hand auger and road cutting channel samples showed visible HM after panning “is considered highly promising in terms of the project being prospective for residual natural rutile mineralisation”.

Deal terms

DY6 has acquired the six licence applications from Gondwana Capital, a company associated with technical consultant Cliff Fitzhenry.

The deal included $125,000 in cash and 2 million ordinary shares at an issue price of 10c, valued at approximately $200,000.

Additional deferred cash and share consideration is also due to be paid six and 12 months post settlement, with performance rights from a previous deal for the Central Rutile project tenements extending to the Weaver tenements.

The Central Rutile project is one of two held by DY6 in Cameroon, which is emerging as a critical minerals and mineral sands hotspot.

It borders the Minta rutile project, where Peak Minerals (ASX:PUA) has identified widespread and high value mineral assemblage of up 93% heavy minerals.

That includes the dominant rutile (up to 69.8%), monazite (up to 35.6%) and zircon (up to 21.5%).

Peak shares have lifted 380% year to date, to a market cap of $137m, while DY6’s are up 462% YTD, with ample room to catch up on valuation if a big discovery is made, given its market cap of just $15m.

This article was developed in collaboration with DY6 Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.