Drilling shows major upside remains at Caravel, one of Australia’s biggest undeveloped copper deposits

Pic: CHBD/E+ via Getty Images

Caravel Minerals lodged its landmark PFS on the Caravel copper project in WA in July, but DFS work is already highlighting the potential to improve on what will be one of the few copper mines of scale to be developed in Australia in the coming years.

The Project would generate over $17 billion (net of payability and TCs/RCs) in revenue over its near three decade life and is expected to be one of the first new generation copper mines accommodating automated haulage, communication and electric vehicles in mine design that will lower operating costs and reduce CO2 emissions initially by 25%.

But work on Caravel’s (ASX:CVV) definitive feasibility study, due to be completed in early 2024, has already demonstrated the potential for improvements on that strong economic case.

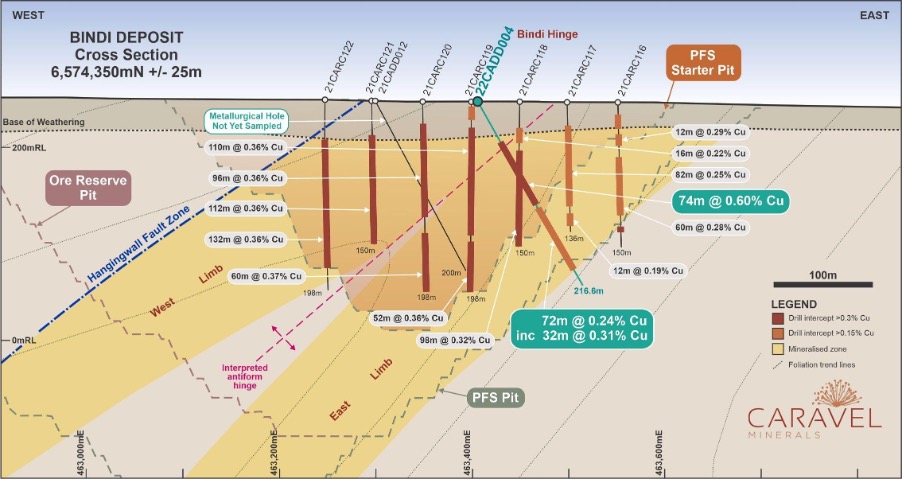

Assay results for four metallurgical holes drilled into starter pit areas at the Bindi deposit have returned grades better than estimates contained in the Bindi ore reserve.

The drilling results also provide increased confidence for an updated resource estimate planned in early 2023. Caravel is already the largest undeveloped copper project in Australia based on 2.84 million tonnes of contained copper in the resource.

The measured and indicated resources at Bindi come in at grades of 0.27% and 0.23%, respectively, but new assays have returned grades well beyond that within ore reserves in the West Limb, Bindi Hinge and East Limb sections of the Bindi starter pits, including:

- 74m at 0.6% Cu from 44m (22CAD004)

- 20m at 0.59% Cu from 104m including 14m at 0.74% Cu from 110m (22CADD002)

- 40m at 0.39% Cu from 48m (22CADD003)

- 98m at 0.27% Cu from 94m including 12m at 0.51% Cu from 98m (22CADD003)

- 54m at 0.32% Cu from 94m (22CADD001), and more.

More results on the way

Drilling activities at Caravel, located 150km northeast of Perth, have been halted for the cropping season.

Major field work is due to resume in December once the harvest is complete, with RC percussion drilling to increase the confidence in an updated resource estimate, more geotechnical diamond drilling, and aircore sterilisation drilling for mine site infrastructure due to begin once it restarts.

Before then, assays are being awaited for another seven diamond core holes that have been completed to provide geotechnical data for the DFS work on the Bindi deposit starter pits and mine infrastructure.

All of the diamond core holes tested to date have intersected high tenor mineralisation in their target zones, confirming the confidence in the Ore Reserve reported in the Caravel PFS.

Hole 22CADD004 in particular intersected strong mineralisation through the nose of the Bindi Hinge, correlating well with higher grade mineralisation in a broad intersection in hole 21CARC118.

This article was developed in collaboration with Caravel Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.