Drill bits are set to spin again at Iltani Resources’ Orient silver-indium project in North QLD

Stage 2 drilling is about to commence again at Orient. Source: Iltani Resources

- Drilling is about to commence at Iltani’s Orient silver-indium project in Northern QLD

- 23 RC holes planned, 10 RC holes to be drilled now, and remainder when wet season abates in early 2024.

- Holes designed to extend silver-indium mineralisation intersected in Stage 1 drilling completed in August 2023 and test zones of extensive stockwork mineralisation identified by mapping

Special Report: Iltani Resources is preparing to start Stage 2 of exploration drilling at the Orient tenure – part of its Herberton project that is believed to be a material silver-indium play with high grades of silver, lead, zinc, indium, antimony and tin.

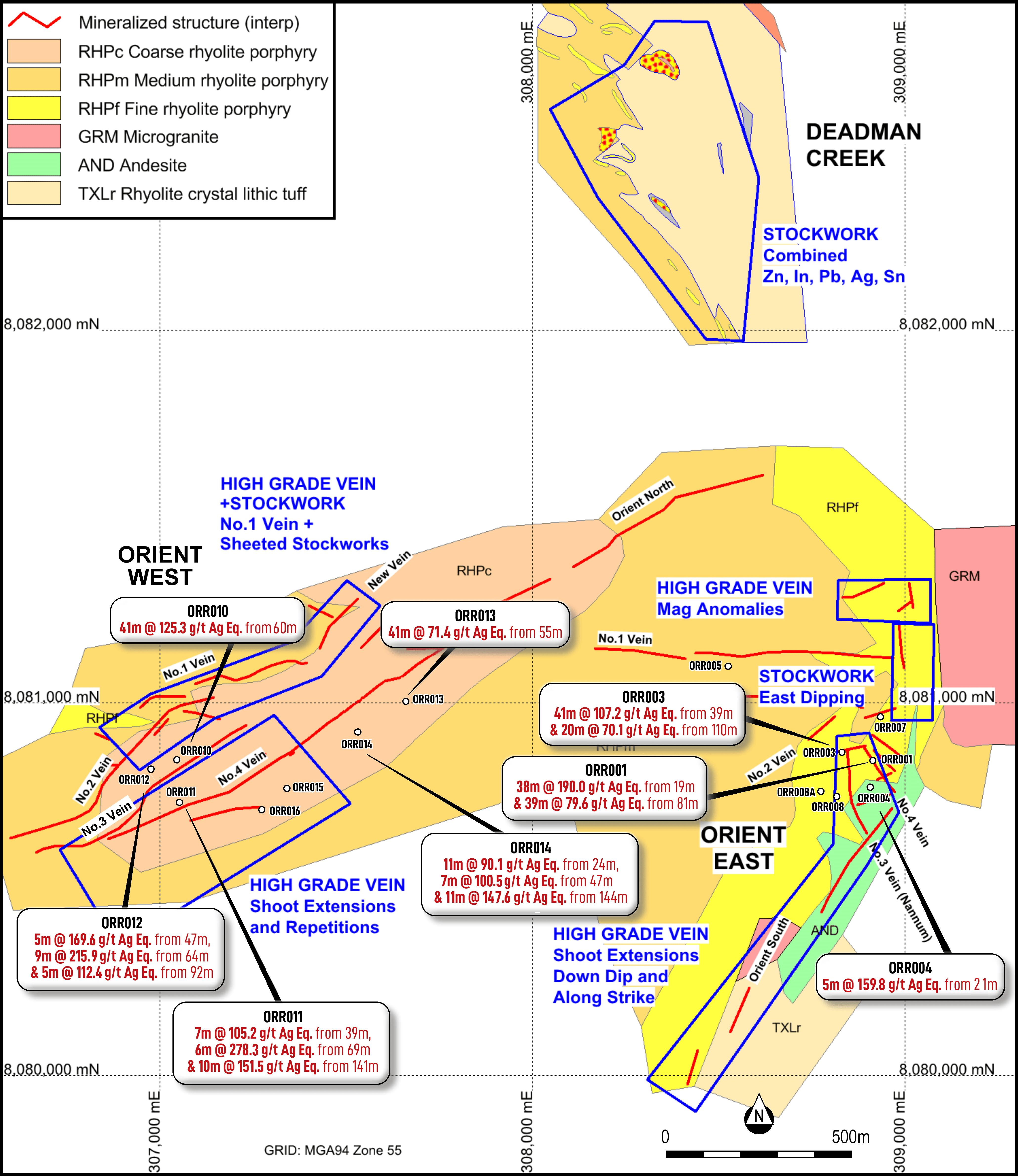

Iltani Resources listed on the ASX in June 2023 and quickly moved to commence drilling at Orient. The Stage 1 RC drill program was successfully completed in August 2023 and ILT hit wide intersections of silver-lead-zinc-indium-antimony-tin mineralisation at Orient West and East, confirming the presence of a significant silver-indium-base metal system at the project.

Mapping recently completed by Iltani indicates that the Orient mineralisation (veins and stockwork) extends over at least 4km2, with extensive zones of argillic, phyllic and propylitic alteration. The outcropping silver-lead-zinc-indium mineralisation has epithermal textures, and Orient likely represents the upper levels of an igneous (porphyry tin) system, which has been preserved at the upper levels, by the collapse of the associated caldera.

Earlier this month the company confirmed the potential for the viable production of separate concentrates of the elements on show at Orient. Metallurgical test work on historical core samples taken from the Orient West deposit in 1988 supported the production of separate lead-silver and zinc-indium-silver concentrates, spurring the case for Iltani Resources (ASX:ILT) prove up the overall Orient project’s resources.

The ability to produce an indium rich zinc concentrate positions Iltani as potentially a key supplier of indium, which has been identified as a critical raw material by multiple studies.

Gettin’ out the drillbit

The Stage 2 drilling will follow up from its highly successful Stage 1 drill program, which returned multiple intersections of 30-40m thick silver-lead-zinc-indium mineralisation at both Orient East and West.

Notable intercepts from the last round included 41m @ 125.3 g/t Ag Eq. (silver equivalent) from 60m downhole and 41m @ 71.4 g/t Ag Eq. from 55m downhole at two drill holes at Orient West

At Orient East, 38m @ 190.0 g/t Ag Eq. from 19m downhole was observed, as was 41m @ 107.2 g/t Ag Eq. from 39m downhole at Orient East.

All mineralisation intersected was open along strike and down dip, and the mineralisation outcrops along a series of small hills and ridge systems.

The Stage 2 program will consist of 23 RC holes, with nine planned at Orient East for 1,300m, 11 at Orient West for 1,840m and three for 360m at the Deadman Creek stockwork target.

ILT managing director Donald Garner says it will be fantastic to restart drilling at Orient to follow up from results received from the company’s Stage 1 drilling program that “significantly exceeded our expectations, with the drill bit delivering wide intersections of mineralisation at potentially open-pittable depths”.

“The Stage 2 drilling is planned to extend the mineralisation drilled in Stage 1 and test multiple stockwork targets recently mapped by a consultant geologist (Nick Tate).

“We also intend to test the Deadman Creek stockwork target with a number of drill holes.

“Stage 2 drilling has commenced and we plan to drill to mid-December, then we will demobilise the rig in anticipation of the wet season, then come back in early 2024 when the wet season has abated and complete the program.”

This article was developed in collaboration with Iltani Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.