Donald Trump wants more domestic production of rare earths

President Trump has signed an executive order to increase domestic production of rare earths: Getty Images

- Trump presidential order a call to action to increase domestic minerals production

- ‘America cannot be dependent on imports from foreign adversaries for critical minerals’, order said

- ASX rare earths companies are in a position to fulfil order criteria

Rare earths companies are in line to benefit from an executive order signed by US President Donald Trump last week designed to boost domestic production of the in-demand material.

President Trump said in the order it was important for the US to create a home base of minerals production to reduce the risk of potential disruption to industry supply chains.

EV company Tesla has selected Piedmont Lithium (ASX:PLL) to supply spodumene concentrate, a precursor to lithium hydroxide, from its North Carolina project to Tesla’s US battery plants.

Tesla, as an American company, puts a strong importance on having a US-based supply chain for various reasons that include security of supply, cost advantages, and closer inventory management, Piedmont Lithium president and CEO Keith Phillips said.

“I think they [Tesla] like to have their suppliers close to home. That’s true for all the auto companies we talked to as well,” he said.

American Rare Earths (ASX:ARR) is accelerating the growth and development of its La Paz project in Arizona, and its Laramie project in the US state of Wyoming.

“Rare earth elements remain a key US strategic resource, which through its domestic development is designed to provide input for US-based processing,” the company said in its 2020 annual report.

ioneer (ASX:INR) recently committed to its goal of getting its Rhyolite Ridge lithium-boron project in Nevada permitted and ready for construction as early as the second quarter of 2021.

Ionic Rare Earths (ASX:IXR) increased to 60 per cent its equity stake in the Makuutu rare earths project in Uganda, central Africa.

The project will produce heavy rare earth oxides and critical rare earth oxides that provide a “viable large-scale, low cost alternative supply outside of China”, the company said.

Rare earths market set for 10 per cent year-on-year growth

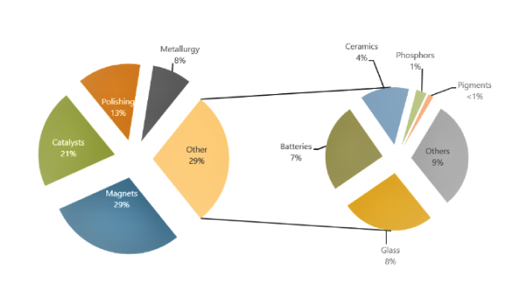

Elements like dysprosium, gadolinium and neodymium are employed in magnet production in EVs and renewable energy.

Their use is expected to account for 40 per cent of total rare earths demand by 2030, according to industry consultancy firm Roskill.

“While growth in rare earth demand is expected to fall back in 2020, as a result of COVID-19 related disruptions to industrial production, a strong recovery in demand is forecast in 2021, increasing by 10 per cent year on year,” Roskill said in a report.

Arafura Resources (ASX:ARU) produces neodymium-praseodymium at its Nolan’s project in the Northern Territory.

It received a boost recently, when customers in China, Europe and Japan confirmed its rare earth oxide products meet their specifications, an important milestone that allows the company to start commercial negotiations with them.

US seeking to reduce dependence on overseas minerals supply

The executive order titled, ‘Threat to the domestic supply chain from reliance on critical minerals from foreign adversaries’ was issued by the White House on September 30.

The law says that “America cannot be dependent on imports from foreign adversaries for the critical minerals that are increasingly necessary to maintain our economic and military strength in the 21st century”.

The order is based on President Trump’s constitutional powers, including the International Emergency Economic Powers Act and the National Emergencies Act.

President Trump signed a similar executive order in December 2017 that required the Secretary of the Interior to identify critical minerals and reduce any potential disruption to the US’s supply chain.

Following this order, the Secretary of the Interior put together a list of 35 minerals essential to US economic and national security that are used in airplanes, computers, and electronics.

For 31 minerals on the list, the US imports more than half its annual consumption, and lacks any domestic production for 14 minerals on the critical list.

Included on the list are minerals such as barite used in hydraulic fracturing for oil and gas, gallium used in semi-conductors and mobile phones, and graphite used in batteries.

Western Australia-based company EcoGraf (ASX:EGR) is building a facility to produce battery-grade spherical graphite with a planned production of 20,000 tonnes per year.

Other critical minerals on the list are antimony, cobalt, indium, lithium, magnesium, rare earth elements, tantalum, titanium, and zirconium.

The US imports 80 per cent of its rare earth elements from one country — China, the order said.

ASX share prices for rare earths companies

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.