District scale: Mako is building a multi-million-ounce West African gold play

The company has entered into an exclusivity agreement with Goldridge Resources . Pic: via Getty Images.

- Mako Gold to raise $2m via a placement to advance exploration and potentially acquire private explorer Goldridge Resources

- Goldridge’s flagship Konan project boasts five priority gold anomalies

- Move would make MKG a district-scale gold play in West Africa

Special Report: Mako Gold is raising $2m to bolster and advance its gold and battery metals portfolio in Côte d’Ivoire, West Africa.

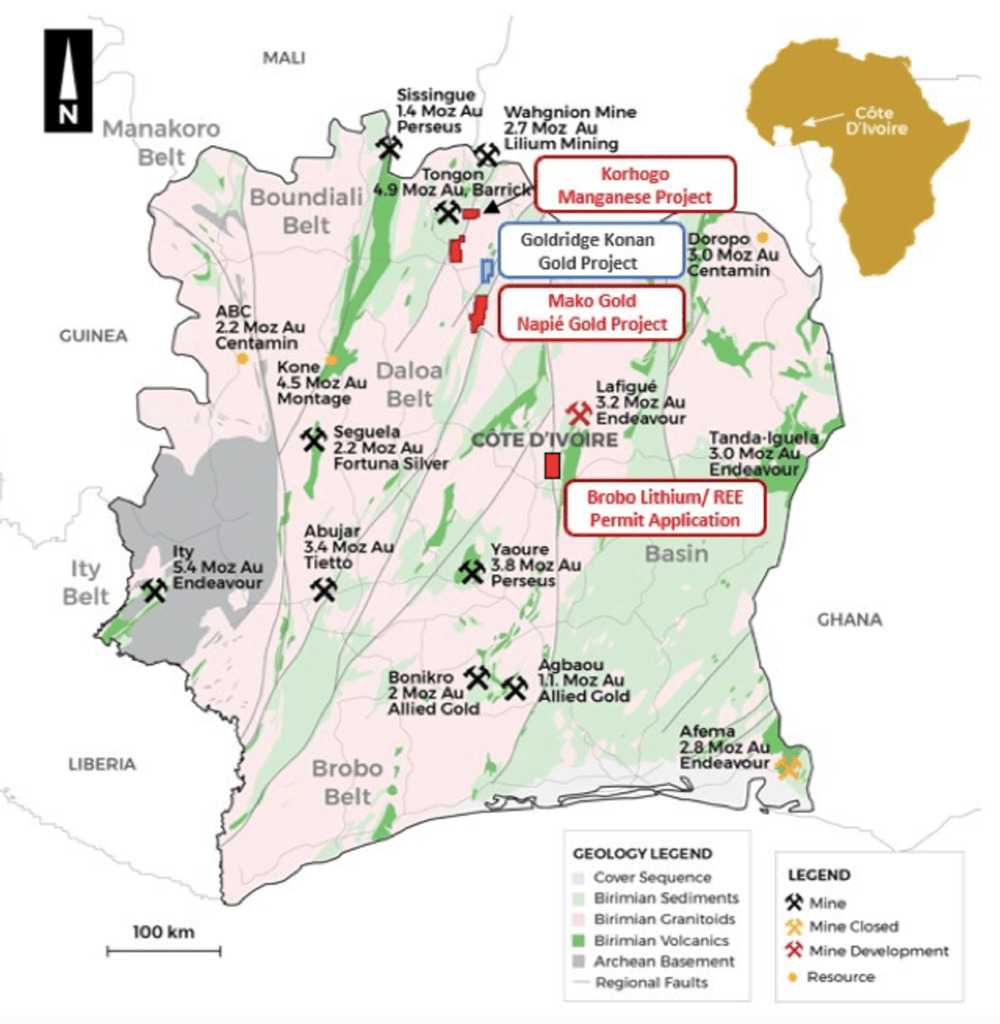

The West African nation is a significant gold producer, with annual output up 14% (yoy) in 2022 to a record 48 tonnes, with several big hitters in the country including Barrick Gold, Endeavour, Fortuna Silver, Perseus (ASX:PRU) and West Africa’s newest ASX-listed gold producer, Tietto Minerals (ASX:TIE).

The country is also a major producer of manganese with 929,700t pulled out of the ground last year.

Mako Gold (ASX:MKG) is hunting both gold and manganese across its 868,000oz Napié and Korhogo projects, close to existing mines in the nation’s north.

The company is now aiming to create a district scale gold play and target in-country growth opportunities in the gold and battery metals space by acquiring private exploration company Goldridge with its flagship Konan project.

“The combined Napié and Konan projects cover 374km2 of highly prospective tenure with proven gold mineralisation and would form a strategic consolidation of the greenstone gold belt,” the company says.

A district scale gold play

The Konan project covers 150km2 and hosts five high priority gold anomalies defined by extensive soil geochem, trenching and limited aircore (AC) drilling.

The maiden AC drill program was highly successful with a notable intercepts of 8m at 4.26 g/t gold from 34m to EOH including 2m at 16.63 g/t gold from 40m (KBAC22-144).

The priority next steps for exploration at Konan include:

- Follow up AC and RC drilling planned to extend mineralisation along strike and at depth (average depth of the AC drilling was 38m) at Felix;

- Undertake initial drill testing of the high priority David prospect, a +2km long gold-in-soil anomaly; and

- Further target generation and refinement of existing regional prospects in preparation for maiden drill testing.

Goldridge has the right to earn up to 93% interest in Konan through an earn-in/ joint venture (JV) agreement with CAREM, a local Ivorian exploration company, on completion of a feasibility study, however the JV structure provides flexibility to accelerate or withdraw following exploration success or failure.

Notably, the private company is also supported by the founders of Tietto who recently transitioned the 3.8Moz Abujar gold project into production and are currently subject to a ~$650m takeover offer.

$2m to fund gold and battery metal exploration

MKG has secured binding commitments to raise $2m (before costs) through a placement at $0.01 per share, representing a 28.6% discount to last close on 14 November 2023 of $0.014.

The placement is cornerstoned by Goldridge Resources founders and shareholders (including Caigen Wang and Jeremy Clark) who have committed to subscribe to 50m new shares ($500,000).

The company also received strong support from existing major shareholder, Dundee Corporation, to maintain their 9.9% holding.

The placement ensures Mako is well positioned to advance exploration on the Napié gold project and advance exploration on its battery metals portfolio including at the Korhogo manganese project where rock chip sampling is currently underway.

It would also mean the company is funded to explore the Brobo project – if granted – which is a new lithium/ REE 400km2 permit application hosting multiple outcropping pegmatites.

Plus, subject to shareholder approval, a share purchase plan is in the works for eligible shareholders to raise up to $500,000 in addition to the placement.

Subject to completion of a Goldridge transaction, MKG has proposed two strategic appointments in experienced West African geologist and ex-RPM global management team member Jeremy Clark as proposed non-executive director and founder and ex-managing Director of Tietto Dr Caigen Wang as proposed strategic advisor.

This article was developed in collaboration with Mako Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.