Diggers and Dealers: This booth is in care and maintenance

Pic: Getty Images

- BHP Nickel West stripped bare naked at Diggers and Dealers

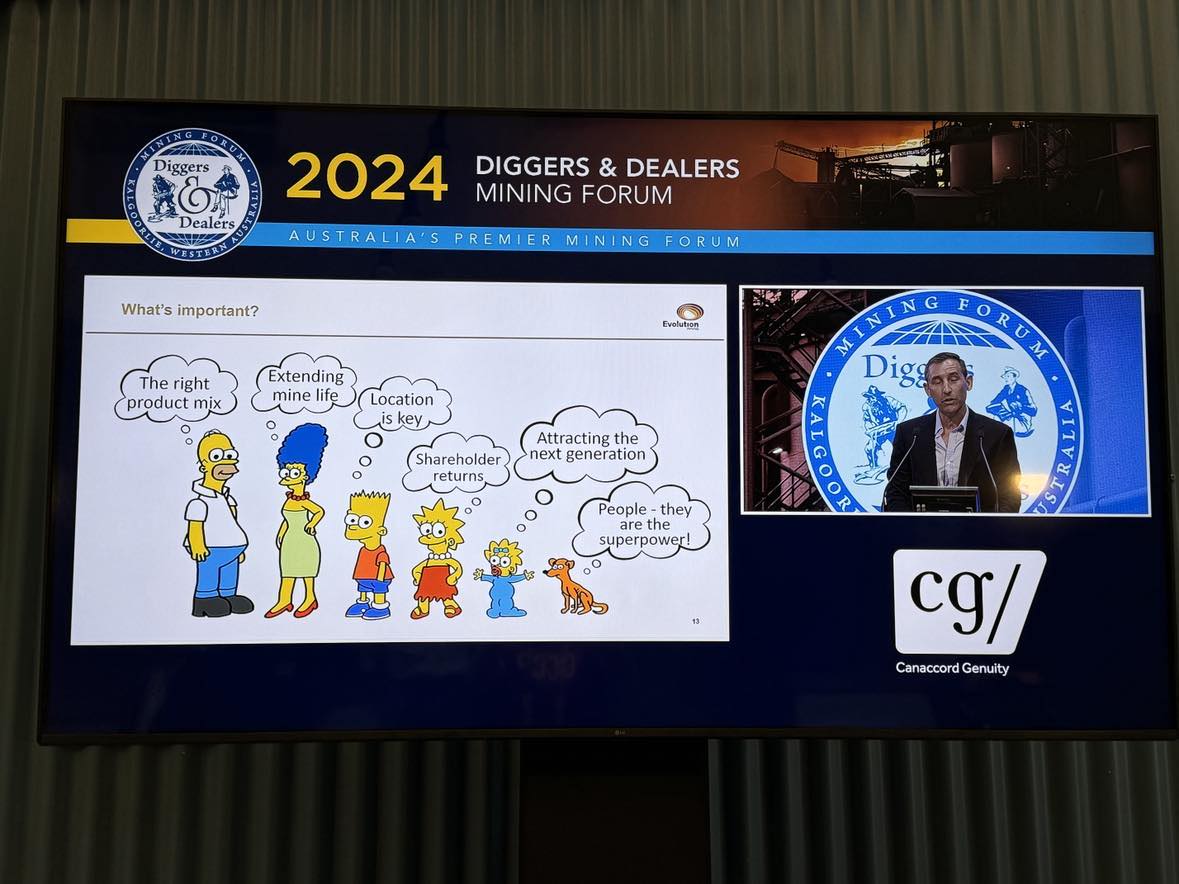

- A questionable Simpsons reference and bullish gold outlook from Evolution’s Jake Klein

- Liontown’s Tony Ottaviano starts the show on Tuesday morning

We’re not more than two months removed from BHP’s (ASX:BHP) decision to place its Nickel West business in WA in mothballs and already costs are being stripped out.

How else to explain its normally well-attended booth at Diggers and Dealers, which stands out for its simplicity.

A black background, name and a few operators milling about, not a single print out or map to be seen.

The 80,000tpa Nickel West division, stung by a price collapse put down to a flood of low cost supply, is on track to report losses of around US$300m for the past financial year.

It’s something not even the deep-pocketed BHP, which will blight its full year result with a ~$5.5bn non-cash impairment linked to the nickel price collapse as well, could stomach, putting paid to plans to use its nickel endowment to play a role in the electric vehicle narrative.

The collapse of WA’s nickel production, soon to fall to just IGO’s (ASX:IGO) Nova mine and Glencore’s Murrin Murrin, has been a major talking point in Kalgoorlie where, just 50km down the road the first nickel boom kicked off in Kambalda in 1966.

Some pictures say 1000 words, this one says just three: Care and Maintenance.

Making D’oh!

Gold’s having a wonderful run and despite a tumble over night no one is crying at $3700/oz.

But their recent success is a double-edged sword, we think they may be getting a little overconfident.

Proof the Midas touch isn’t real, we reckon Evolution Mining (ASX:EVN) and its exec chair Jake Klein missed the mark with this slide.

We’re all for lightening the mood but come on, if you’re going to pull this at least be a little faithful to the source material. How many ounces of gold cover the cost of this copyright settlement?

We’re Groening.

Not as much to complain about with Klein’s positivity on the gold price amid a global economic environment that looks more uncertain by the day.

“I’d quoted Citi’s research piece which has a base case of US$2700-3000 for 2025. And I think is was published a couple of months ago, they may be being conservative,” he told media on the sidelines in Kal.

While high prices are bringing the bankers into the fold, Klein is not so sure the wave of dealmaking expected in the gold space is necessarily a good thing.

A number of companies are now looking to bridge the gap and repeat the success he and Bill Beament had after the 2013 gold collapse, when departing North American majors offloaded unloved assets that turned the one time small caps into $8bn and $16bn companies, respectively.

“I think you’d be better off doing it when gold collapsed in 2013 than now,” he said.

“Now that’s not to say it’s not going to happen now but our view has always been to kind of try and buy accretive, better quality assets.

“I feel our portfolio is well prepared for this boom. We’ve just bought Northparkes seven months ago, we acquired the balance of Ernest Henry in 2021. We’re well positioned.

“I think what you’re referring to is are there companies with shorter mine lives seeing the gold price go up feeling a kind of a momentum to do deals.

“I think there is a market sentiment that deals are a good thing at the moment. I’m not sure that it’s always the case.”

READ: Diggers and Dealers: Miners and analysts see digs and deals in gold’s bright future

Get lith

Tony Ottaviano was in the Diggers equivalent of the graveyard slot, of which there are two.

One is the final round on Wednesday afternoon, when delegates are heading home to prep for the festival’s famous gala dinner.

The other is the 8.30am on Tuesday, which comes after the investment banks take over Hannan Street’s hotels on Monday with parties that extend into the early morn.

The Liontown Resources (ASX:LTR) boss was in fine form having, we were told, sharpened up and wound down by watching some Seinfeld reruns the night before.

He has a fine story to sell, having just produced first concentrate at the Kathleen Valley mine, one of only four second generation lithium mines to emerge in 2023 and 2024, alongside Sigma Lithium’s Grota Do Cirilo in Brazil, Wesfarmers and SQM’s Mt Holland and Ganfeng’s Goulamina in Mali.

(That’s putting aside Core Lithium’s higher cost and smaller Finniss, which shut as spodumene prices dived some 85% last year).

With spodumene concentrate back in bearish territory at US$890/t, its timing for the underground development could have been more fortuitous.

But Ottaviano says Liontown has around $460m in the bank thanks to some debt facilities, doesn’t plan any equity raisings and has flagged there will be efforts to strip out costs at KV before hitting nameplate rates by doing things like adjusting concentrate grades.

On the broader market, he remains of the belief supply will disappoint, questioning whether incumbent producers will actually expand production as much as they have studied (think Pilbara’s 2Mtpa expansion case at Pilgangoora).

Ottaviano wants to see the market mature to prevent the recent price volatility seen in lithium, saying the Government may need to subsidise upstream production in WA (home to ~50% of the world’s lithium raw materials) as well as refining to support the long-term viability of the EV supply chain.

“When you see price drop as fast as it has, it just tells you that the market is not mature, and the government’s got to play a role to help buffer that until industry sorts itself out through a proper world related index for pricing, and not governed by one jurisdiction,” he said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.