Dig In: Toubani’s Kobada DFS confirms high value +150,000ozpa African gold play

The company is aiming for the Kobada gold project to be shovel-ready by 2025. Pic: via Getty Images

- Toubani Resources’ DFS for the Kobada gold project highlights attractive financial metrics

- Post-tax NPV is US$635 million and IRR is 58% based on US$2200/oz gold prices

- The company confident of optimising capital and operating costs further

Special Report: Toubani Resources’ definitive feasibility study for the Kobada gold project in Mali has confirmed the project as a significant gold development asset underpinned by its large scale, free-dig and open pittable oxide resource.

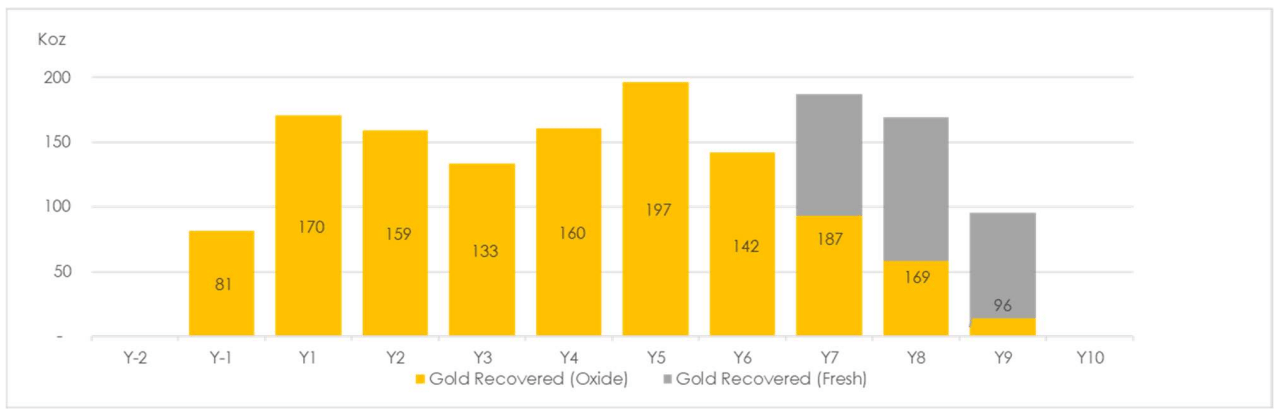

The study update elevates Kobada into the rare group of +150,000oz per annum gold development projects in West Africa, with a peak output of 197,000oz in its fifth year post ramp up, at one of the lowest capital intensities in the sector.

Kobada boasts attractive financial metrics including a post-tax NPV of US$635 million and IRR of 58% at a gold price assumption of US$2,200/oz. That IRR, a measure of profitability and return on investment, stands almost four times higher than the rate typically chased by majors.

Plus, there’s significant upside for Toubani Resources (ASX:TRE) at spot gold prices, with post-tax NPV increasing to US$897 million with an IRR of 73% at US$2,600/oz.

The project is also one of the lowest capital intensity development projects in the sector with an initial upfront capital of US$216M, including US$18M in contingency.

All-in sustaining costs of US$1,004/oz and C1 Cash Costs of US$825/oz were prepared on the basis of the current cost environment, underpinning strong average annual operating cash flows of US$158m per annum.

And this strong cash flow generation underpins a rapid post-tax payback period of 1.5 years at US$2,200/oz – or 1.25 years at US$2,600/oz.

Study underpinned by large ore reserve

Kobada boasts impressive total ore reserves of 53.8Mt at 0.90g/t for 1.56Moz of gold, all in the probable category.

And the 1.26Moz of oxide ore reserves (44.3Mt at 0.88g/t gold) underpins the first seven years of high-margin oxide production – with average production averaging around 162,000oz per annum over the current life of mine.

Oxide hosted gold is typically cheaper to mine and process compared to fresh or sulphide ore, enabling companies to make strong returns at what appear to be relatively low average grades.

There’s also upside potential, with resource drilling planned ASAP to test over 50km of prospective structures and for depth extensions below the DFS pit design and current extent of the resource.

“The strategy to update the Kobada feasibility study was driven by our belief that the Kobada gold project is a unique and rare development asset that had yet to reveal its true potential,” Toubani managing director Phil Russo said.

“The delivery of the 2024 Kobada DFS demonstrating Kobada as an asset belonging in the +150,000 ounce per year tier, producing at an initial mine life of over 9 years while at an AISC of just US$1,000/oz, is an exceptional outcome.

“The key attributes of the Kobada gold project are the large mineral resource of near-surface mineralisation and the free dig and free milling oxide ore reserves.

“The study highlights that these benefits flow through the entire value chain, translating to low operating costs as well as one of the lowest capital intensity projects in West Africa, if not the sector.”

Optimising capital and operating costs further

The company says numerous opportunities to optimise capital and operating costs are being pursued as Kobada moves forward along the development path, including:

- Confirmatory testwork to validate processing flowsheet and reduce capital

- Identify opportunities to self-perform construction of non-process related infrastructure to further reduce costs and improve the schedule

- Geotechnical and hydrological studies to refine mine design to improve stripping ratios and reduce mining costs.

“The economic leverage of a low capital and operating cost project is seen in the financial outcomes of the DFS with a rapid payback of 1.5 years at significantly lower gold prices than today’s spot prices,” Russo said.

“While Kobada is clearly strong today, numerous opportunities to enhance the Kobada DFS have been identified and are being pursued to further enhance our already lean capital and operating cost profile, while in parallel our exploration strategy to define additional high-value oxide growth targets to supplement, and potentially increase production, is set to commence.”

Shovel ready status by 2025

Russo said that, given the strength of the DFS, Toubani is confident Kobada is a project that can succeed in West Africa today and looks forward to finalising all in-country agreements with the State of Mali as Toubani readies Kobada for development.

“The 2024 DFS has established an excellent platform for the company to continue to build momentum with Kobada providing exceptional development asset exposure in the backdrop of a rising gold market,” he said.

“It is an exciting time to be advancing a gold development asset of the significance of Kobada and we look forward to continuing to execute our objectives with renewed rigour following today’s release of the DFS.”

This article was developed in collaboration with Toubani Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.