Diatreme releases study for zircon project but investors aren’t all that excited

Pic: Schroptschop / E+ via Getty Images

Emerging mineral sands player Diatreme Resources says it has substantially revised down the costs of building its flagship ‘Cyclone’ zircon project in Western Australia.

Diatreme shares (ASX:DRX) jumped 15 per cent on the news, before cooling to their previous day closing price of 2c.

A ‘definitive feasibility study’ (DFS) on Diatreme’s flagship Cyclone zircon project in the Eucla Basin of Western Australia slashed capital expenditure estimates from $161 million in to $135 million.

Miners undertake up to four different types of studies when examining whether or not a resource can be mined economically. These are — in order of importance — scoping, preliminary feasibility (PFS), definitive feasibility (DFS) and bankable feasibility (BFS).

Diatreme also estimates average revenue of $130m and after-tax profit of $26.6 million each year over Cyclone’s 13-plus year life.

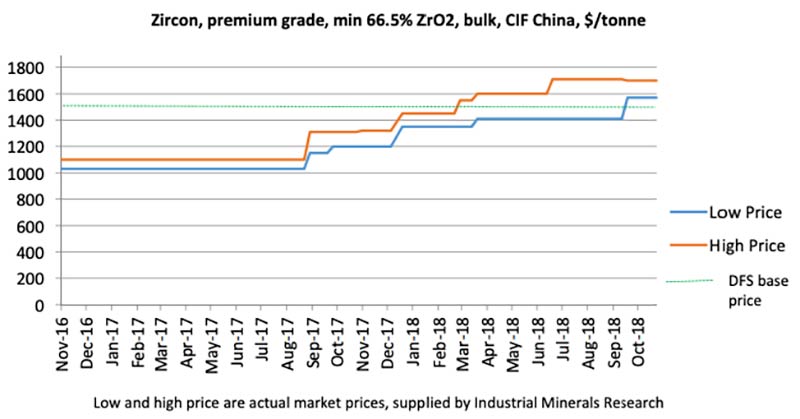

This was calculated using a base pricing assumption of $US1500 per tonne for premium zircon, which is used in engines, electronics, spacecraft and ceramics.

Zircon would contribute about 80 per cent of the project’s value, the company told investors.

The zircon price was trading around $US1200 per tonne before it bombed at about $US900 per tonne in mid-2016.

Since then it has reversed the negative trend, climbing to over $US1500 per tonne in 2018 as demand exceeds supply.

Diatreme says current base prices for zircon are in the range of $US1580 for contract pricing, through to $US1700 for ‘spot’ pricing.

Diatreme chairman Gregory Starr says the DFS confirms that Cyclone’s economics were sound “and that the project is capable of attracting the necessary investment”.

The DFS was undertaken by ENFI – a subsidiary of massive Chinese miner China Minmetals Corporation – which said it was “confident that “current prices are likely to form a solid base for the project and can be confidently used for financial evaluation”.

ENFI will also help source potential project investors, offtakers, and project debt funders using its network within China’s state-owned enterprise and banking sectors.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.