Developing a nickel *and* cobalt project? You’re in a good spot

Getty Images

Special Report: Having both nickel and cobalt is a win right now, with both metals benefiting from supply issues, which is driving prices higher.

Both nickel and cobalt have firmed in recent times as vital raw materials in the supply of lithium-ion batteries, which despite the name, have large amounts of both minerals in them.

These minerals are not only pegged to the lithium-ion battery revolution, but shortages will soon develop on the supply side which are already beginning to build in pricing support.

Here’s how:

Nickel firming as battery metal in Asia

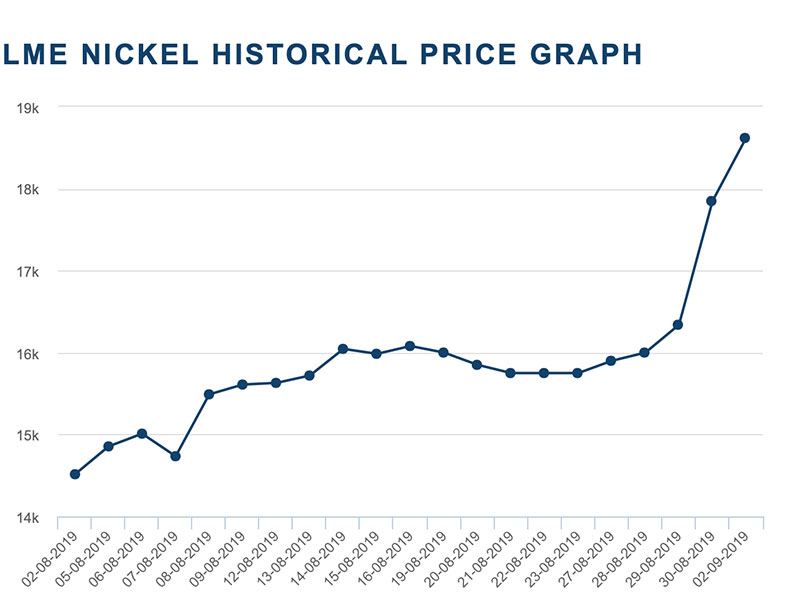

Nickel has been one of the breakout commodities over the last year, with its contract on the London Metals Exchange (LME) rising more than 50 per cent on the year.

Traditionally used in stainless steel, the commodity has taken on a new complexion as a battery metal.

While metals such as lithium have undergone their ‘hype loop’ for being attached to battery manufacturing, the nickel hype has only started to emerge.

This is largely thanks to an edict in China that all new electric vehicles manufactured in the country need to have a range of more than 400km — which means heavier and more powerful batteries.

Enter nickel, which is being used in increasing amounts in order to give the batteries more of a charge.

Therefore, battery manufacturers have been scrambling to shore up supply, leading to a few emerging supply issues.

For example, earlier this year Wood Mackenzie said that manufacturers were facing a supply crunch.

“Although the battery sector share of nickel demand is much smaller than other metals, getting the quantity of nickel that EVs will need by the mid-2020s will be a challenge,” it wrote.

“While high-nickel ternary batteries will mean higher corresponding demand for nickel, like cobalt, our long-term deficits are becoming more feasible.”

As alluded to above, cobalt from non-child-labour sources, is also facing a supply crunch.

Cobalt also useful, but supply from non-awful sources is running out

Cobalt is an incredibly useful ingredient in lithium-ion batteries, but there’s been increasing awareness around supply chain issues, mainly from the Democratic Republic of Congo, over the past year.

While the DRC supplies a huge amount of cobalt to the world, a large degree of it is gathered as part of artisanal mining operations that are associated with ethical issues.

As you’d expect, pressure is mounting on manufacturers to make sure they source only ethical cobalt.

It’s created somewhat of a supply vacuum, and mine closures caused by low prices are making it worse.

Earlier this month, senior analyst at Benchmark Mineral Intelligence, Caspar Rawles, said the mothballing of Glencore’s Mutanda mine in the DRC would create issues.

“The outlook for the market before the announced closure was that it would go through a period of oversupply for at least the next 12-18 months,” he told Stockhead.

“This pessimistic sentiment on the market has weighed heavily on prices and was one of the key contributing factors in the falling market we have experienced since the start of Q2 2018.

“With the closure this has changed, heightening concerns about availability of supply.”

This means aspiring miners looking to produce battery grade nickel and cobalt are in a very good spot right now.

Enter Australian Mines (ASX:AUZ).

Sconi offtake locked in, finance the next miletone

The company is one of the few Australian miners developing both nickel and cobalt projects — at its flagship Sconi project in Queensland and Flemington project in NSW.

Sconi is a cobalt-nickel-scandium play, making it one of the few projects like this in Australia.

The development has the potential to provide 7000 tonnes of cobalt sulphate per year, 46,800 tonnes of nickel sulphate per year, and 48 tonnes of scandium oxide per year — all with a 30 year mine life

The company recently locked in a crucial agreement to sell all of Sconi’s nickel and cobalt production for at least seven years to South Korean battery maker SK Innovation.

With an existing base at Sconi, upcoming drilling at Flemington, and even early exploration work being done at the company’s Thackaringa project near Broken Hill — Australian Mines and its investors will have plenty to chew on over the next six months.

All the while, the market will continue to scream out for nickel and cobalt.

Not a bad spot to be in.

This story was developed in collaboration with Australian Mines, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.