Depressed copper prices, higher costs take a chunk out of Aeris’ bottom line

Calm down, it's just a zombie. Picture: Getty Images

Copper producer Aeris Resources (ASX:AIS) has had a disappointing second half of 2018, widening its loss by 57 per cent to $10.5m.

Revenue actually increased 8 per cent to $113.5m due to high copper production, but that was offset by lower copper prices, higher costs and a sizeable foreign exchange loss.

Aeris’ copper was only fetching $8476 per tonne in the last six months of last year, whereas the price was $8638 per tonne a year earlier.

On top of that the costs blew out to $108.1m from $94.1m thanks to higher tonnes mined and processed, higher volumes of copper concentrate shipped, and lower development metres capitalised.

The Tritton operations in New South Wales produced 13,268 tonnes of copper, which was 1041-tonne increase on the second half of 2017.

Meanwhile, Aeris also booked a foreign exchange loss of $2.4m in the second half compared to a $1.8m gain in the same period of 2017.

The company’s goal is to produce 24,500 tonnes of copper in FY19 at a cost of between $2.75 and $2.90 per pound, or between $6062.73 and $6393.40 per tonne.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

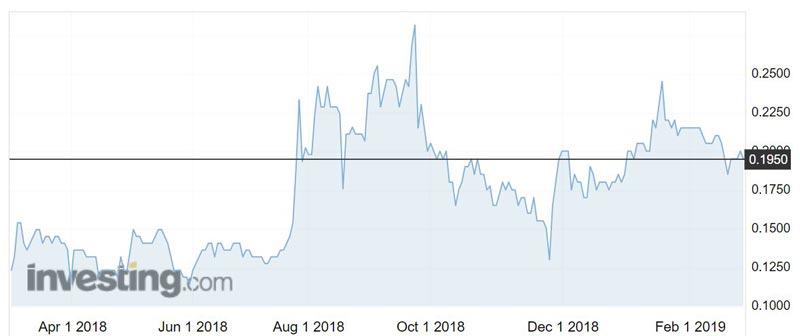

The price of copper spent most of 2018 heading south, tumbling nearly 20 per cent to bottom at $US5822 ($8120.97) per tonne in early September.

But it is off to a better start this year, reversing the downward trend and gaining 11.7 per cent to trade around $US6488.50 per tonne.

It has notched a nearly eight-month high as stockpiles continue to decline and sentiment picks up on hopes the US and China are getting closer to ending their trade war.

The copper price still has a bit of ground to make up though, to get back to the $US7261.50 it reached in June last year.

Aeris’ share price dipped 2.5 per cent to 19.5c on Tuesday morning.

Stockhead is seeking comment.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.