Delta Lithium launches IPO of gold spin-off Ballard Mining

Delta shareholders will vote on the spin-off of Ballard Mining. Pic: Getty Images

- Delta Lithium spin-off Ballard Mining has launched its IPO priced at 25c per share to raise $25-30m

- Proceeds will be used primarily to fund exploration, extensional and infill drilling at Mt Ida

- Mt Ida currently has a 1.1Moz @ 3.33g/t gold resource and potential for growth along a 26km underexplored shear zone

Special Report: Delta Lithium shareholders will soon be exercising their voting rights to decide if the Mt Ida gold project will be divested into new ASX-listed company Ballard Mining.

At a general meeting to be held in Perth on June 30, shareholders will vote on the sole resolution, namely for the distribution of shares in Ballard and the reduction of shares in the company by an equal amount.

Delta Lithium (ASX:DLI) had made the decision to divest the 1.1Moz Mt Ida gold project in WA’s Eastern Goldfields into the new company to split the commodities and investor proposition

Incoming Ballard Mining managing director Paul Brennan told Stockhead’s Barry Fitzgerald in a podcast interview that the current resource provided the platform for Delta to spin the gold asset out into its own entity and seek the funds to develop the project going forward.

This would also mean that funds raised by Delta for lithium exploration would be used for that purpose while Ballard’s capital will be used to progress Mt Ida.

Funded for growth

In its initial public offering Ballard Mining will seek to raise between $25m and $30m through the issue of 80-100 million shares priced at 25c each.

Additionally, Delta shareholders will receive one fully paid Ballard share for every 11.25 Delta shares they own as part of the spin-out while Delta itself will hold between 46% and 49% of the new company depending on the take-up of the IPO.

This will result in a market capitalisation of between $80m and $85m on listing.

Proceeds from the IPO will be used primarily to fund exploration, extensional and infill drilling at Mt Ida along with mining, metallurgical, geotechnical and water studies.

Listen: Paul Brennan chats with Barry FitzGerald

In a recent instalment of the Explorers Podcast, host Barry FitzGerald spoke with incoming Ballard Mining managing director Paul Brennan about the company’s plans in WA’s Eastern Goldfields, ahead of its planned debut on the ASX.

A golden prize

Mt Ida sits within the heart of the WA Goldfields region with four processing plants located within 100km.

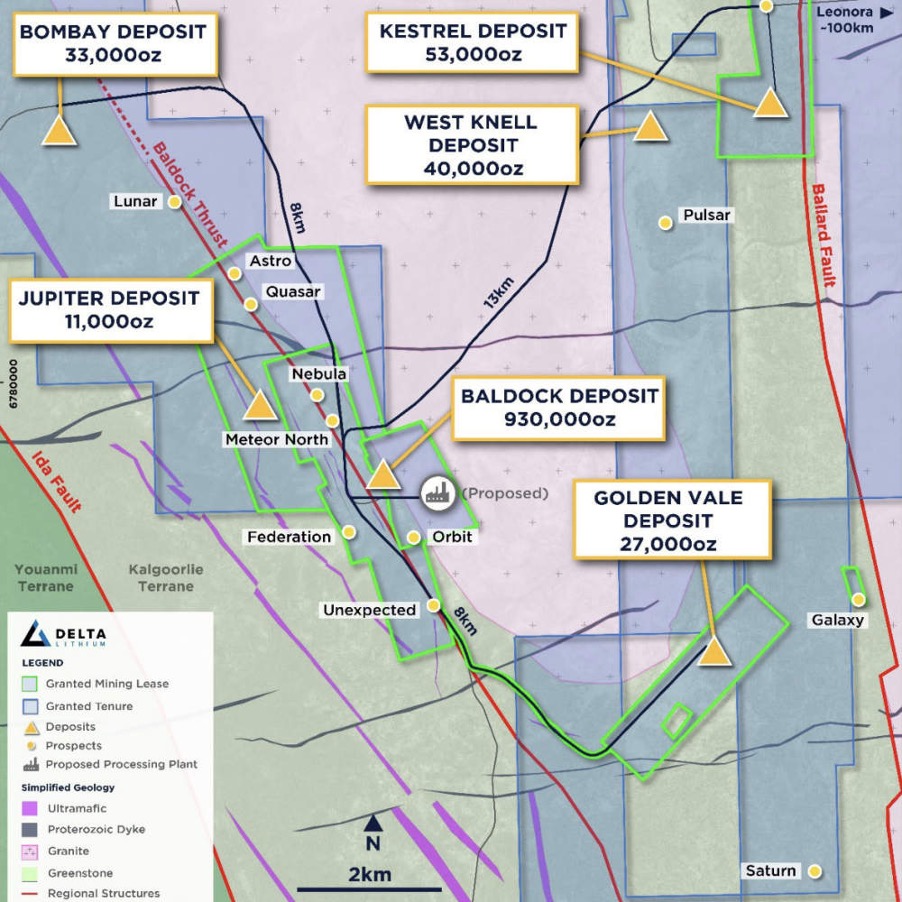

It is a real prize with an inferred and indicated resource of 10.3Mt grading 3.33g/t, or 1.1Moz of contained gold in six deposits following a recent resource upgrade.

That’s just past the million ounce mark that’s generally seen as the point where potential project lenders pay close attention.

The project is fully permitted for mining with applications progressing for a 1.5Mtpa process plant and associated tailings facility.

Ore at Mt Ida is free milling and non-refractory, making it amendable to conventional carbon-in-leach processing. Initial metallurgical testwork has already delivered 24-hour leach recoveries above 90%.

There is also camp-scale potential for exploration with some 26km of highly prospective underexplored shear zones and potential to expand resources in the six known deposits.

A planned 80,000m infill and extensional drill program is on the cards to underpin a feasibility study and ore reserve estimate at the main Baldock deposit, which is expected to take about 12 months.

Infill drilling will recover samples to support definitive feasibility study-level test work.

Plans are also in place for some 50,000m of exploration drilling to test the 26km of continuous greenstone belt folded around the Copperfield Granit where orogenic, shear-hosted gold lodes have been observed.

Of these, 35,000m will test the 13km Baldock Thrust while another 15,000m will be carried out on the Ballard Fault.

A high-resolution drone magnetic survey is planned for July 2025 across the entire prospective strike to improve its structural understanding, which is in turn key to finding another Baldock.

“The Ballard strategy will be to continue de-risking that baseload feed at Baldock, as well as continue to explore along the prospective shear zones in the area that have largely remained untouched in the last 20 years,” Brennan noted.

This article was developed in collaboration with Delta Lithium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.