Delta Lithium grows Yinnetharra footprint on acquiring adjacent project

There’s more ground to cover at Delta Lithium’s Yinnetharra project. Pic: Getty Images

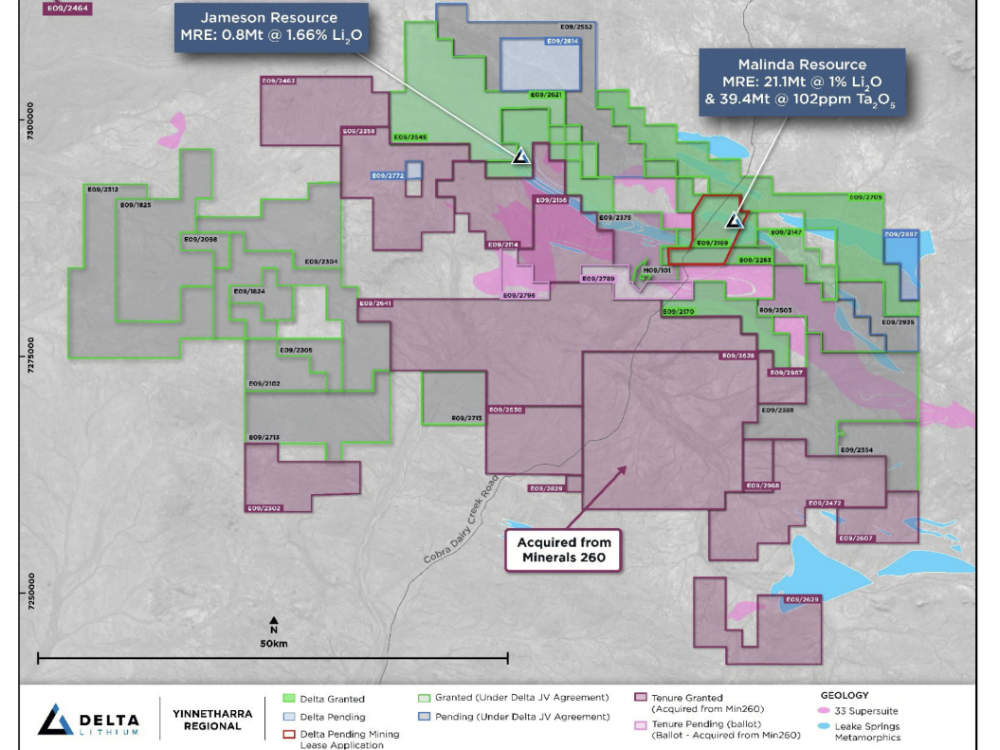

- Delta Lithium expands Yinnetharra lithium and tantalum project with acquisition of 1750km2 Aston project

- Yinnetharra now covers 3100km2 with an additional 10km strike of the key Leake Springs Metamorphic unit

- Company will start systematic geochemical sampling and mapping over priority areas as well as geophysical surveys

Special Report: Delta Lithium has expanded the footprint of its Yinnetharra lithium and tantalum project in Western Australia by acquiring Minerals 260’s adjacent Aston project.

Aston comprises 15 granted exploration licences covering 1750km2 of highly prospective yet underexplored tenure that is 2km along strike from the high-grade Jameson resource of 800,000t grading 1.66% Li2O within the same host rocks.

This gives Delta Lithium (ASX:DLI) a dominant 3100km2 landholding in the Upper Gascoyne lithium province and grants a strong opportunity to undertake regional exploration immediately along strike of its existing deposits.

It also includes an additional ~10km of strike of the Leake Springs Metamorphic unit which hosts all lithium and tantalum resources at Yinnetharra along with many other highly prospective mafic units.

The acquisition from Minerals 260 (ASX:MI6) follows the company’s recent resource update of 21.1Mt @1.0% Li2O & 39.4Mt @ 102ppm Ta2O5, which included upgrading indicated resources at Yinnetharra by 140% to 16.1Mt at 1% Li2O. This makes up 74% of the overall resource of 21.9Mt at 1% Li2O and 75ppm tantalum.

Yinnetharra also hosts an additional tantalum resource of 17.5Mt at 136ppm tantalum that is exclusive of the lithium-hosted mineralisation within the same pit shells.

Strategic addition

Managing director James Croser said the tenure was an “excellent strategic addition” to the company’s Yinnetharra project and a significant bolt-on to the recent Mortimer Hills acquisition.

“Delta has strengthened our dominant position in this highly prospective Upper Gascoyne region,” he added.

“Delta’s technical team will have access to over 1,700km2 of new ground and the systems our team have developed over the last two years operating in this terrane positions us perfectly to now execute systematic exploration across this new prospective ground.

“The extra tenure provides immediate exploration targets with early stage LCT anomalies, which will be critical as we continue to advance mining studies towards feasibility with the aim of delineating reserve tonnes.

“Delta’s dominant position surrounding the Thirty-Three supersuite granites, which are thought to be the source for the Malinda and Jameson deposits, has been enhanced.”

Once the acquisition is settled, Delta will start systematic geochemical sampling and mapping over priority areas as well as geophysical surveys.

Additionally, planning is underway for passive seismic surveys interpreted to target deep water paleochannels with a hydrogeological program. This is due to start in 2025.

This article was developed in collaboration with Delta Lithium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.