Delecta gets the wheels turning with Utah gold acquisition

Pic: John W Banagan / Stone via Getty Images

Special Report: Delecta has announced it will enter the gold game in the US, picking up the highly prospective Speedway gold project in Tooele County, Utah.

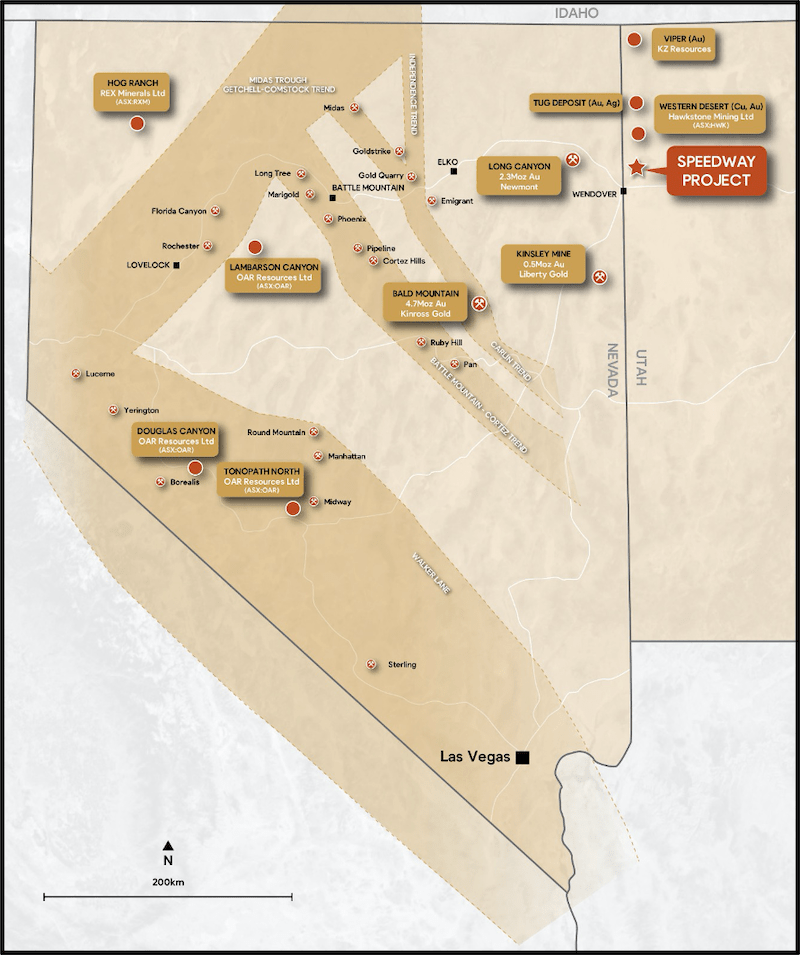

The Malcolm Day-led company announced the acquisition to the market this morning following a period of due diligence over Speedway, which sits 40km southeast of the 2.1-million-ounce Long Canyon gold mine owned by Newmont Corporation and 16km from the town of Wendover.

Delecta’s (ASX:DLC) new project is considered highly prospective for Carlin-style gold – the type found at Long Canyon named after the gold deposits of the famed Carlin Trend.

While Long Canyon is not on the Carlin Trend, it sits in the shelf carbonate sequence which extends to the east of the trend and into Utah – a factor which raised awareness of the gold potential in western Utah and one which helped to put Speedway on Delecta’s radar.

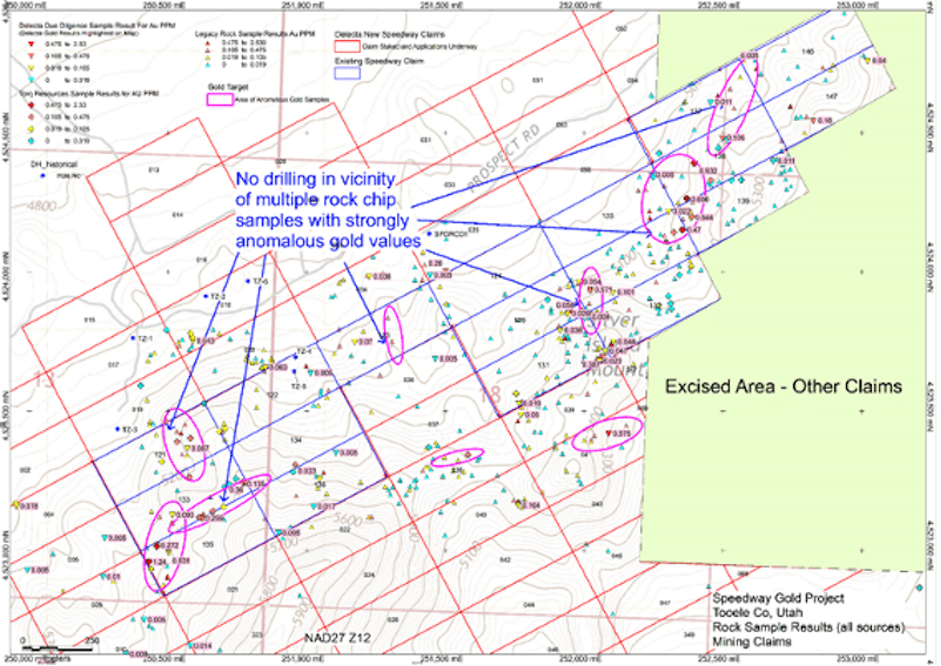

Due diligence sampling at Speedway confirmed the existence of multiple mineralised outcrops showing strongly anomalous gold values associated with brecciated and altered limestone rocks.

The acquisition includes a historical database of over 800 historic rock chip samples with limited follow-up testing of identified gold anomalies.

The samples are taken over 2.5km of strike, with most historic exploration work predating the discovery of Long Canyon.

Delecta said this factor could have meant the full significance of limestone breccias carrying gold mineralisation was not understood at the time of testing.

According to Day, the project presents as an entry point to one of the world’s top-shelf gold regions.

“We are delighted to have secured the Speedway Gold Project, a highly prospective land package which provides the Company with the opportunity to make a significant gold discovery,” he said.

“The acquisition ticks all of our boxes from an acquisition criteria perspective, representing the culmination of a significant period of due diligence by the Company and its consultants to identify and acquire a gold project in a tier-1 location that has significant upside exploration potential.

“This transaction delivers compelling benefits to our shareholders; a low entry cost gold project with exploration upside that has the potential to meet our strategic goals of identifying a multi-million-ounce gold deposit.

“With an exploration program imminent to identify first-pass drilling targets, we are excited by the opportunity to explore for our own elephant size gold deposit in what is undoubtably in the handful of top gold producing gold regions globally.”

Exploration work including mapping and significant soil sampling is expected to begin shortly with the aim of developing drill targets to be tested in the second quarter of 2021.

Highly prospective ground

Rock chip work carried out during the due diligence program at Speedway resulted in 59 samples, the highlight of which was SPRK134.

That sample returned 1.24 grams per tonne gold, with brecciated limestone that’s silicified and has a pinkish hematite alteration. The sample sits adjacent to a legacy Torq Resources sample which assayed 0.982g/t gold.

Despite an extensive database of rock chip sampling by the past owners, which include BHP, Atlas Gold and Torq, Delecta said limited systematic follow up work was carried out when gold was detected.

“Historic drilling appears to have been controlled by geophysical survey outcomes rather than geochemical sampling results,” the company said in its release to market.

“Accordingly, Delecta plans to focus on untested gold geochemical anomalies and to extend sampling and mapping in key target areas.”

Terms of the deal

Delecta has secured Speedway on a 15-year lease agreement to explore and develop the project under a staged payment plan.

The company will acquire an interest in the project for a fee of $US55,000 on signing, followed by a $US50,000 payment at the second anniversary of the deal and a $US75,000 payment at the third anniversary. Payments increase until the fifth anniversary where the payment is US$150,000 and similarly thereafter.

The Company may exercise the option at any time during the term of the agreement. The purchase price payable on exercise of the option is US$3,000,000, with a credit for amounts previously paid to the Owner, including, but not limited to the minimum payments set out above and any royalty payments already made to the Owner.

The deal also includes a finder’s fee to a Nevada-based project generator, which includes an upfront payment of $US20,000, a 2 per cent expenditure fee and a 0.5 per cent net smelter royalty which can be purchased within the first four years of the initial deal for $US2 million.

Delecta also retains a right to terminate the agreement after two years without any additional fees payable.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.