Delecta acquires historic, copper project in Utah

Pic: Schroptschop / E+ via Getty Images

Special Report: Delecta has just made a company changing acquisition in the US state of Utah. This historic copper project shares a similar geological setting to the nearby Lisbon Valley mine, which produces 20 to 30 million pounds of copper every year.

Delecta (ASX:DLC) has struck a deal to acquire the Copper Ridge project, covering four historical copper mines and prospects over 9km of strike.

At the northern end and lying just outside the claim block is the Hoosier mine, which previously produced about 100,000 ounces of silver and, more importantly, an unspecified tonnage of ore grading 8 per cent copper. That’s high grade.

Included in the claims is the historic copper mining operation, the Cobalt #1 mine, which produced copper, silver and cobalt in the 1950s as well as 2 other small mines and numerous prospects.

Delecta will buy American Vanadium, which owns the Copper Ridge project, for 100 million shares upfront and another 100 million shares on defining a resource of at least 15,000t of copper equivalent.

The company will also issue another 100 million shares on completion of a scoping study demonstrating an internal rate of return (IRR) of at least 20 per cent along, with granting American Vanadium shareholder Coral Brook a 3 per cent net smelter royalty.

IRR is one of the measures used to estimate potential profitability of a project – the higher above zero it is, the more profitable the project.

Copper Ridge: a new Lisbon Valley?

Copper Ridge is about 95km — within trucking distance — of the Lisbon Valley mine, which produces between 20 million and 30 million pounds of copper per annum. Importantly for Delecta, it has spare processing capacity which could lead to a potential toll treating arrangement for any ore produced at Copper Ridge. Toll treating represents a fast, cost effective path to production for Delecta.

Both Lisbon Valley and Copper Ridge are located on what is potentially the same mineralised ‘structure’ and share a similar geology and mineralisation style.

Besides the historic mining operations, there’s plenty of upside at the project.

In 2014, Rock chip sampling by a previous explorer returned a top hit of 10.6 per cent copper and identified the Mealey, Xaz and Harrison prospects for follow up drilling.

Further exploration between the prospects identified 83 sites with visible copper averaging 0.76 per cent copper and a maximum result of 17 per cent copper.

Shallow drilling also confirmed the presence of copper mineralisation with a best assay of 3.66m at 0.56 per cent copper with 10 holes ending in mineralisation.

Delecta said mineralisation at Copper Ridge has potential to occur at depths greater than tested by previous drilling, which did not exceed 12m depth. At Mealey all 3 holes ended in mineralisation.

In addition, recent sampling identified the presence of significant levels of cobalt which could increase the economic potential of the project.

Delecta plans to kick off exploration with geological mapping, a photogeological interpretation and a soil sampling program to gain a better understanding of the mineralisation and its controls. This will aid in drill targeting.

Geophysics will be assessed as a potential method to identify buried copper sulphides occurring below the base of oxidation while drilling will be undertaken on targets identified by these programs.

Uranium-vanadium project upside

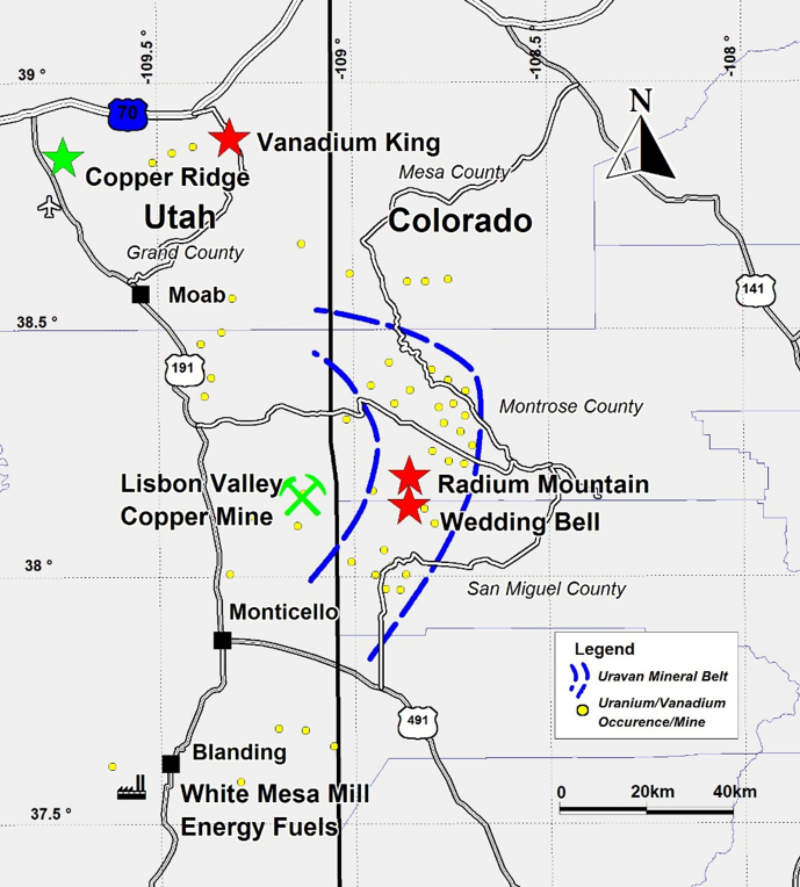

Vendor American Vanadium also owns the Vanadium King project in Grand County, Utah, and the Radium Mountain and Wedding Bell Projects in Colorado.

All three projects are within the Colorado Plateau, which hosts the vanadium-uranium rich Uravan Mineral Belt. This belt and adjacent areas have a total reported production from 1947 to 1979 of more than 34.7 million kg of uranium and 187.4 million kg of vanadium oxide.

Previous exploration at Vanadium King encountered widespread low to intermediate grade uranium mineralisation.

Delecta plans to drill nine holes to test for the presence of the reported mineralisation. This will define stratigraphy and location of the mineralised horizon, which will allow the company to plan a Phase 2 resource drill program.

Meanwhile, the contiguous Radium Mountain and Wedding Bell Projects lie in the Uravan Mineral Belt and share the same geology and style of mineralisation. Both areas contain a number of historical mines that were subject to varying levels of exploration and development.

The company plans to carry out geological mapping to identify mineralised zones and allow correlation with the available historical data while any accessible underground workings will be mapped and sampled.

This is aimed at identifying drill targets that could host economic mineralisation.

Capital Raising

Delecta plans to carry out a placement of shares priced at 2 cents each to retail and sophisticated investors that will raise between $2.5 million and $3 million to fund the acquisition and planned work programs.

This includes work on its existing Highline cobalt-copper project in Nevada’s Goodsprings region, which has a history of high-grade mineral production.

As part of the acquisition, the company will also undertake a consolidation of its shares on a ‘two for five’ basis and will seek shareholder approval at a general meeting to approve the acquisition.

Board Appointments

Delecta is also appointing Bryan Hughes as its chairman and Greg Smith as its technical director.

Hughes is the chairman of Pitcher Partners Perth Accountants, Auditors and Advisors and specialises in corporate advisory, turnaround and reconstruction. He has many years’ experience working closely with, and consulting to, various corporate stakeholders on a wide range of matters.

Smith was previously the managing director of Elemental Minerals and Lindian Resources. He started his career in 1975 and has worked over a wide cross section of minerals and in a number of countries including Australia, Canada and Africa.

This story was developed in collaboration with Delecta, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.