Debt-free gold miner Kingsrose is due for a re-rating after past troubles

Pic: Tyler Stableford / Stone via Getty Images

Few small resources companies survive a near-death experience in the way Kingsrose Mining has.

This is the first clue to what’s shaping up as a significant recovery by a company best seen today as an exploration story, and less as a miner.

High-grade gold lies at the heart, and is the reason for the survival of Kingsrose (ASX:KRM).

It’s a stock that blossomed seven years ago but failed to fully understand the risks associated with working in a tropical environment like the southern tip of the Indonesian island of Sumatra, where its mines are located.

Heavy rainfall, a feature of that part of the world, has to go somewhere — and a hole in the ground such as a mine is a perfect place. That is what happened when the Talang Santo mine flooded, leading to its closure six months ago.

Losing Talang Santo coincided with another problem dogging Kingsrose: high debt levels.

When combined with the flooding the only solution was a period in voluntary administration so repairs could be made to the mine and the balance sheet.

Debt-free and ready to go

The corporate overhaul is now complete.

Kingsrose achieved debt-free status at the end of last year after a restructuring process that saw one major creditor take a haircut on what it was owed, with a payment of $2.25 million satisfying a debt of $4.4 million.

At the site, the Talang Santo mine is not yet back in production but another mine called Way Linggo has made a comeback.

It was largely responsible for Kingsrose posting a modest profit of $3.16 million in the December half, a result which compares with a loss of $13.13 million in the previous corresponding period.

Way Linggo is not a long-term solution to the challenge ahead. That lies initially with Talang Santo, a mine based on rich epithermal (volcanic) veins which yield gold at a grade of around 12 grams to the tonne, enabling even a small operation to produce gold at a cash cost of less than $US700 an ounce.

The next 12 months will be especially important for Kingsrose as it focuses on three issues:

1. Maximising gold production at Way Linggo which has been turned into an open pit to remove remnant ore such as support pillars left during the mine’s underground phase.

2. Finalising a feasibility study into developing an open pit mine at Talang Santo which will permit a return to a rich system of gold veins.

3. Stepping up exploration across the 100 square kilometres of tenement which ranks as some of the most prospective ground in a region known for rich gold deposits associated with a major geological fault running along the west coast of Sumatra.

It’s the combination of cash flow from residual mining operations, the prospect of a return to a rich but flooded mine, and the potential for fresh discoveries which ensure ongoing investor interest in Kingsrose.

Because while it has gold in the ground it doesn’t yet have the skills to get it out in a way which is consistently profitable.

> Bookmark this link for small cap breaking news

> Discuss small cap news in our Facebook group

> Follow us on Facebook or Twitter

> Subscribe to our daily newsletter

Lessons from the early years

In hindsight, Kingsrose was always going to have problems because so much of what it did in the early years was based on keeping costs down and starting gold extraction as quickly as possible.

That approach led immediately to problems in the processing plant, which had to have equipment retro-fitted to handle ore that proved to be more difficult than expected.

The style of mining was also unusual for a modern Australian gold miner: narrow stopes (tunnels) using equipment which to a modern miner looked like it came from a museum of miniature mining equipment.

The theory of keeping everything simple and small seemed valid for a while, but failed to withstand the challenges thrown up by the orebody, in the processing plant, and the heavy rainfall which feed the high-pressure aquifers in the region.

A new lease on life

Today, Kingsrose is effectively a company which has been given a chance to start over.

It has a small pot of cash in the bank ($9.65 million at December 31), one goldmine yielding remnant ore, another in a re-design process, and a number of highly attractive exploration targets.

Investor interest in the re-invention of Kingsrose has been limited so far.

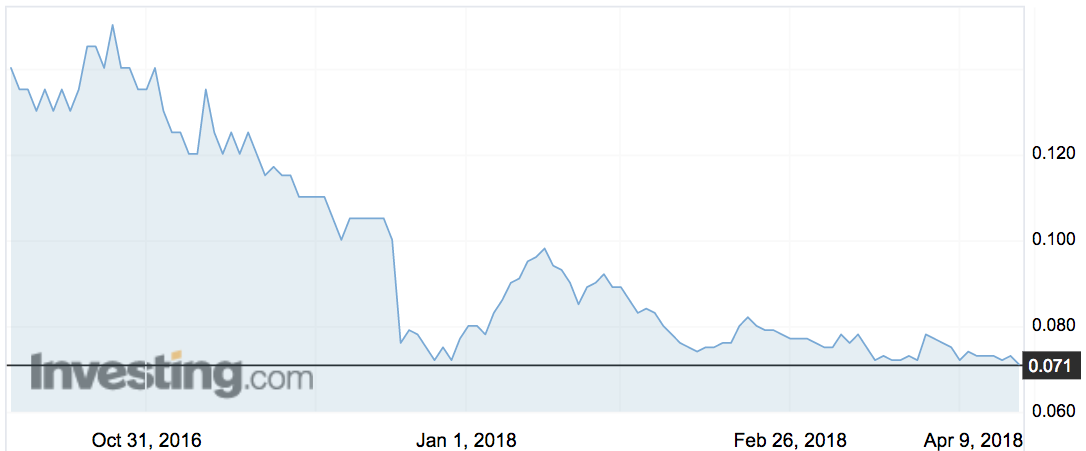

The stock has been trading at around 7.4c which capitalises the business at $52 million, a value which largely reflects the potential for a re-start at Talang Santo and exploration success.

If management has learned from past mistakes, Kingsrose could enjoy a substantial re-rating as cash builds, mine plans unfold, and drilling re-starts on exploration targets.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.