De Grey speedily raises more than $500m for +500koz a year Hemi gold mine

The quickly raised equity is to be followed by debt-financing to develop the monster Hemi gold mine. Pic via Getty Images.

- $514m raised at $1.10/sh via placement and institutional entitlement offer to build Hemi, a future top-five Australian gold mine

- $85.6m worth of shares also on offer to retail shareholders from May 15

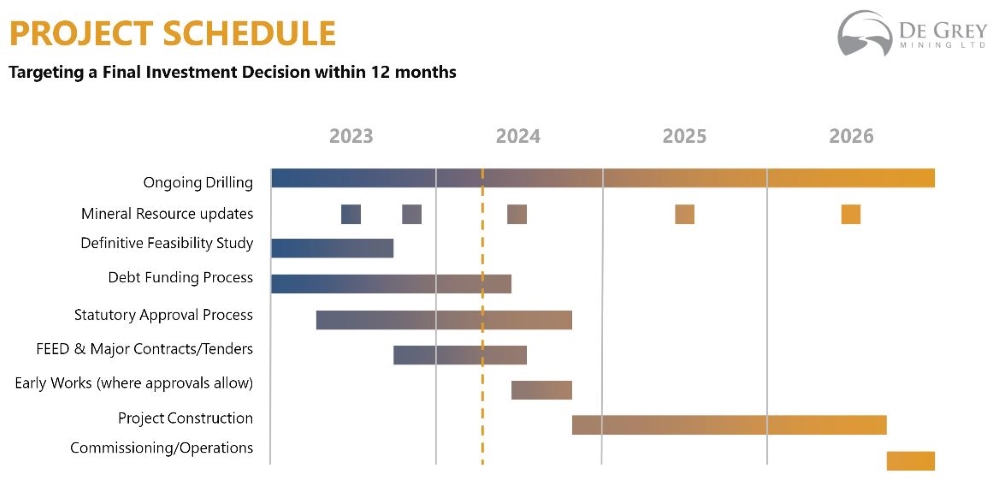

- DEG aiming for debt financing component of +$1bn to be finalised H2 2024

- Major shareholder Gold Road opened its wallet to take part in the raising

Special Report: WA gold star De Grey Mining rattled the tin for $600m earlier this week and has already raised $514m worth of shares from institutional investors and major shareholders.

The equity raise is a key milestone towards debt funding development of its giant +10Moz Hemi gold deposit, with the remaining $85.6m to be offered to retail investors.

Gold Road Resources (ASX:GOR), the largest shareholder in De Grey Mining’s (ASX:DEG), confirmed its participation in the equity raise to the tune of ~$50.9m.

The underwritten $600m raise will increase De Grey’s cash balance to $919m which the Company says is more than sufficient to fund the equity part of the mine development.

The remainder will come from debt financing, whereby money is provided by external lenders, like banks. The equity capital injection has now de risked the future debt component, which often requires equity funding as a prerequisite.

Approved term sheets from debt financiers remains on schedule for mid-2024, the company says.

A future star gold producer

A definitive feasibility (DFS) envisaged a 530,000ozpa operation at Hemi over an initial 10 years, already making it one of Australia’s top-five gold producers.

The DFS also showed great economics, with an AISC of $1,295/oz on an assumed gold price of $2,700oz for post-tax cashflow of $4.5bn.

That $4.5bn is highly likely to increase (as is its post-tax IRR of 36%) – as the spot gold price is currently ~$800 higher at $3,516/oz.

Equity raise popular with small discount

The placement came in at fixed price of $1.10 per share, representing a 13% discount to the last closing price of $1.265 per share and a 10.4% discount to the TERP – the assumed price the stock will have following the rights issue.

The retail offer will open on May 15 with up to $85.6m (at the same price of the institutional offer) available for eligible retail shareholders to increase their investment in WA’s next massive gold operation.

“The underwritten equity raising represents a landmark milestone and a key de-risking event for De Grey and underpins our ongoing project debt financing workstreams which are progressing well,” DEG managing director Glenn Jardine says.

“The significant level of support received from key stakeholders to date provides strong validation of the high-quality nature of Hemi and our strategy of becoming a material Australian gold producer.”

De Grey will use its strengthened balance sheet to continue to progress development activities and strategic objectives towards final project approvals.

Use of funds and exploration activities

Project execution workstreams are continuing and funds will be applied to ordering long lead items, key contractor appointments and advancing engineering and design activities.

They will also go toward initial infrastructure costs and further ongoing exploration and studies.

The company says brownfield exploration continues to provide very strong results with potential for significant resource conversion, including at its newly acquired 1.44Moz Ashburton gold project.

Studies on potential additional production from the Hemi underground and regional deposits are progressing and greenfield exploration across greater Hemi and regional areas, including the Egina JV, is underway.

This article was developed in collaboration with De Grey Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.