De Grey puts its foot on the 1.44Moz Ashburton project in the Pilbara

Special Report: Major gold mine developer De Grey has signed an exclusive option agreement to potentially acquire the 1.44Moz Ashburton gold project, a move which could ultimately increase the production rate and mine life of its Hemi gold project.

De Grey’s (ASX:DEG) Hemi project is already world class, with a September DFS – the most advanced of all project studies – showing the development of the project which will deliver 530,000ozpa and more than $4 billion of free cash flow over its first decade of life.

As it progresses with pre-development activities and final approvals for the project, De Grey is also looking at ways to improve these metrics, both from its own asset base and business development.

Studies are being undertaken on the potential to build a regional concentrator to exploit part of the 2.2Moz Regional Resource outside its main Hemi deposit. The concept will examine producing the concentrate to further process at the Hemi pressure oxidation (POx) circuit, a similar strategy De Grey will now assess for Ashburton over the 12 – 18 month option period.

“The proposed 10Mtpa gold plant at Hemi, including a 0.8Mtpa POx circuit, will be a regionally strategic asset that provides the company with the potential to treat gold ore and concentrates from other regional gold projects,” DEG managing director Glenn Jardine says.

“This leverage has the potential to increase Hemi’s annual gold production rate, economic returns and project life.

“The company’s current scoping study into its 2.2Moz Hemi regional resource is also consistent with this strategy.”

Ashburton: one of the largest unmined gold resources in the Pilbara

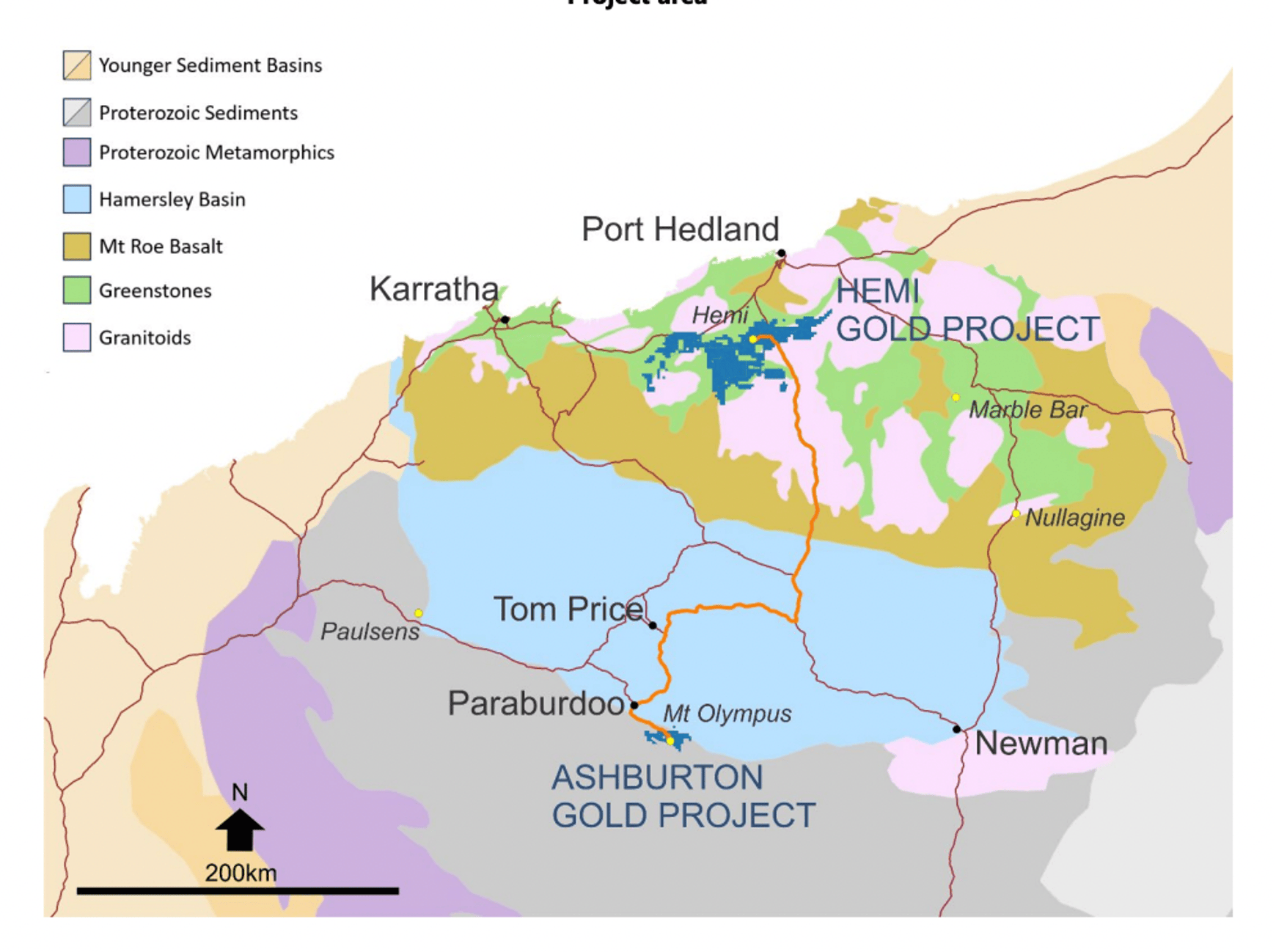

As part of this strategy, DEG has signed an option agreement which gives it the exclusive right to conduct due diligence on, and potentially acquire, Kalamazoo Resources’ (ASX:KZR) 1.44Moz Ashburton project, located ~290km from Hemi.

The option includes an initial option fee of $3m; a minimum $1m on exploration, test work and studies; and potentially another $30m if De Grey elects to acquire the project.

The Company has established business development and studies teams to complete the work on Ashburton which are separate to the Hemi Project development team.

DEG says initial due diligence indicates the potential to economically deliver concentrate at some future time from Ashburton to the proposed Hemi POx plant with a view to potentially increase Hemi’s annual gold production rate and/or to extend Hemi’s operational life.

At a potential overall acquisition cost of under $25/oz gold, Ashburton represents an attractive opportunity for DEG in consolidating regional opportunities surrounding Hemi.

“Ashburton’s 1.44-million-ounce resource is one of the largest unmined gold resources in the Pilbara outside of Hemi,” Jardine says.

“It has previous mining history, an extensive drilling database and development concept studies which indicate it may be complementary with our development strategy for Hemi.”

Perth stockbroker Argonaut described the option as “sensible” and noted the potential acquisition cost of $25/oz of Mineral Resource “represents one of the lowest $/0z transactions in the last 10 years”.

This article was developed in collaboration with De Grey, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.