De Grey Mining locks in guaranteed $22m cash top-up

Unlocking options Pic: Getty Images

Special Report: Well respected broker Bell Potter Securities has shown its confidence in De Grey Mining by agreeing to underwrite a $22m capital raising.

The gold explorer (ASX:DEG) has received commitments for a $3m placement and Bell Potter is fully underwriting a $19.1m entitlement offer.

“The ability to attract a broker of the quality of Bell Potter to the capital raising is testimony to the quality of the tenement package that De Grey will own 100 per cent following the acquisition of Indee Gold,” executive chairman Simon Lill said.

“We view Bell Potter’s interest in the company and the introduction of a new group of shareholders as transformational.”

De Grey announced in early February 2017 that it had picked up an option to acquire Indee Gold for $15m in cash and shares.

>> Learn more about De Grey Mining

Lil said De Grey had structured and priced the capital raising to encourage all shareholders to support it, while at the same time ensuring completion of the required capital raising via the fully underwritten backing of Bell Potter.

The placement and entitlement offer are both being done at 5c per share.

Existing substantial shareholder DGO Gold (ASX:DGO), which currently has a 5.9 per cent stake, have separately announced today that they will be subscribing for 6 million shares in the placement at 5c per share, are committed to taking up its full entitlement in the new issue being approximately 24 million shares at 5c per share, as well agreeing to sub-underwrite the De Grey entitlements issue to the extent of a further 70m shares at 5c per share.

This represents a further investment of up to $5M in DEG (if there is a 100% shortfall in the rights issue), which is a vote of confidence in DEG and quality of the project.

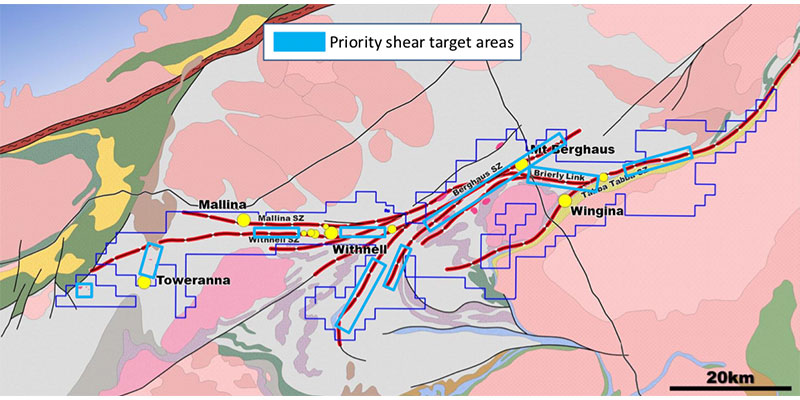

DGO executive chairman Eduard Eshuys said the company first invested in De Grey in July 2018 to gain exposure to its highly prospective province-scale gold exploration land position in the Pilbara region of Western Australia.

“De Grey’s drilling results from that date have exceeded DGO’s expectations and resulted in the recently announced increase in resources from 1.2m ounces at the time of DGO’s initial investment to 1.7m ounces, now for a finding cost of approximately $20 per ounce,” he said.

“DGO looks forward to playing a more active role in the next phase of De Grey’s resource discovery strategy as the company seeks to grow its resource base to a corporate target of >3 million ounces,” Eshuys said.

On completion of the placement, two DGO directors – Eshuys and Bruce Parncutt – will join De Grey’s board.

Earlier this week De Grey revealed a 21 per cent resource boost, most of which came from recent drilling at the Toweranna deposit. Every deposit at the Pilbara gold project remains open.

A presentation released today shows that funds from the capital raising will be used on:

- Extension drilling to expand resources;

- Drilling across unexplored shear zone targets – “looking for potential big new discoveries of 2M – 5M ounces” and

- Seven Toweranna intrusion hosted “look alike” targets.

Availability of funding would now appear to indicate De Grey can achieve its short term target of +2M ounces by end 2019, and medium term target of +3M ounces.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebookor Twitter

This story was developed in collaboration with De Grey Mining, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.