De Grey is rapidly closing in on its 2-million-ounce gold target in the Pilbara

Pic: Schroptschop / E+ via Getty Images

Special Report: De Grey Mining is definitely proving it is more than capable of hitting its 2-million-ounce target at the Pilbara gold project by the end of 2019.

And investors are confident too, with shares rallying 10.5 per cent to an intraday high of 8.4c.

De Grey (ASX:DEG) is already not far off that with a 1.4-million-ounce inventory.

And its Toweranna prospect at the Pilbara Gold Project just keeps giving up the gold, prompting De Grey to start high-impact resource extension drilling.

De Grey is now well-advanced with its 5000m drilling program, which is due to be completed this month, and the first results are expected to be imminent.

The company says Toweranna has shown “significant potential” to extend the resources – particularly with recent high-grade hits like 7m at 4.02 grams per tonne (g/t), including 1m at 22g/t, from 8m, and 10.4m at 4.93g/t from 8m, including 3.25m at 12.51g/t from 11m.

Anything over 5g/t is considered high-grade and the gold is located close to surface, making the economics much more attractive.

“We think there is huge potential to grow Toweranna as part of our short-term pursuit of growing the PGP resource up to 2 million ounces and beyond,” technical director Andy Beckwith told Stockhead.

“Toweranna is growing in stature with every drill hole and the shallow resource potential to 200-250m depth provides the opportunity to underpin a substantial step-change in the future open pit dimensions and economics.

“This new style of mineralisation in the region demands attention with high priority resource extension drilling underway.”

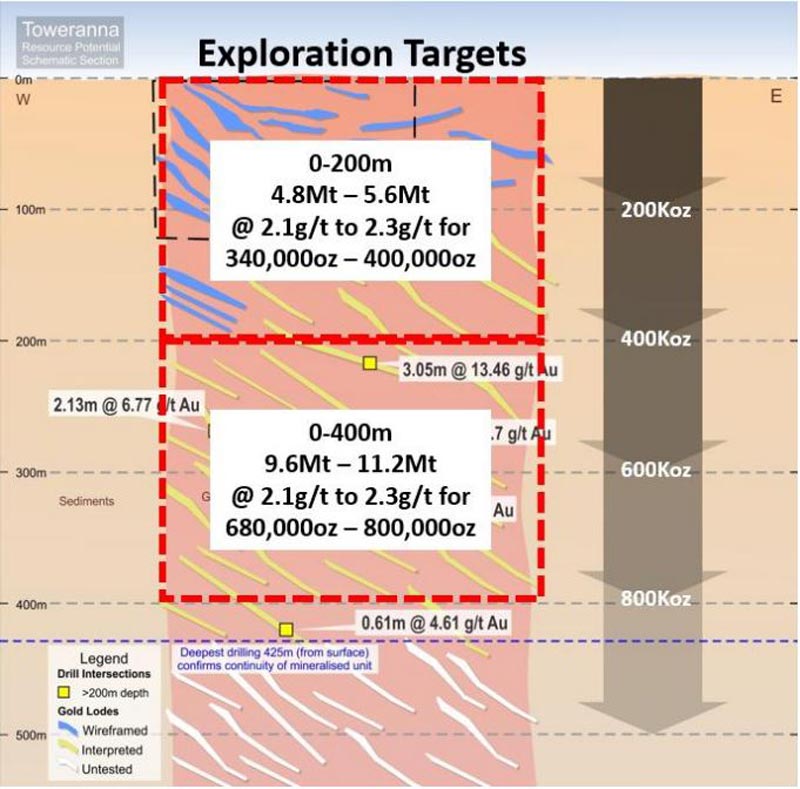

This has led De Grey to outline a total exploration target for Toweranna of 9.6 million tonnes to 11.2 million tonnes at 2.1g/t to 2.3g/t for 680,000 ounces to 800,000 ounces of contained gold.

That includes the existing resource of 2.01 million tonnes at 2.2g/t for 143,900 ounces of contained gold.

The exploration target is at this stage focused only on the top 400m of the deposit.

Undervalued

Financing and marketing specialist Red Cloud Klondike Strike backs the view that there is “room to grow, a lot”.

“In our view, De Grey is one of the few development companies with a path to produce plus 100koz/year, have exceptional exploration upside in +200km of shear zones and trading at a steep discount to its peer group,” Red Cloud said.

Red Cloud believes that the Pilbara gold project is of a scale and has the exploration upside that makes De Grey an “attractive target for mid-tier producers.”

De Grey is currently trading at 7.8c, giving it a market value of about $33m.

But Red Cloud thinks the junior explorer is worth more like 30c per share, which would lift its market value to about $127m.

So much more gold to give

Recent assessment shows the Toweranna deposit is under drilled with potential to extend both the shallow resources to the east within the granite body and also substantially increase resources at depth.

De Grey says gold mineralisation clearly extends beyond 100m deep and has been shown to occur to at least 420m deep in limited historic drilling.

The current resource indicates an average of about 1400 ounces per vertical metre occur in the first 100m.

This latest drilling program is expected to increase resources in the eastern shallow portions (<100m) of the deposit, which in turn is likely to further increase the ounces per vertical metre.

Any increase in ounces per vertical metre is expected to improve the final open pit design and economics.

With a massive 2-million-ounce gold resource targeted by the end of the year, De Grey has already increased its Pilbara gold project development study from 1 million tonnes per annum (Mtpa) to 2Mtpa.

This could boost De Grey’s vision of annual gold production from 65,000 ounces to beyond 100,000 ounces.

Red Cloud believes De Grey will be one of those very profitable gold producers when it does come into production.

“We believe that with a planned throughput of 2Mtpa (~5500tpd) De Grey would produce 143koz per year at cash costs of $US621/oz for initial capex of US$98m,” Red Cloud said.

Red Cloud’s estimates assumes production will start in 2022 and includes production from multiple deposits — with 59 per cent from open pits and 41 per cent from underground.

This story was developed in collaboration with De Grey Mining, a Stockhead advertiser at the time of publishing.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice. If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.