De Grey about to lock in debt funding for world class Hemi gold project

Funding requirements have been committed to for Hemi. Pic: Getty Images.

- Credit approved terms secured for $1bn in debt funding from domestic and international finance institutions for development of Hemi

- An additional $130m cost overrun facility also included

- Debt funding will complete financing for a future top-5 Australian gold mine

Special Report: De Grey Mining has received credit approved terms for $1.13 billion in debt facilities from commercial banks to round out financing the development of its +10Moz Hemi gold deposit.

It includes a $1bn senior debt facility and additional $130m cost overrun facility and will bankroll the Hemi project’s construction once finalised along with De Grey Mining’s (ASX:DEG) existing cash balance of +$850m.

On top of this, government credit agencies – the Northern Australia Infrastructure Facility and Export Finance Australia – are in the final stages of considering their participation in the lending syndicate.

“We have reached another significant corporate milestone as we move closer to the commencement of construction of Hemi,” DEG CFO Peter Canterbury says.

“We look forward to moving ahead with our lender group and finalising documentation over the coming months to achieve the targeted $1bn senior debt facility in the second half of 2024.

“Combined with our existing cash reserves exceeding $850m following our recent $600m equity raising, the proposed debt package is expected to fully finance the development of Hemi and brings us closer to a final investment decision once we receive environmental approvals for commencement of project construction.”

The funding marks a key milestone for De Grey, which is looking to bring arguably the best Australian gold discovery this century to fruition, with orders of long lead items continuing.

Development will kick off following a final investment decision that is now only hinging on the required environmental approvals.

Latest developments

A definitive feasibility study for Hemi last year suggested the mine will produce 530,000oz of gold a year over its first decade, though that only includes initial open pit resources whilst DEG is still exploring in and around the existing resource.

Once constructed and ramped up, it will comfortably rank within Australia’s five largest gold mines.

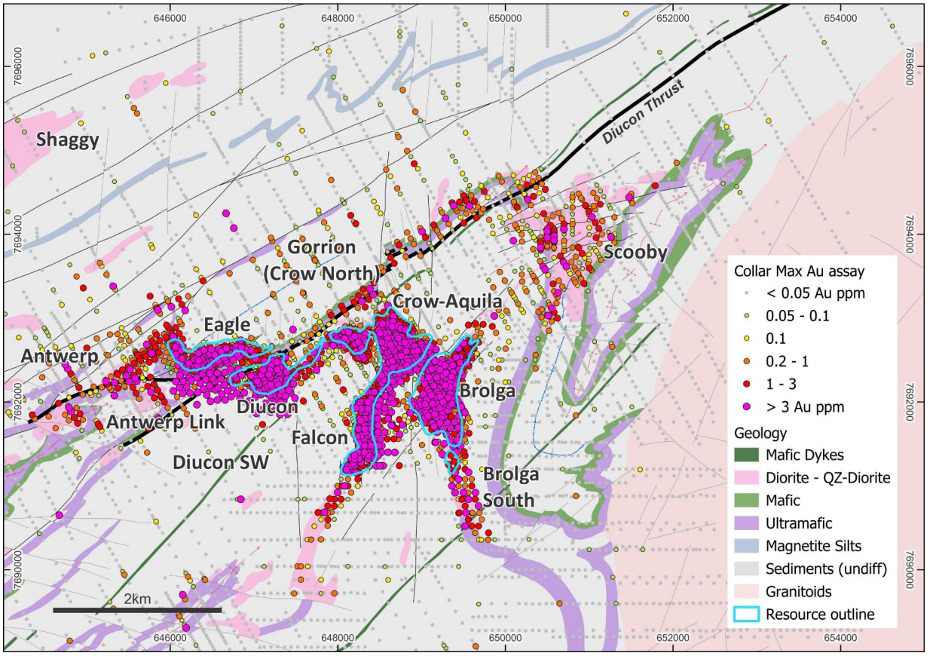

Recent extensional drill results from the Eagle and Diucon deposits have struck more high-grade gold, including a best hit of 20.4m at 4.0g/t Au including 0.9m at 19.0g/t Au and 0.7m at 79.7g/t Au at Eagle.

Shallow drilling at Diucon showed 2.5m at 3g/t Au from 383.4m and 4m at 1.6g/t Au from 429m.

The gold developer says in addition to potential resource increases, deeper drilling at Hemi will support conceptual studies into potential underground mining in the future.

This article was developed in collaboration with De Grey Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.