Dateline secures ~$9m funding to unlock Gold Links production

Pic: Tyler Stableford / Stone via Getty Images

Dateline Resources aims to bring its Gold Links gold Project in Colorado into production on the back of a US$6.8 million (A$9 million) loan facility announced this morning.

The facility, previously flagged by Dateline (ASX:DTR) managing director Stephen Baghdadi in a recent release, has a 10-year maturity date, with the first four years interest-only followed by principal and interest for the remainder of the term.

The interest rate is 6% per annum, payable monthly, and the funds have been received in full and are not subject to drawdown limits.

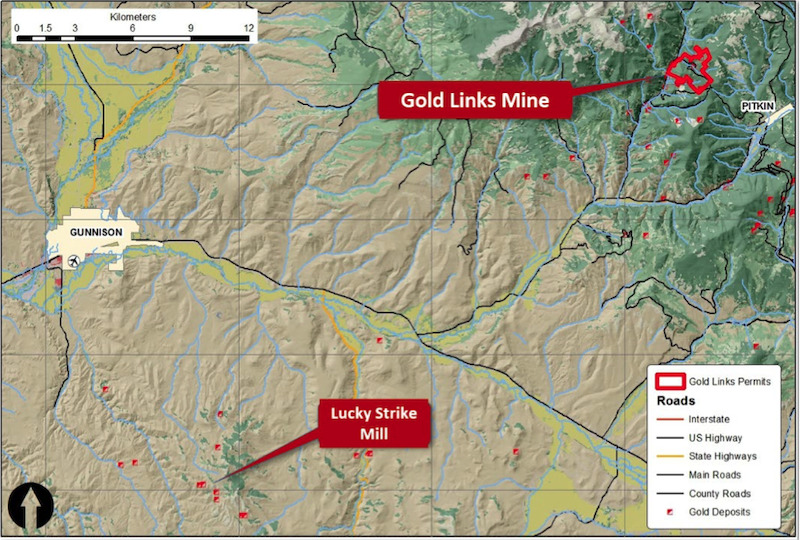

The loan is secured and ringfenced by the hugely prospective Gold Links project in Colorado, a project comprising four historically significant gold mines which Dateline intends to bring back into production. The assets were mined intermittently by various owners until 1942.

The working capital facility will fund a significant program of work expected to begin in Q2 of this year, which includes:

- Underground and surface drilling to increase both the current resource base and confidence in the inferred resource below old workings;

- Underground development to enable the extraction of the indicated and inferred resource, which is expected to begin in Q3; and

- Processing of the extracted resource at the 100%-owned Lucky Strike Mill expected to begin in Q4.

The Gold Links Project comprises a swarm of high-grade, narrow gold veins over an area of more than a kilometre across strike and 5km strike length. Drilling conducted by Dateline from 2017-2019 confirmed mineralisation was open at depth at both the 2150 and Sacramento veins.

Sections of the 2150 vein which may have been considered subeconomic when initially mined are still present above the Project’s old workings.

The above section of 2150 currently has an indicated JORC resource of 9033 tons for a total 3879 ounces of gold at 14.73 grams per tonne, and an inferred resource of 4134 tons for a total 882 ounces of gold at 7.32g/t.

The company views the gap between grade on the indicated and inferred resources above 2150 as promising, as it supports the case that the potential exists to increase the inferred grade with closer spaced drilling – an activity the loan facility will allow it to carry out.

The section below 2150 has an inferred resource measuring 21,026 tons for a total of 6453 ounces of gold at 10.52g/t, while the Sacramento vein has an inferred resource of 110,780 tons for 10,378 ounces of gold at a grade of 3.21g/t.

Ore will be processed at the Lucky Strike Mill 50km from the consolidated Project, which is designed to capture gold by gravity separation and sulphide flotation and can churn through 100 tons of ore per day.

Dateline intends to operate the mill for 12 months on a 24/7 basis from the beginning of production.

News keeps flowing

Today’s news comes just weeks after Dateline announced its intention to acquire the Colosseum gold project in California from Barrick Gold.

Baghdadi said the loan facility would benefit both Projects as the company tracked towards gold production.

“This funding provides the capital required to assist with increasing the resource at Gold Links and transform the company into a gold producer, with sales expected to fund increased exploration and development activity both at the Gold Links and at the Colosseum once that transaction is completed,” he said.

Colosseum was last mined in 1993 – just half of its planned mine life – when the gold price was below US$350 per ounce.

It produced 344,000 ounces from a historically calculated mine reserve of 700,000 ounces, based on a 1.0g/t cut-off grade and 2.5g/t gold head grade.

This article was developed in collaboration with Dateline Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.