Cyclone Metals test work produces 68.7pc magnetite concentrate from ‘Iron Bear’

Cyclone Metals is now looking to produce a premium direct reduction magnetite concentrate grading 70% iron. Pic: via Getty Images.

- Cyclone Metals’ metallurgical test work produces blast furnace magnetite concentrate grading 68.7% iron

- Product commands a market price of US$159/t, a US$25/t premium above the 62% iron benchmark

- Metallurgical test work underway to produce a premium direct reduction magnetite concentrate grading 70% iron

- Resource upgrade also in the works along with flow sheet for high yield, low cost production of blast furnace grade concentrate

Special Report: Cyclone Metals’ first phase of metallurgical test work on ore sourced from its flagship Block 103 ‘Iron Bear’ magnetite iron project has successfully produced a high grade blast furnace magnetite concentrate grading 68.7% iron.

Sitting within Canada’s Labrador Trough — one of the largest magnetite iron ore belts on earth– the Iron Bear project already has a resource of 7.2 billion tonnes grading 29% iron and 18.9% magnetic iron.

While magnetite iron ore projects typically cost a lot more to build than their hematite counterparts due to the need to process lower grade ore into a concentrate suitable for sale, the resulting concentrate typically grades between 65% to 70%.

This is ideally suited for low emissions steelmaking and commands a far higher price with industry experts expressing their belief that magnetite concentrates are increasingly attractive due to increasing carbon taxes and structurally higher energy costs.

Cyclone Metals (ASX:CLE) started an extensive metallurgical test work program on bulk sediment samples collected from Iron Bear in September to determine if a high-quality magnetite iron concentrate can be easily produced.

Major milestone achieved

This test work is now starting to pay dividends with the successful production of the magnetite concentrate grading 68.7% iron with very low deleterious elements and silica below 3.5%.

Iron ore of this grade currently commands a market price of US$159/t under cost and freight terms to China (meaning that the seller is responsible for the costs involved in transporting the ore to the destination port) – a US$25/t premium above the 62% iron benchmark.

Significantly, testwork has achieved very high recoveries of >97% of Iron Bear’s iron ore content and implies that there will be minimal wastage of the mined ore, which will likely result in more favourable economics.

This was achieved using a sediment bulk sample of 1.6t grading 17% magnetic iron that is representative of the overall deposit.

“We have achieved a major milestone in the development of our flagship Iron Bear project by demonstrating that we can easily produce a class leading 68.7% Fe grade iron ore product with a 97% magnetite recovery,” chief executive officer Paul Berend said.

“Given the massive scale of the deposit, the access to rail and port infrastructure, this is starting to look like the future.

“We are working hard to define a premium ultra-low silica direct reduction magnetite product which will be very attractive to European steel makers looking to reduce their carbon footprint.

“We are targeting to introduce this unique premium product to the steel industry as early as first quarter next year.”

Making progress

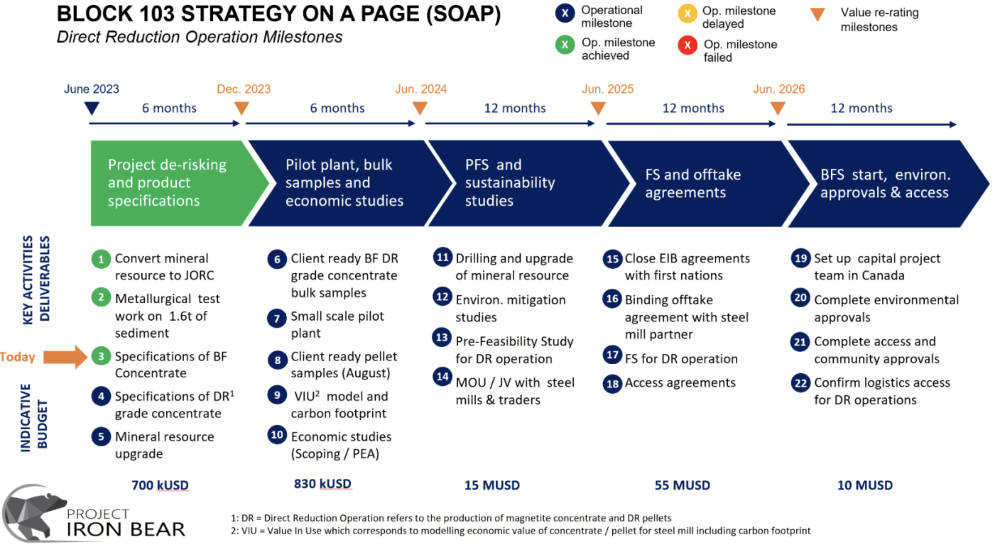

CLE notes that it is currently on track to achieve all its SOAP (Strategy On A Page) operational milestones planned for the 2023 calendar year.

This includes completing metallurgical test work to produce a premium direct reduction magnetite concentrate grading 70% iron with silica below 1.5% to enable ultra-low carbon steel production (milestone 4) and upgrading resources (milestone 5).

Current resources at Iron Bear are based on the Greenbush zone which represents just 25% of the total mineralised area within the project.

The company is also completing the flow sheet for production of blast furnace grade concentrate with high yields, recovery rates and low grinding costs.

This article was developed in collaboration with Cyclone Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.