Cyclone Metals signs MoU with Vale to develop the Iron Bear project

The MoU defines a two-phased investment pathway for Vale to earn a controlling interest in Iron Bear. Pic: Getty Images

- Cyclone Metals signs MoU with Vale

- The MoU defines a two-phased investment pathway to develop Cyclone’s Iron Bear

- Vale is one of the world’s largest iron ore and iron ore pellets producers

Special Report: Cyclone Metals has entered a MoU with Vale, one of the world’s largest iron ore producers, to fast-track development of the Iron Bear project.

The MoU defines a two-phased investment pathway for Vale to earn a controlling interest in Iron Bear, with the first investment comprising a contribution of up to US$18 million.

Those funds will be used on various development activities such as a preliminary feasibility study, mineral resource drilling and environmental baseline studies.

Phase 1 will only be deemed complete once the full Phase 1 contribution has been received by Cyclone Metals (ASX:CLE), or when the work program has been substantially completed.

In this case, Vale will not earn an interest in the Iron Bear project and can withdraw at any time during Phase 1.

Phase 2 will see the forming of a joint venture, with Vale earning a 30% equity interest in the Iron Bear JV which would increase to 75% when it takes decision to mine (or when Vale’s total contribution reaches US$120 million, even if DTM has not been achieved).

The two companies will each hold two of five board seats on the Iron Bear JV’s governing board with an independent chairman to be agreed upon.

When Vale earns a 75% interest in the JV, the company will nominate a majority of directors on the JV’s governing board.

Once DTM is achieved, and subject to Cyclone shareholders’ approval, Vale will have the right to acquire Cyclone’s remaining 25% JV equity interest at a fair market value.

Global powerhouse

“Vale is a powerhouse for the production of ultra clean iron ore products which includes DR pellets and their proprietary cold briquettes,” CLE CEO Paul Berend said.

“They are an ideal partner for us, and we look forward to leveraging Vale’s extensive operational and financial resources to realise the full potential of Iron Bear.”

As a global mining powerhouse with an annual output exceeding 300Mt, Vale supplies premium-grade iron ore products tailored for blast furnace and direct reduction steelmaking, offering a range of fines, lump ore, and pellet feed that supports cleaner, more efficient steel production.

The company’s vertically integrated operations include some of the world’s most advanced mining complexes, such as Carajás in Brazil, which boasts high-grade reserves and low impurities.

Vale’s infrastructure network spans over 2000km of heavy-haul railways and multiple deep-water ports, enabling efficient large-scale exports to steelmakers worldwide.

While many view China’s probable steel production decline and slowdown in its property sector as a sign of price weakness, others say the country’s leading position in solar, wind and EVs are ramping industrial demand for steel.

Prices have briefly dropped below US$90/t on several occasions since falling from all-time highs of US$237/t in May 2021, but they’ve always rebounded back above US$100/t despite analysts predicting prices could fall below US$80/t.

Rapid development plan

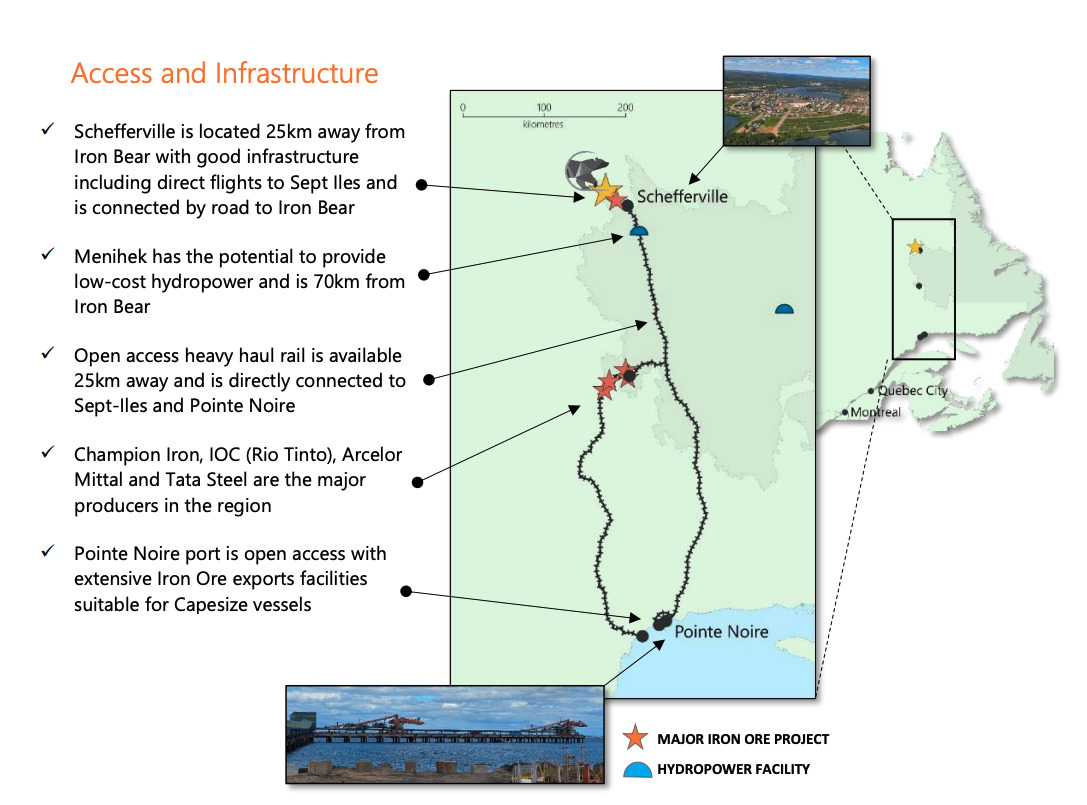

Cyclone’s large 16.6Bt Iron Bear magnetite resource in Labrador, Canada is down the road from the Bloom Lake complex mined by the $3 billion-capped ASX-TSX Champion Iron (ASX:CIA).

So far Cyclone’s test work has established it can produce a direct reduction grade concentrate grading 71.3% iron and 1.1% silica and DR-grade pellets containing 67.5% Fe, 1.6% SiO2, 0.12% MgO, and 0.65% CaO, delivered at a pilot plant in Quebec last quarter.

The company has a rapid development plan for the project with bulk samples of DR and BF concentrates available for steel mill clients in Q2 2024 and DR and BF pellets in Q2 2025.

That testwork has brought the likes of Vale through the door. While many steelmakers want to ramp up direct reduction milling, a process that generates a fraction of the CO2 emissions as blast furnaces, the supply of appropriate iron ore materials is a major roadblock.

Less than 10% of iron ore traded on the seaborne market has the grade and purity to supply DR mills, placing a premium on the development of assets like Iron Bear.

This article was developed in collaboration with Cyclone Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.