Cream rises with high-grade copper at New World’s quality Antler and Javelin projects

Antler drilling returns up to 11.8% copper equivalent. Pic: Getty Images

- New World Resources drilling hits exceptional 8.0m intersection grading 8.3% copper equivalent at Antler

- Resource definition drilling at the new Pinafore deposit at Javelin also hits high-grade copper mineralisation

- Very high grades are the primary reason why NWC is advancing Antler to production as quickly as possible

Special Report: New World Resources’ drilling has proven the quality of its Antler and Javelin projects in Arizona, after returning very high-grade intersections of up to 11.8% copper equivalent.

A rich intersection of 8m at 5.9% copper, 7.6% zinc, 0.6% lead, 37.3g/t silver and 0.46g/t gold (8.3% copper equivalent) in hole ANT134 was returned from the northern end of the Main Shoot at the Antler project.

It accompanies another assay of 2.5m grading 11.8% copper equivalent (10% copper, 4.2% zinc, 1.1% lead, 55.5g/t silver and 0.99g/t gold) in hole ANT131, also from the northern end of the Main Shoot.

These results exceed expectations from the resource model, which New World Resources (ASX:NWC) expects will result in increases in both tonnage and grade of the corresponding part of the Antler deposit resource.

Exceptional assays – including 2.5m at 7.3% copper, 6.5% zinc, 1.7% lead, 76.5g/t silver and 0.42g/t gold (9.7% copper equivalent) were also returned from drilling to better define the South Shoot at the Antler deposit.

Meanwhile, resource expansion drilling at the recently acquired Pinafore deposit within the company’s Javelin project also intersected high-grade mineralisation with hole JAV013 returning a 7.4m intersection grading 1.1% copper, 5.4% zinc, 0.2% lead, 7.3g/t silver and 0.19g/t gold (2.7% copper equivalent).

The results are a very welcome follow-up to the company’s release of a pre-feasibility study in July that outlined the technically and financially robust development of a 1.2Mtpa underground mining operation with a 12.2-year life at Antler.

High-grades reason to fast-track Antler to production

“Seeing thick intercepts of exceptionally high-grade mineralisation at both our Antler and Javelin copper projects is an exciting development which underlines the quality and endowment of these projects,” New World Resources managing director Mike Haynes said.

“Intersecting 7.4m at 2.7% copper-equivalent in very early stages of exploration drilling clearly illustrates the potential of the Pinafore Deposit, which lies within the broader Javelin project.

“And intersecting some of the highest-grade mineralisation we have encountered to date in recent ore reserve definition drilling at the Antler project – including intercepts such as 8m at 8.3% copper-equivalent and 2.5m at 11.8% copper-equivalent – reinforces the extremely valuable nature of the 11.4Mt mineral resource base that we have delineated there.

“These very high-grades are a primary reason why we are advancing Antler to production as quickly as practicable – as in almost any copper price environment, mining ore at those grades makes money.

“But with prevailing high prices – and with even higher prices forecast in the coming years – we expect to be able to operate with extremely high margins as one of the lowest cost copper producers in the world.”

Antler and Javelin

Drilling at Antler is aimed at increasing the confidence in the components of the mining inventory that are scheduled to be mined in the first 3-4 years of operations – and to obtain a composite sample to use in advanced metallurgical test work.

Antler currently has a resource of 11.4Mt at 4.1% copper equivalent.

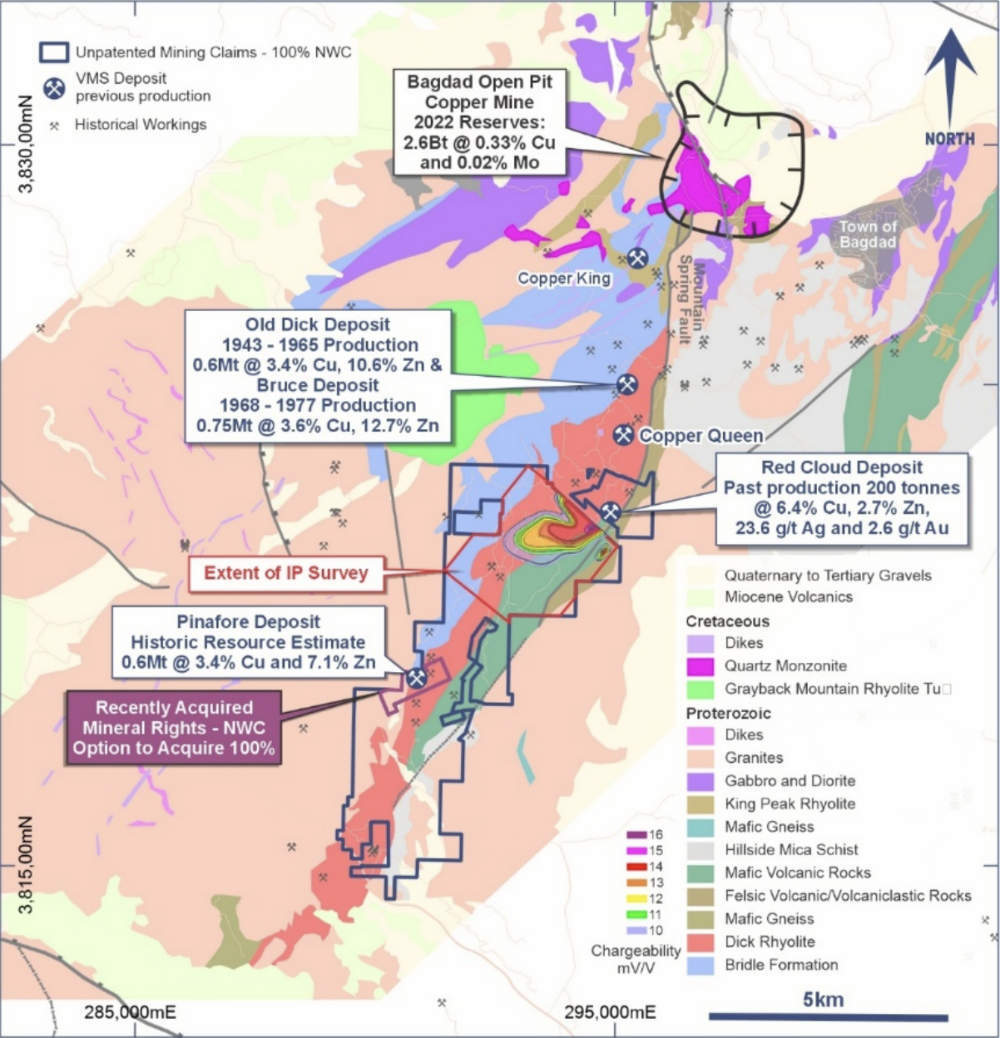

Adding interest, VMS deposits such as Antler tend to occur in clusters, so there is considerable potential to discover additional mineralisation at NWC’s multiple targets within its 5000 acre project area.

At Javelin, the recently acquired Pinafore deposit lies within a 1.2km-long corridor where alteration has been mapped at surface.

Drilling at this deposit has been temporarily suspended while an induced polarisation geophysical survey is carried out to help target the strike and depth extensions of the mineralisation intersected to date.

Ongoing exploration

NWC expects the IP survey to be completed by a contractor during September, with results expected in October. It is anticipated that drilling at Pinafore will resume shortly thereafter.

Two rigs continue to drill to expand the resource base at Antler.

This article was developed in collaboration with New World Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.