Counter Cycle: Rusty Delroy’s palladium power play

Rusty Delroy has been going long on palladium. Pic: Supplied/Stockhead

Welcome to Counter Cycle with Nero Resource Fund founder and co-portfolio manager Rusty Delroy, a Cottesloe-based fund manager who has developed a reputation for taking the path less travelled in his investments.

Today, Delroy talks about his conviction that a rebound is on the cards for the sold-off platinum group metals sector.

It’s three years since palladium prices rose to previously unthinkable highs, rising above US$3000/oz as sanctions began to flow against the world’s largest producer of the precious metal, Russia.

For a brief moment, platinum group metals producers in South Africa, Canada and the USA were among the most profitable mining companies in the world. But supply never dried up as the market bet, while weak economic growth and rising electric vehicle market share threatened its main demand centre in the catalytic converters used to moderate emissions from internal combustion engine cars.

By early 2024 palladium was trading below its sister metal platinum for the first time in six years, and on Friday the twin precious commodities were fetching US$922/oz and US$949.40/oz respectively.

Now, 50% of the world’s production is losing money and many companies who have eeked out small profits in the past two years have been ‘high grading’ – only mining the best parts of their deposit but sacrificing future cashflows and mine life in the process.

It’s why Nero Resource Fund’s contrarian co-founder Rusty Delroy is tipping the bottom of the platinum market, as producers look increasingly likely to cut supply and deficits already emerging.

“If you’re taking a position here at a US$950 an ounce type of entry – palladium and platinum trade pretty close to 1 to 1 these days – then I see a pretty limited downside,” he said.

“Maybe it trades 10% lower, but all that would do is accelerate the curtailments that are already on the cards at this price point. So, in some ways, maybe it gets you to where you want to be quicker.

“As odd as that sounds, the price going lower might actually get you to a higher price quicker.

“You’ve got 10% downside, maybe. But I think you’ve got 30% upside as a base case and I think it could go a lot higher than that. Palladium was at US$3000 not that long ago.

“Supply risks out of South Africa and obviously Russia, which is hard to measure because it is far more opaque, but I certainly don’t see them incentivised here.”

Supply concerns

Delroy’s comments come after a nightmare earnings season for the world’s top pure-play platinum and palladium producers.

South African-focused Anglo American Platinum, the world’s largest PGM producer with a cost base of US$986/oz, reported a 40% drop in headline earnings in 2024 to US$450m.

Its major competitor Impala Platinum, reported a 43% fall in headline earnings to US$99m for the first half as boss Nico Muller flagged the potential mothballing of its Canadian operations despite a 7% lift in after-tax profit to US$97m.

Sibanye-Stillwater meanwhile reported a US$311m loss for 2024. While that was far lower than its US$2.03bn loss in 2023, the future of its Stillwater operations in Montana remains a source of conjecture, with its mining and recycling operations in the States propped up by credits linked to the Inflation Reduction Act, a Biden administration policy now at risk from Donald Trump and Elon Musk’s “chainsaw”.

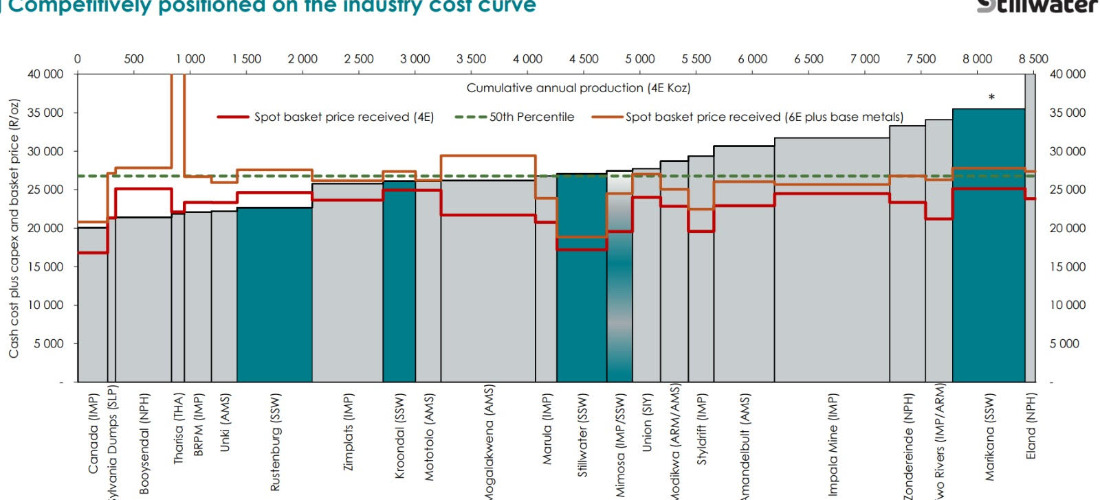

This chart from Sibanye is instructive of the challenges facing incumbent producers.

Miners don’t like putting mines in care and maintenance, Delroy said.

They cost money to shut down, and few companies are comfortable ceding market share in case they miss the next boom. But something has to give, he thinks.

“Cost curves are the be-all and end-all of commodity and commodity equity investing in my mind. The rest of it is really noise and timing issues,” Delroy said.

“Our view at the moment is that we’re trading well into the cost curve.”

PGM investing has its complexities. As the Sibanye chart shows, some miners may have lower cash costs than others but still be struggling because their basket price – the mix of metals that goes into each ounce sold – is now as lucrative.

“We haven’t been right just yet, I think there are elasticity issues,” Delroy cautioned.

“It’s kind of a game of who breaks first because if your competitor breaks, then you’re likely to see supply come out and the price will rise. And so if you can just survive, then on the back side of that you enter a place where you’re receiving margin whilst they’re still shut in.

“So I feel like that’s the game that’s been happening down here for a reasonable period of time now. But I think there’s signs here that that the break is coming.”

Demand side

That informs Nero’s view US$1300/oz is the base case for palladium, and there may be upside beyond that.

He also thinks the demand impacts of electrification have been overstated.

That’s backed up by the latest five-year forecasts from the World Platinum Investment Council, which thinks there will be platinum market deficits averaging 672,000ozpa from 2026 to 2029.

“In the automotive sector, slowing demand growth in light vehicle electrification is entrenched,” WPIC director of research Edward Sterck and analyst Wade Napier said.

“Accordingly, we expect a long tail in automotive platinum group metals (PGM) demand, with modest erosion of -1.4% CAGR for platinum and -1.0% CAGR for palladium through 2029f. Our updated automotive outlook includes a deferred fuel cell electric vehicle ramp-up.”

They now see an additional 156,000z of demand for palladium over the forecast period and reduction of 217,000oz. There could be further tailwinds if Donald Trump’s anti-EV positions turn into more demand for ICE vehicles.

Delroy also thinks demand is unlikely to fall off a cliff.

“It is around these assumptions that demand is going to radically fall away on uptake of EVs, right?” he quipped.

“That is in all the models and the reality there as opposed to what’s being modelled, is that for the last two years in the world’s deepest, most liquid EV market, China, pure EVs, haven’t gained any market share.

“They’ve pretty much flatlined. All the market share gains have been in REEVs and hybrids. So that’s range extender EVs and hybrid EVs. And both of those still use a reasonable proportion of PGMs. It’s not as high as an ICE, but it is still decent.”

Delroy also thinks recycling supply is overstated in models, with recycling and scrapping briefly surging when palladium ran beyond US$3000/oz in 2022.

“I heard stories of of cars literally coming off the production lines and then being sent to have the catalytic converters ripped out in a black market type of exercise before they’d even been sold,” he said. “That’s anecdotal. But without question, there were some funny things going on when there was a big price, you know, when you had US$3000 palladium.

“And I think some of the assumptions moving forward don’t factor in just how unsustainable some of those practices probably were. Our view is supply is not incentivised here. And on top of that, a lot of forecasts around recycling supply are far too ambitious.”

So where is Nero investing?

There are a number of palladium and platinum-exposed stocks on the ASX.

ImPlats’ Zimbabwean subsidiary Zimplats Holdings (ASX:ZIM) is the largest producer on the Aussie bourse, while small caps such as South Africa’s Southern Palladium (ASX:SPD), Future Metals (ASX:FME) and the closely watched Chalice Mining (ASX:CHN) are at various stages of the development spectrum, while others like Terra Metals (ASX:TM1) at Dante Reefs in the West Musgraves of WA have made early stage discoveries in Australia.

But Nero is looking further afield to international markets, including the trade of physical palladium itself.

In the world of equities, Delroy points to two overseas opportunities.

One is Tharisa Minerals, which is listed in both London and Johannesburg, and produces close to 150,000oz of 5E PGMs and gold a year along with 1.58Mtpa of chrome concentrate from its mills near Rustenburg.

“Tharisa is a producer out of South Africa, right down the the correct end of the cost curve, we really like [its] management, it’s well aligned and a good business that trades on very cheap metrics,” Delroy said.

His other pick is Bravo Mining Corp, which is listed on the TSX and owns the Luanga deposit in Brazil’s Carajas mineral province, which contains a measured and indicated palladium equivalent resource of 10.4Moz, with another 5Moz PdEq inferred.

“Bravo we like as probably the best undeveloped, non-Russian or South African asset globally,” he said.

The other stock being closely watched by Nero is Anglo American’s platinum division, which is undergoing a demerger as part of its parent’s plan to focus on copper and iron ore in the wake of a failed hostile BHP takeover bid.

That would create what would comfortably be the west’s largest pure play PGM stock.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Nero Resource Fund holds positions in Tharisa Minerals and Bravo Mining Corp.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.