Could Sayona be on track to become a mini-PLS? Two out of three experts say… sure

Picture: Getty Images

- The near-term lithium producer is up 100% since the start of the year

- The North American Lithium operation in Canada could restart as soon as Q1 23

- Two out of three experts say there’s still room for the company to grow

Crowd favourite and near-term lithium producer Sayona (ASX:SYA) is up over 100% since the start of 2022, sitting at a market cap of $2.4 billion, earning the company a recent spot in the S&P Dow Jones ASX 200.

This is mostly because back in June, the company and Piedmont Lithium (ASX:PLL) announced plans to reboot the North American Lithium operation in Quebec, Canada, and considering the wave of pro-lithium sentiment explorers and producers have been riding this year the timing couldn’t be better.

The mine could be up and running as soon as Q1 2023, Sayona says, with procurement 94% completed, 95% of required permits received and construction ramping up.

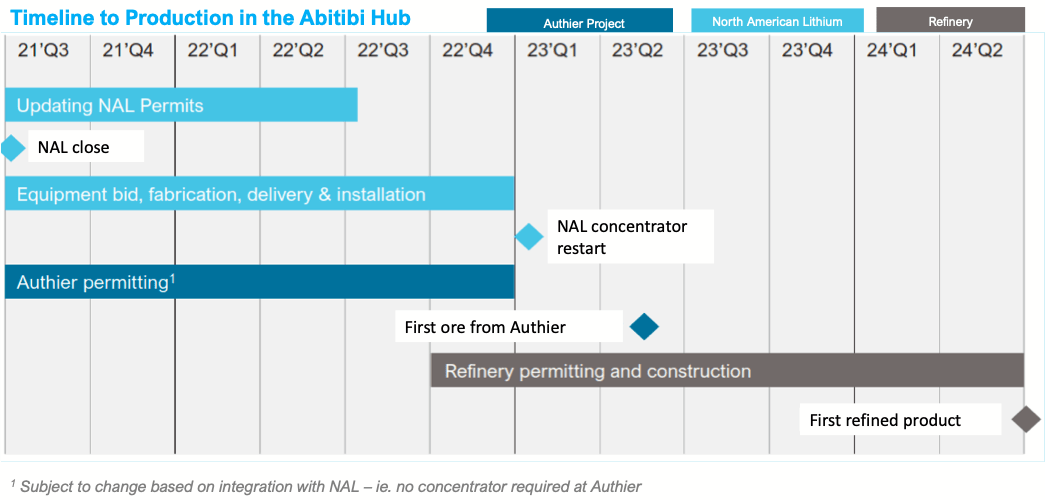

Here’s what the timeline looks like:

NAL will produce 163,266tpa of 6% Li2O concentrate over a 27-year mine life, with a pre-tax NPV of $1 billion and IRR of 140% at a spodumene price of just US$1,242/t, well below the current market price.

Here’s why that’s kind of a big deal.

Sayona – a US hard rock star?

Virtually all the commercial lithium supply in the world comes from two major sources: brine producers operating in South America’s arid desert regions across Argentina and Chile, and hard rock mines located in the Western Australian outback.

A few years ago, efforts to start up similar hard rock mines in Canada ran aground when the market for lithium and the raw materials that feed into the electric vehicle supply chain dried up.

So, the NAL mine will be the first local source of spodumene concentrate in North America at a time when the US is working hard to improve its domestic supply chain.

Piedmont will have offtake rights for the greater of 113,000tpa of spodumene concentrate from NAL – or half of production.

It will also have rights to purchase 60,000t or 50% of concentrate from Sayona’s nearby Authier project, and further down the line, Sayona is also looking at developing a conversion facility in Quebec itself to produce lithium carbonate and/or hydroxide.

Word on the street is that the company could be on track to become a mini-Pilbara Minerals (ASX:PLS), whose market cap is sitting around five times that of Sayona’s at $13.6bn.

But it’s important to remember Sayona hasn’t actually produced any lithium yet… and with its share price soaring, is there still room to run?

We asked the experts.

VP Capital co-founder John So

So says Sayona is an interesting opportunity in the lithium space because of the NAL operation, and its exploration assets in Australia and Canada.

“As with a lot of lithium producers or developers, SYA’s share price has performed very well in the past few months, rising from a little over 10c per share to over 30c per share.

“Being a brownfield means the capital expenditure requirement has not been onerous.

“That said, the share price performance of the company now means it trades on a higher, near-term cashflow multiple than other would-be developers, although the project does command a mine life of over 20 years.”

So also noted that the Authier product has been demonstrated to be able to be successfully processed into battery-grade material, paving the way for a potential downstream lithium carbonate operation in time – which the company has touted.

“The company has the potential to become a mini-PLS in time, but scale of its operations and its breadth means it would still require more years of bringing other assets online to achieve that,” he said.

Seneca Financial Solutions CEO Luke Laretive

Laretive is not quite convinced and thinks the company many have already topped out.

“There are two relevant perspectives here, in my view,” he says.

“The project is low grade under 1.1% Li2O1, not 100% owned and based on peers/supply chains at risk of delay and cost overrun.”

He also added that, in his opinion, the valuation is full.

“At a thumb suck c. $230-250m EBITDA in FY27, so it’s on over 10x EV/EBITDA, which is where you’d expect it to trade once actually in production and all the construction/execution risk is in the rear-view mirror,” he said.

“In short, I don’t think investors are getting great risk-reward relative to alternatives available.”

Peak Asset Management executive director Niv Dagan

Dagan is another in the yes camp, confident Sayona is headed in the right direction with 95% of required permits approved and 70 staff on site as of 16 September.

“Over the weekend, the price of lithium carbonate has surged to record highs as the China passenger car association raised its forecast for new EV sales to 6 million units this year – more than double the numbers sold in 2021!” he said.

“To add ‘fuel to the fire’, Bloomberg Intelligence has also suggested that battery use — both for EVs and as residential and commercial energy storage — is expected to double, driving demand for lithium even higher.

“Spodumene is a source of lithium which is essential to the production of many consumer consumables, and with the rise in hybrid/electric cars, the material is more in demand than ever.”

And he says the NAL operation and offtake contract with Piedmont to buy 113,000 dry metric tons, or 50% of production (whichever is greater) is a major upside for Sayona.

“The price is market based with a minimum of $500/t and a maximum of $900/t, for the lifetime of the NAL,” Dagan said.

“We feel that this represents a major upside for the SYA, as well as the mining industry as a whole.

“Following this news, SYA is being added to the ASX200, which again re-enforces the strong position SYA holds in the field.”

SYA share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.